Chrysler 2003 Annual Report Download

Download and view the complete annual report

Please find the complete 2003 Chrysler annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98th Fiscal Year

Annual Report

Consolidated and Statutory Financial Statements

at December 31, 2003

Table of contents

-

Page 1

Annual Report Consolidated and Statutory Financial Statements at December 31, 2003 98th Fiscal Year -

Page 2

... of candidates for the Company Board of Statutory Auditors; âš amount of expenses borne by the Company to safeguard common interests of holders of preference and savings shares. Agenda Fiat S.p.A. Head Office: 250 Via Nizza, Turin, Italy Paid-in capital: 4,918,113,540 euros Entered in the Turin... -

Page 3

... Group Relaunch Plan Products and Services Innovation and Technology Environment Human Resources Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A. Process of Transition to International Accounting Standards (IAS/IFRS) Corporate Governance Stock Option Plans... -

Page 4

Board of Directors and Control Bodies Board of Directors Chairman Chief Executive Officer Umberto Agnelli (1) Giuseppe Morchio (1) Directors Angelo Benessia (2)...of the Nominating and Compensation Committee (2) Member of the Audit Committee (3) Secretary of the Board Board of Statutory Auditors ... -

Page 5

... 2002, but reflected a significant improvement in cost containment, and the closing quarter, when all indicators of the operating and financial performance showed clear signs of a turnaround, as the Group began to benefit from the introduction of new models. This improvement enabled us to begin 2004... -

Page 6

... of technological innovation, which is benefiting from the new stimulus provided by increased R&D spending. Suffice it to say that in this area alone Fiat plans to invest about 8 billion euros in four years. In 2004, the Group's operations will also fully benefit from the introduction of new models... -

Page 7

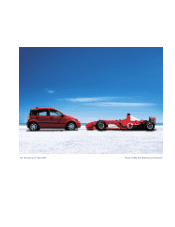

Fiat Panda Car of Year 2004 Ferrari F2003-GA 2003 World Champion -

Page 8

...: âš Services in the areas of personnel administration, temporary staffing, facility management, administrative and corporate finance consulting, information and communication technology, purchasing, and e-procurement. âš Publication of the La Stampa newspaper, and sale of advertising space for... -

Page 9

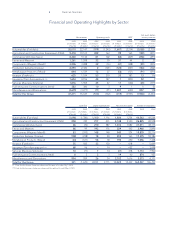

... in fixed assets Research and development Operating result/net revenues (ROS) Operating result/average net invested capital (ROI) Net result before minority interest/net revenues Net result/Group interest in average stockholders' equity (ROE) Capital expenditures/depreciation Number of employees 47... -

Page 10

...in millions of euros) Number of employees 2003 2002 Automobiles (Fiat Auto) Agricultural and Construction Equipment (CNH) Commercial Vehicles (Iveco) Ferrari and Maserati Components (Magneti Marelli) Production Systems (Comau) Metallurgical Products (Teksid) Aviation (FiatAvio) (*) Insurance (Toro... -

Page 11

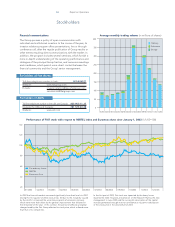

...the financial community and the Group' senior management. 400 Ordinary 350 Preference Savings 300 Average monthly trading volume (in millions of shares) 250 200 For holders of Fiat shares: Toll-free telephone number in Italy: 800-804027 Website: www.fiatgroup.com E-mails: investor.relations@geva... -

Page 12

... Group International institutional investors Italian institutional investors Other stockholders 800,417,598 30.06% 2.76% 2.70% 2.39% 2.07% 16.26% 10.76% 33.00% Highlights per share (in euros) Cash flow per share (**) Earnings per share Dividend per share (*) ordinary and preference shares savings... -

Page 13

... âš The cost structure must be made highly competitive by rationalizing the Group's product design and engineering operations, streamlining its manufacturing organization, increasing efficiency and strongly supporting the development of professional competencies among the engineering, marketing and... -

Page 14

..., working to monitor customer satisfaction and improve its communication tools. This led to the introduction of new instruments to measure product satisfaction and delivery quality with dealers in selected areas of Europe, and to the development of the "Voice of the Market" program, which... -

Page 15

... of its Customer Service activities. On one front, the company developed a series of new products (ranging from guarantee extensions to planned maintenance programs) that help preserve vehicle values over time. On another, it reinforced all of its spare part procurement and delivery systems. These... -

Page 16

... system. The Fiat Research Center and ANAS, the Italian national highway administration, promoted the "Integrated Traffic Safety" project based on cooperation between smart vehicles and highways. This project will set up two development test sites equipped with Intelligent Transportation Systems... -

Page 17

... automobile. As part of this wider purview, the center's research also focuses on experimental materials, technologies and telematics systems. Similarly, Elasis strives to broaden its understanding of safety-related problems through joint research initiatives with public agencies and infrastructure... -

Page 18

... Systems. In 2003, earlier prototype vehicles were joined by the new Panda "Hydrogen". Further advances were also made in public transit applications, where trials are now being carried out on two new fuel cell-powered busses in Turin and Madrid. âš Production processes. The Fiat Research Center... -

Page 19

...million euros (2% of its total payroll) in training and professional development programs designed to support the operations of its companies around the world. About 71,000 employees received training and development support. Isvor Fiat, which acts as the corporate university of the Fiat Group, also... -

Page 20

... main labor agreements included the signing of annual collective contracts by most Fiat Group companies operating in France. These contracts provide for annual wage increases of about 2%. In Poland, where staff compensation did not change in 2002, the employees of Fiat Auto received a wage increase... -

Page 21

... large property improvement, management, and sales. ⚠Fiat Auto Holdings' retail financing activities in Brazil were sold to the Itaù banking group at the end of March 2003 and deconsolidated from that date. ⚠The agreement to sell the Toro Assicurazioni Group to the DeAgostini Group was signed... -

Page 22

... increase in France, which went against the negative market trend, and in Spain. The Sector maintained its leadership in the Western European market for medium range vehicles thanks to introduction of the New Eurocargo model. âš Ferrari and Maserati reported revenues of 1,261 million euros for... -

Page 23

...the 163 million euros reported for 2002, notwithstanding the negative foreign exchange effect stemming from appreciation of the euro. The Sector result improved markedly thanks to improved margins on new products, higher sales prices, and cost savings realized through the integration plans with Case... -

Page 24

... and Construction Equipment (CNH) Commercial Vehicles (Iveco) Ferrari and Maserati Components (Magneti Marelli) Production Systems (Comau) Metallurgical Products (Teksid) Aviation (FiatAvio) (*) Insurance (Toro Assicurazioni) (**) Services (Business Solutions) Publishing and Communications (Itedi... -

Page 25

...long-term unemployment benefits, severance incentives, and writedown of property, plant and equipment and intangible fixed assets according to the Relaunch Plan presented at the end of June 2003. Restructuring expenses include expenses and provisions that refer mainly to Fiat Auto (259 million euros... -

Page 26

... Property, plant and equipment Property, plant and equipment Operating leases Financial fixed assets Investments on behalf of life insurance policyholders who bear the risk Financial receivables held as fixed assets Deferred tax assets Total Non-Current Assets Net inventories (1) Trade receivables... -

Page 27

...of FiatAvio S.p.A.). On a comparable basis, inventories were 389 million euros higher due to the increase in Fiat Auto stock connected with the introduction of new models. Trade receivables totaled 4,553 million euros, 1,231 million euros less than the 5,784 million euros reported at the end of 2002... -

Page 28

... Property, plant and equipment Financial fixed assets Investments on behalf of life insurance policyholders who bear the risk Financial assets not held as fixed assets Deferred tax assets Reserves Policy liabilities and accruals where the investment risk is borne by policyholders Working capital... -

Page 29

... typically generated by sales of vehicles and are generally managed under dealer network financing programs as a typical component of the portfolio of the financial services companies. These receivables are interest bearing, with the exception of an initial limited, non-interest bearing installment... -

Page 30

...from the sale of fixed assets Net change in financial receivables Change in securities Change in securities of insurance companies net of policy liabilities and accruals Other changes Total D) Total cash flows provided by (used in) financing activities: Increase in borrowings Repayment of borrowings... -

Page 31

30 Report on Operations Analysis of the Financial Position and Operating Results of the Fiat Group and Fiat S.p.A The principal applications of funds during the year consisted of: âš 2,011 million euros in fixed assets (2,771 million euros in 2002), including investments in vehicles to be leased... -

Page 32

... by the Commercial Vehicles Sector for the entire year of a company that operates in the field of financing sales outside Western Europe. The result before taxes of normal Financial Activities (which does not include the impact of the result of equity investments owned by the financial companies in... -

Page 33

... Property, plant and equipment Property, plant and equipment Operating leases Financial fixed assets Investments on behalf of life insurance policyholders who bear the risk Financial receivables held as fixed assets Deferred tax assets Total Non-Current Assets Net inventories (1) Trade receivables... -

Page 34

... table below. During 2003, the Group strengthened its financial structure by reducing net indebtedness (financial payables net of intersegment activities, cash and marketable securities) from 24,594 million euros to 15,542 million euros. Cash and marketable securities increased by a total of 2,004... -

Page 35

... Marelli Holding S.p.A. Working capital consists of receivables from and payables to Tax Authorities, trade receivables and payables, and receivables from and payables to employees for 49 million euros, and ordinary treasury stock for 28 million euros (4,384,019 shares). It shows an increase of... -

Page 36

... laws relating to financial statements interpreted and integrated in accordance with Italian accounting principles, and the applicable provisions of IAS/IFRS were identified; âš an action plan was formulated that was aimed at identifying the steps required to adapt the Group's corporate processes... -

Page 37

..., the estimated cost should be discounted to present value, a technique not contemplated by current Italian laws. Employee benefits IAS 19 sets out the method of accounting for employee benefits and, accordingly, the Group dedicated a specific working group to the analysis of labor legislation, in... -

Page 38

... Corporate Governance Code of Italian listed companies, which is mentioned as a model in the regulations issued by Borsa Italiana (Italian Stock Exchange) on corporate governance. Furthermore, as an issuer of financial instruments listed on various international markets, including the New York Stock... -

Page 39

... activity, quarterly reports, strategic relaunch plan, capital increase, budget, motions regarding the organizational structure, significant transactions and transactions with related parties submitted by the executive directors, appointments of company officers, the activity of the Audit Committee... -

Page 40

...targets by specific dates. Detailed information on the compensation of directors and the stock options is provided in the Notes to the Financial Statements of Fiat S.p.A. and the Internal Control Compliance Officer shall participate at Committee meetings. The directors who hold corporate posts, the... -

Page 41

... events, and all documents pertaining to corporate governance. During 2003, meetings and conference calls were organized in order to provide periodic operating and financial information and illustrate the Relaunch Plan and capital increase. In addition, a toll-free number (800-804027) and two e-mail... -

Page 42

... Stock Option Plans Thus far, the Board has approved Stock Option Plans offered to about 900 managers of the Group's Italian and foreign companies who are qualified as "Direttore" or have been included in the Management Development Program for high-potential managers. Plan regulations share... -

Page 43

...suretyships and guarantees in connection with the issuance of billets de trésorerie (Fiat France S.A.), bonds and lines of credit (Fiat Finance and Trade Ltd, Fiat Finance Luxembourg S.A., Fiat Auto Financial Services Limited, and New Holland Credit Company LLC); and to secure bank loans (Fiat Auto... -

Page 44

... billion euros by October 31, 2004. In consequence of this capital increase, the share owned by Fiat Partecipazioni S.p.A. in Fiat Auto Holdings B.V. rose to 90%. The following actions were taken in 2003 as part of the corporate and legal streamlining programs: âš in the Commercial Vehicles Sector... -

Page 45

... does not change any of the future strategic options of the Fiat Group. âš The following new products were introduced during the first quarter of 2004: Fiat Auto chose the 74th International Geneva Motor Show for the worldwide introduction of several Fiat-brand models, including the on-road and off... -

Page 46

45 Report on Operations Operating Performance - Sectors of Activity -

Page 47

... that new models (Fiat Panda, Fiat Idea, Lancia Ypsilon and Alfa GT) were not introduced until late in 2003 and at the beginning of 2004. These new models are showing good potential in terms of market penetration and appeal to customers. Sales Performance - Automobiles and Light Commercial Vehicles... -

Page 48

...this environment, Fiat increased its market share to a level above 10%. In China, Fiat Auto's joint venture with the Yueijin Motor Group increased the level of sales, which reached 37,200 units compared with 23,700 units in 2002. During 2003 the product line, which comprised the Fiat Palio and Albea... -

Page 49

...by cost savings. Financial and service activities At the end of March 2003, as part of its streamlining effort, Fiat Auto sold its Brazilian consumer credit and leasing operation to the Itaù bank. This transaction was followed, in May 2003, by the signing of an agreement with several large Italian... -

Page 50

... was achieved despite a 9.6% contraction in consolidated revenues (20,010 million euros in 2003), an 8.8% drop in unit sales and a 9% increase in R&D outlays which amounted to 939 million euros in 2003. This result was made possible by cost reductions and the positive effect of new models that were... -

Page 51

... performance of heavy equipment, while sales volumes increased in the rest of the world (+7%). In Western Europe, the initial problems connected with integration of the Fiat-Hitachi and Fiat-Kobelco sales networks also contributed to the contraction, following formation of Fiat Kobelco Construction... -

Page 52

... network and its customers. In Europe, CNH Capital Europe, the company operated in partnership with BNP Paribas Lease Group (BPLG), continued to grow as envisaged without causing an increase in the indebtedness of CNH. In 2003 CNH financial activities posted revenues of 549 million euros, compared... -

Page 53

... Report on Operations CNH Depreciation and amortization for the period totaled 450 million euros (541 million euros in 2002), of which 141 million euros for the amortization of goodwill connected with the acquisition of Case. In 2003 the net loss was 192 million euros, of which 198 million euros... -

Page 54

...approximately 49,600 units (+32.1%). In Western Europe, Iveco sold about 119,300 vehicles, or 7.4% less than in 2002. Unit sales were down in Italy, Germany and Great Britain, but increased in France and Spain. Iveco's share of the Western European market for vehicles with a curb weight of more than... -

Page 55

...at December 31, 2002. Financial and service activities In 2003, the finance companies of the Iveco Finance Group, which provide financing and leasing services to support the sales of Iveco products in Western Europe, signed 22,533 contracts to finance sales of new commercial vehicles (34,000 in 2002... -

Page 56

... develop new families of engines configured for different types of applications (automotive, agriculture, power generation, marine and railroads). Also in this area, Iveco has virtually completed its investment program for the NEF line of engines and is continuing to fund the expansion of production... -

Page 57

... of 2,401 units were sold in Europe, where Germany once again confirmed its position as the largest European market (second in absolute terms for worldwide sales) with 661 units, a fall of 3%. Italian customers purchased 520 units, in line with 2002. Sales to the Maserati network totaled 2,900 units... -

Page 58

... euros in 2002 (an increase of 4.4%). At 32 million euros, operating income was lower than the 2002 figure of 70 million euros as a result of high expenditure on research and development and the negative impact of exchange rate movements, which offset the improved mix on Ferrari models. Capital... -

Page 59

...an increase in orders booked by certain businesses, in particular the engine control unit with the introduction of the diesel system, and the lighting area thanks to new applications. Operating income of 32 million euros (compared with an operating loss of 16 million euros in 2002) reflects the cost... -

Page 60

...partly offset by those booked on new markets. Overall, 66% of the orders for contract work were acquired in Europe and 26% in the NAFTA area, with the remaining 8% coming from Brazil and new markets (South Africa and China). Orders for contract work can be broken down as follows: 19% from Fiat Group... -

Page 61

... consolidating its relations with Renault and PSA in Europe and Italy. As part of the restructuring plan, the Crescentino plant (Italy) reviewed its production strategy and by the end of 2004 will increase its focus on the manufacture of components for light vehicles. Other significant restructuring... -

Page 62

... (traditional and online purchasing) and Risk Management S.p.A. (management of insurable Group risks). Revenues for 2003 totaled 333 million euros, 73% of which from "captive" customers. âš I.C.T. - Information and Communication Technology: the main activity in this unit is Global Value, a joint... -

Page 63

... and advertising). Publikompass S.p.A. booked advertising billings in excess of 307 million euros, an increase of 7.4% over 2002 that was partly due to new licensing agreements. Revenues by business unit 0 Newspaper publishing 50% Advertising 100% Operating performance In 2003, sales of Italian... -

Page 64

... 2003 Dear Stockholders, The Statutory Financial Statements at December 31, 2003 show a loss of 2,358,789,924 euros. We propose that this loss be fully covered through recourse to the following items of stockholders' equity. Retained earnings Additional paid-in capital Other reserves - Extraordinary... -

Page 65

-

Page 66

65 Fiat Group - Consolidated Financial Statements at December 31, 2003 Fiat S.p.A. Head Office: 250 Via Nizza, Turin, Italy Paid-in Capital: 4,918,113,540 euros Entered in the Turin Company Register Fiscal Code: 00469580013 -

Page 67

...securities Treasury stock Finance lease contracts receivable Investments where the investment risk is borne by policyholders and those related to pension plan management Total TOTAL FIXED ASSETS CURRENT ASSETS Inventories Raw materials and supplies Work in progress and semifinished products Contract... -

Page 68

67 Fiat Group Consolidated Financial Statements at December 31, 2003 Consolidated Balance Sheet (in millions of euros) December 31, 2003 December 31, 2002 CURRENT ASSETS (continued) Receivables Trade receivables: due within one year due beyond one year Total Trade receivables Receivables from... -

Page 69

... tax reserves Other reserves Insurance policy liabilities and accruals Policy liabilities and accruals, where the investment risk is borne by policyholders, and those related to pension plan management TOTAL RESERVES FOR RISKS AND CHARGES RESERVE FOR EMPLOYEE SEVERANCE INDEMNITIES PAYABLES Bonds... -

Page 70

69 Fiat Group Consolidated Financial Statements at December 31, 2003 Consolidated Balance Sheet (in millions of euros) December 31, 2003 December 31, 2002 PAYABLES (continued) Payables to associated companies: due within one year Total Payables to associated companies Taxes payable: due ... -

Page 71

... Secured guarantees TOTAL GUARANTEES GRANTED COMMITMENTS Commitments related to derivative financial instruments Commitments to purchase property, plant and equipment Other commitments TOTAL COMMITMENTS THIRD-PARTY ASSETS HELD BY THE GROUP GROUP ASSETS HELD BY THIRD PARTIES OTHER MEMORANDUM ACCOUNTS... -

Page 72

... in contract work in progress Additions to internally produced fixed assets Other income and revenues: revenue grants other Total Other income and revenues TOTAL VALUE OF PRODUCTION COSTS OF PRODUCTION Raw materials, supplies and merchandise Services Leases and rentals Personnel: salaries and wages... -

Page 73

... than equity investments securities held in current assets other than equity investments financial receivables Total Writedowns TOTAL ADJUSTMENTS TO FINANCIAL ASSETS EXTRAORDINARY INCOME AND EXPENSES Income: gains on disposals other income Total Income Expenses: losses on disposals taxes relating to... -

Page 74

... eliminated net of related tax effects, together with all intercompany receivables, payables, revenues and expenses arising on transactions within the Group. Exceptions are the gross margins on intercompany sales of plant and equipment produced and sold at prices in line with market conditions, in... -

Page 75

... for specific loans, where significant. Depreciation is provided on a straight-line basis at rates that reflect the estimated useful life of the related assets. When, at the balance sheet date, property, plant and equipment show a permanent impairment in value below their carrying value, such assets... -

Page 76

...based on the life of the lease and the related risk in managing such contracts. Treasury stock consists of Fiat S.p.A. shares bought back by Fiat Ge.Va. S.p.A. and by Fiat; it is valued at the lower of cost or market, cost being determined on a Last-In First-Out (LIFO) basis. A specific reserve for... -

Page 77

...receivables sold, net of discounting costs. This net value is included in the Value of production since it relates to revenues arising out of the normal operations of the financial services companies (to this end, the financial income of such companies is included in revenues from sales and services... -

Page 78

... with the above mentioned policies disclosed under memorandum accounts. Costs relating to the factoring of receivables and notes of any type (with recourse, without recourse, securitization) and nature (trade, financial, other) are charged to the statement of operations on an accrual basis. -

Page 79

... the agreements signed in December 2002, the Automobile Sector concluded the sale of Fiat Auto Holdings' retail financing activities in Brazil to the Itaù banking group at the end of March 2003 and the activities were deconsolidated from that date. The sale price was 247 million euros, realizing... -

Page 80

... during the year mainly for the capitalization of license acquisition costs for the development of technologies and products incurred by FiatAvio S.p.A. for 68 million euros (relating to the first six months of the year) and other deferred charges benefiting future periods by Fiat Auto for 27... -

Page 81

... plans initiated by certain Sectors of the Group. As a result of those analyses, property, plant and equipment were written down by 351 million euros (227 million euros in 2002), detailed by Sector as follows: Automobiles 312 million euros, Commercial Vehicles 6 million euros, Metallurgical Products... -

Page 82

...Fiat Group Consolidated Financial Statements at December 31, 2003 Notes to the Consolidated Financial Statements 3 Financial fixed assets Investments (in millions of euros) Value at 12/31/2002 Equity in earnings Change in Acquisitions Equity in the scope of and losses consolidation Capitalizations... -

Page 83

... mainly due to the exit of Capitalia S.p.A. (-481 million euros), a Toro Assicurazioni Group holding, the inclusion of Edison S.p.A. shares (65 million euros) and other minor changes (-7 million euros). The reduction in unlisted companies valued at cost (-23 million euros) is the result of the sale... -

Page 84

... of engines and gears for cars that was set up in the second half of 2001 between Fiat and General Motors Corporation (General Motors) under the well-known strategic alliance. The key figures taken from the financial statements of Fiat-GM Powertrain, drawn up in accordance with the accounting... -

Page 85

... of 2002, the Fiat Group sold a 14% holding to certain other stockholders of the company (Banca Intesa, IMI Investimenti and Capitalia, hereinafter the "Banks") for 548 million euros, realizing a gain of 189 million euros. The related sales contracts and the contemporaneous agreements with another... -

Page 86

... an Italian company held equally by the four Banks, at the price of 370 million euros. This transaction led to a loss of 15 million euros that had already been set aside in a specific reserve for risks in the consolidated financial statements at December 31, 2002, based upon the binding agreements... -

Page 87

... included marketable government securities and bonds held by the insurance companies for 2,311 million euros. At December 31, 2003, the carrying values are substantially in line with fair value. Treasury stock At 12/31/2003 Number of shares (thousands) Cost (in millions of euros) Number of shares... -

Page 88

87 Fiat Group Consolidated Financial Statements at December 31, 2003 Notes to the Consolidated Financial Statements Investments where the investment risk is borne by policyholders and those related to pension plan management (in millions of euros) At 12/31/2003 At 12/31/2002 Change Investments ... -

Page 89

... taxes receivable from the Italian tax authorities and include the tax credit relating to the advance payments of income tax on employee severance indemnities paid by Italian companies. The portion of interest accrued on that receivable relating to the current year is recorded in Financial income... -

Page 90

... the Consolidated Financial Statements At December 31, 2003, Other securities include short-term bonds and commercial paper (1,480 million euros) and highly rated liquidity funds of leading international banks (2,365 million euros) in which mainly the treasury management companies of the Group had... -

Page 91

... Group Consolidated Financial Statements at December 31, 2003 Notes to the Consolidated Financial Statements million euros compared to the end of 2002 is mainly due to the change in the scope of consolidation. Financial receivables from others also include the net value of subordinated securities... -

Page 92

... of three new ordinary shares for every five shares of any class of stock outstanding, at the price of 5 euros, following the execution of the capital stock increase in August 2003 voted by the Board of Directors on June 26, 2003. The capital stock increase was effected on the basis of the mandate... -

Page 93

...set and previously communicated by Fiat, in which case the holder of the warrants may opt to subscribe to the shares in exchange for warrants. The resolutions regarding the capital increase to service the stock option plans (28 million euros) have been revoked since the Board of Directors decided on... -

Page 94

... by the Stockholders' Meeting of Fiat Auto Holdings B.V. held April 23, 2003 and subscribed to by Fiat Partecipazioni S.p.A. (the direct parent company of Fiat Auto Holdings B.V.) for 3 billion euros, whereas General Motors has not as yet subscribed to its share of the capital increase, as described... -

Page 95

...tax on gains Capital investment grants Other Total Deferred tax liabilities Deferred tax assets for: Taxed reserves for risks and charges Inventories Taxed allowances for doubtful accounts Pension funds Adjustments to financial assets Other Total Deferred tax assets Theoretical tax benefit connected... -

Page 96

... Financial Statements As disclosed in the accounting policies, in recording Deferred tax assets, each company in the Group critically evaluated whether the conditions existed for the future recoverability of such assets on the basis of updated strategic plans, accompanied by the related tax plans... -

Page 97

...of euros) Trade Financial Other Total Trade Financial Other At 12/31/2002 Total Bonds Convertible bonds Borrowings from banks Other financial payables Advances Trade payables Notes payable Payables to unconsolidated subsidiaries Payables to associated companies Taxes payable Social security payable... -

Page 98

...(at December 31, 2002, fair value would have been approximately 2,169 million euros lower than the carrying value). The fair values of such financial payables take into account the current market cost of funding with similar maturities, and, for bonds, their market prices. The interest rates and the... -

Page 99

... risk, implicit in the bond, of an increase in the General Motors share price above 69.54 U.S. dollars, a Total Return Equity Swap agreement was put into place as described in Note 14. âš Other bonds: these refer to the following issues: - Bonds issued by Fiat Finance & Trade Ltd. S.A. with coupon... -

Page 100

...the Framework Agreement, dated May 27, 2002, with Capitalia, Banca Intesa, SanPaolo IMI and Unicredito Italiano (Money Lending Banks) for the purpose of providing the Fiat Group with the financial support it needs to implement its strategic and industrial plans. The facility was secured on September... -

Page 101

... original value of 15.50 euros in accordance with the rules established by the AIAF - Italian Association of Financial Analysts - following the Fiat S.p.A. capital increase) and the average stock market price in the last three or six months, depending on the case, preceding the repayment date. The... -

Page 102

... relating to the current year. Financial deferred income includes deferred interest income on the portfolio of the financial services companies. The change from December 31, 2002 is principally due to the change in the scope of consolidation for 751 million euros. 14 Memorandum accounts Guarantees... -

Page 103

... accounts, receivables and bills discounted by the Group without recourse having due dates beyond December 31, 2003 amount to 9,852 million euros (in 2002, 13,794 million euros with due dates beyond December 31, 2002). Receivables and bills discounted without recourse refer to trade receivables... -

Page 104

... addition to the trend of the euro/U.S. dollar exchange rate. The fair value of the equity swaps is the result of the positive trend in the General Motors share price. The difference between the "Carrying value" and "Fair Value" is mainly due to the accounting principles adopted for the valuation of... -

Page 105

... into the same number of General Motors shares as once held by the Fiat Group (32,053,422 shares). The option exercise price implicit in the bonds coincides with the pre-sale unit carrying value, in U.S. dollars, of the General Motors shares in the consolidated financial statements of Fiat, prior to... -

Page 106

...Agreement") signed on March 13, 2000, by which 20% of the Automobile Sector was sold to General Motors, the Fiat Group had reserved itself a Put option at fair market value with General Motors on its remaining investment in Fiat Auto Holdings B.V. (80% in 2000, now 90% following the capital increase... -

Page 107

... invest in a structural manner outside the foundry sector: âš should Fiat be the object of the acquisition of control by another car manufacturer. The exercise price of the option is established as follows: âš for 6.5% of the share capital of Teksid, the initial investment price increased pro rata... -

Page 108

... and Construction Equipment Commercial Vehicles Ferrari and Maserati (*) Components Production Systems Metallurgical Products Aviation (**) Insurance (***) Services Publishing and Communications Other companies Total Revenues from sales and services and Change in contract work in progress... -

Page 109

... million euros (290 million euros in 2002) mainly relate to disposals of non-strategic activities as a consequence of the policy to reduce invested capital. The gains realized on the sale of non-strategic buildings total 157 million euros (159 million euros in 2002). 16 Costs of production Costs of... -

Page 110

... Insurance claims and other insurance costs amount to 1,367 million euros in 2003 (4,045 million euros in 2002). The decrease from 2002 is due to the sale of the Toro Assicurazioni Group. 17 Financial income and expenses Investment income (in millions of euros) 2003 2002 2001 Dividends Tax credit... -

Page 111

... Group (56 million euros). Dividends were mainly received from minority investments valued at cost. This item included 68 million euros in 2002 for dividends received on General Motors shares. The Gains on sale of investments held in current assets decreased by 26 million mainly on account... -

Page 112

... exchange losses of 2,472 million euros in 2003 (2,557 million euros in 2002). The Losses on sale of securities amounts to 8 million euros in 2003 and include losses of 6 million euros on the sale of investments not held as fixed assets. Discounts and other expenses includes receivables discounting... -

Page 113

... expenses and provisions for risks in relation to corporate restructuring transactions of 658 million euros, other extraordinary writedowns of assets on the basis of changes in market prospects and the consequent new business plans of 215 million euros. They also include additional extraordinary... -

Page 114

... at December 31, 2003 Notes to the Consolidated Financial Statements the market prospects and the consequent new business plans of 216 million euros and on the basis of the estimated realizable value indicated in the subsequently signed agreement for the sale of the Fraikin business of 210 million... -

Page 115

... at December 31, 2003 Notes to the Consolidated Financial Statements 21 Other information Assets by geographical area Total Assets (in millions of euros) At 12/31/2003 At 12/31/2002 At 12/31/2001 Europe North America Mercosur Other areas Total Assets 49,690 9,200 2,890 931 62,711 75,254 12,013... -

Page 116

... and Capital (loss) Amortization expenditures Total Assets 2003 Automobiles Agricultural and Construction Equipment Commercial Vehicles Ferrari and Maserati Components Production Systems Metallurgical Products Aviation (**) Insurance (***) Services Publishing and communications Other companies and... -

Page 117

... year incurred. In 2003 and 2002 direct research and development expenses were 1,747 million euros and 1,748 million euros, respectively. For the most important projects, the Group has applied for financing to the Italian government and the European Community under related legislation. At the end of... -

Page 118

...post of Chief Executive Officer on June 10, 2002, of which 9,296 thousand euros will be paid in 20 years. The list of companies included in the consolidated financial statements (Article 38 and 39 of Legislative Decree 127/91) is attached. Turin, March 26, 2004 The Board of Directors By: Umberto... -

Page 119

-

Page 120

119 Annex to the Notes to the Consolidated Financial Statements -

Page 121

... significant equity investments of the Group is provided below. The companies on this list have been classified according to percentage of ownership, method of consolidation and type of business. The information provided for each company includes: name, registered office, country and capital stock... -

Page 122

121 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % ... -

Page 123

... Credit Corporation Case Credit Holdings Limited Case Credit Ltd. Case Equipment Holdings Limited Case Equipment International Corporation Case Europe S.a.r.l. Case Harvesting Systems GmbH Case India Limited Case International Limited Case International Marketing Inc. Case LBX Holdings Inc. Case LLC... -

Page 124

... held by % of voting rights Name Registered office Country Capital stock Currency % interest held CNH Financial Services GmbH CNH Financial Services S.A. CNH Financial Services S.r.l. CNH France S.A. CNH Information Technology Company LLC CNH International S.A. CNH Latino Americana Ltda CNH... -

Page 125

... Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held New Holland Retail Receivables Corporation... -

Page 126

... the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held Iveco Danmark... -

Page 127

...Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held Iveco Ukraine Inc. Kiev Ukraine 62,515,200... -

Page 128

127 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % ... -

Page 129

... a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held Magneti Marelli Sistemi di Scarico S.p.A. Magneti Marelli South Africa (Proprietary) Limited Magneti Marelli Suspension Systems... -

Page 130

...to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held Comau Poland... -

Page 131

... the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held Magnesium Products of Italy... -

Page 132

... Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held H.R. Services S.p.A. Individua... -

Page 133

132 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % ... -

Page 134

133 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries consolidated on a line-by-line basis (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % ... -

Page 135

... to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries valued by the equity method % of Group consoli- Interest dation held by % interest held % of voting rights Name Registered office Country Capital stock Currency âš Automobiles Alfa Romeo Inc... -

Page 136

... to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries valued by the equity method (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held âš Components Cofap... -

Page 137

136 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries valued at cost % of Group consoli- Interest dation held by % interest held % of voting rights Name Registered office Country Capital stock Currency âš Automobiles Fiat ... -

Page 138

... Financial Statements The Companies of the Fiat Group Subsidiaries valued at cost (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held Comau (Shanghai) International Trading Co. Ltd. Comau U.K. Limited... -

Page 139

138 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Subsidiaries valued at cost (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held Fiat-... -

Page 140

... Financial Statements The Companies of the Fiat Group Associated companies valued by the equity method % of Group consoli- Interest dation held by % interest held % of voting rights Name Registered office Country Capital stock Currency âš Automobiles Fiat-GM Powertrain B.V. Fidis Bank... -

Page 141

140 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Associated companies valued by the equity method (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % ... -

Page 142

...to the Consolidated Financial Statements The Companies of the Fiat Group Associated companies valued at cost % of Group consoli- Interest dation held by % interest held % of voting rights Name Registered office Country Capital stock Currency âš Automobiles Car City Club S.r.l. Turin Consorzio... -

Page 143

...Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Associated companies valued at cost (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held S.I.MA.GEST2 Societ... -

Page 144

143 Fiat Group Annex to the Notes to the Consolidated Financial Statements The Companies of the Fiat Group Associated companies valued at cost (continued) % of Group consoli- Interest dation held by % of voting rights Name Registered office Country Capital stock Currency % interest held ... -

Page 145

...the Consolidated Financial Statements The Companies of the Fiat Group Other companies valued at cost % of Group consoli- Interest dation held by % interest held % of voting rights Name Registered office Country Capital stock Currency âš Agricultural and Construction Equipment Lubelska Fabryka... -

Page 146

145 Fiat S.p.A. - Financial Statements at December 31, 2003 Fiat S.p.A. Head Office: 250 Via Nizza, Turin, Italy Paid-in Capital: 4,918,113,540 euros Entered in the Turin Company Register Fiscal code: 00469580013 -

Page 147

...and buildings Plant and machinery Other assets Total Financial fixed assets Investments in: Subsidiaries Associated companies Other companies Total investments Other securities Total TOTAL FIXED ASSETS CURRENT ASSETS Inventories Contract work in progress Advances to suppliers Total Receivables Trade... -

Page 148

147 Fiat S.p.A. Financial Statements at December 31, 2003 Balance Sheet âš LIABILITIES AND STOCKHOLDERS' EQUITY December 31, 2003 in euros December 31, 2002 in euros STOCKHOLDERS' EQUITY Capital stock Additional paid-in capital Revaluation reserve under Law No. 413 of 12/30/91 Legal reserve ... -

Page 149

148 Fiat S.p.A. Financial Statements at December 31, 2003 Balance Sheet âš MEMORANDUM ACCOUNTS (note 14) December 31, 2003 in euros December 31, 2002 in euros GUARANTEES GRANTED Unsecured guarantees Suretyships on behalf of: Subsidiaries Others Other unsecured guarantees on behalf of: ... -

Page 150

... VALUE OF PRODUCTION Revenues from sales and services Change in contract work in progress Other income and revenues TOTAL VALUE OF PRODUCTION COSTS OF PRODUCTION Raw materials, supplies and merchandise Services Leases and rentals Personnel Wages and salaries Social security contributions Employee... -

Page 151

... of Operations 2003 in euros 2002 in euros ADJUSTMENTS TO FINANCIAL ASSETS Writedowns Equity investments Securities among current assets other than equity investments TOTAL ADJUSTMENTS EXTRAORDINARY INCOME AND EXPENSES Income Gains on disposals Other income Expenses Taxes relating to prior years... -

Page 152

... advances to suppliers. Work in progress under long-term contracts (i.e. contracts signed between Fiat and Treno Alta Velocità - T.A.V. S.p.A. in connection with the High-Speed Railway Project, described in Note 4) is valued on the basis of the respective production cost. Amounts received from the... -

Page 153

... are recorded on the accrual basis. Costs relating to the sale of receivables of any type (with and without recourse) and nature (trade, financial, other) are charged to the statement of operations on an accrual basis. Income taxes Liability for corporate income taxes due for the fiscal year... -

Page 154

...the Financial Statements ANALYSIS OF THE INDIVIDUAL ITEMS Fixed assets 1 Intangible fixed assets Start-up and expansion costs At December 31, 2003, they totaled 56,917 thousand euros, and include costs (bank charges and other charges) incurred in connection with the 2002 and 2003 capital increases... -

Page 155

154 Fiat S.p.A. Financial Statements at December 31, 2003 Notes to the Financial Statements 2 Property, plant and equipment At December 31, 2003 and 2002, property, plant and equipment totaled 45,238 thousand euros and 48,174 thousand euros, respectively. These amounts are net of accumulated ... -

Page 156

155 Fiat S.p.A. Financial Statements at December 31, 2003 Notes to the Financial Statements (in millions of euros) Company name % owned by Fiat S.p.A. 2002 Acquisitions Book Capital value increases Contributions Mergers Disposals Write-downs 2003 Book value Subsidiaries Fiat Partecipazioni... -

Page 157

... Financial Statements In particular, increases include: (in thousands of euros) Acquisitions Subsidiaries 51% of Fiat Information & Communication Services S.r.l. from Fiat Partecipazioni S.p.A. (formerly Sicind S.p.A.) 5% of Fiat Revi S.c.r.l. from Toro Assicurazioni S.p.A. Total Capital increases... -

Page 158

... Financial Statements contains a list of equity investments and the additional information required under Article 2427 of the Italian Civil Code and the supplemental data recommended by CONSOB, including changes in quantity and value of subsidiaries and associated companies and, for publicly traded... -

Page 159

...line with the previous year. As regards fixed assets, the tables at the end of these Notes to the Financial Statements include the following: âš the additional information on cost, upward adjustments, writedowns and amortization and depreciation required under Article 2427 of the Italian Civil Code... -

Page 160

... factoring companies refers in part to receivables sold to factors and not yet paid. The credit for net deferred tax assets was the result of provisions to reserves in fiscal 2002 for tax prepayments on losses from equity investments deductible in subsequent fiscal years (238,000 thousand euros) net... -

Page 161

...Global N.V. against issuance of 5,920,000 preferred shares (Note 3). In 2003 receivables due from tax authorities, for which Government securities have already been requested in lieu of cash, were sold without recourse to Ifitalia. 7 Cash Bank and post office accounts This item, which at the end of... -

Page 162

... the sale of receivables due from Tax Authorities Other operating costs Total prepaid expenses 502 7,736 8,238 254 681 935 248 7,055 7,303 9 Stockholders' Equity Capital stock Capital stock, fully paid-in, amounts to 4,918,114 million euros at December 31, 2003 and consists of 983,622,708 shares... -

Page 163

...meeting of May 13, 2003. The decrease was partly compensated by the proceeds from the sale of the option rights of the 2003 capital increase that were not exercised and which were sold on the stock market pursuant to Article 2441, paragraph 3 Italian Civil Code, net of the amount paid for the option... -

Page 164

... following writedown of treasury stock Allocation to additional paid-in capital of the value of unexercised option rights sold on the stock market Capital increase from 3,082.1 million euros to 4,918.1 million euros through issue of ordinary shares as resolved by the Board of Directors on June 26... -

Page 165

... shares (23,256 thousand euros) on the stock market, expenses for employee bonuses (7,103 thousand euros), losses of equity investments in excess of their book value (148 thousand euros), scholarships (68 thousand euros), and costs connected to personnel laid off with long-term unemployment benefits... -

Page 166

... Italian Association of Financial Analysts - AIAF - the value has been adjusted with respect to the original value of 15.50 euros following the capital increase of Fiat S.p.A.) and the average stock market price in the last three or six months, depending on the case, preceding the facility repayment... -

Page 167

... of the substitute tax payable on the capital gain earned on the sale of IN.TE.SA. S.p.A. will be paid within the filing deadline for the 2003 tax return. Social security payable This item totaled 2,344 thousand euros at December 31, 2003, an increase of 909 thousand euros from December 31... -

Page 168

...), bank loans (279,816 thousand euros), and rent payment obligations for buildings leased from Morgan Stanley & Co. International Ltd. and other lessors (407,940 thousand euros). The net decrease of 185,618 thousand euros from December 31, 2002 is mainly due to lower guarantees provided to secure... -

Page 169

... and Trade Ltd. 8,118,721 thousand euros, Fiat Finance North America Inc. 187,632 thousand euros, Fiat Finance Luxembourg S.A. 1,764,842 thousand euros, Fiat Finance Canada Ltd. 100,000 thousand euros), credit lines (New Holland Credit Company LLC 395,883 thousand euros, Fiat Auto Financial Services... -

Page 170

... and, for the remaining 10,000,000 shares, by executing a total return equity swap contract with a reference price of 6.173 euros per share. The swap matures on August 31, 2004. Under current accounting principles, hedge-accounting rules cannot be applied to equity swaps, even when they are executed... -

Page 171

... rental income from buildings owned by Fiat S.p.A. and leased to Group companies; 9,110 thousand euros in fees paid by subsidiaries for services performed by employees of Fiat S.p.A. in the capacity of Directors; 1,557 thousand euros deriving from the capital gain on the sale of the building located... -

Page 172

...euros); losses on sales of vehicles and office equipment (231 thousand euros), prior period expenses for employee bonuses (2,379 thousand euros) that were ascertained upon audit to be less than what was paid and sundry items. It also includes fees paid to the Statutory Auditors and Directors of Fiat... -

Page 173

...438 273,447 Other financial income From receivables held as fixed assets This item was equal to zero in 2003. This item represented accrued interest on a loan to Elasis S.c.p.A. paid off in the first half of 2002. From securities held as fixed assets other than equity investments This item consists... -

Page 174

... unsecured guarantees provided on behalf of the following Group companies: Fiat Finance and Trade Ltd Fiat Partecipazioni S.p.A. (formerly Sicind S.p.A.) Fiat Finance Luxembourg S.A. Fiat Auto Financial Services Limited Banco CNH Capital S.A. Fiat Auto S.p.A. New Holland Credit Company LLC FiatSava... -

Page 175

... (320 thousand euros), and Fiat Revi S.c.r.l. (27 thousand euros). Writedowns of securities among current assets other than equity investments This item amounted to 5,076 thousand euros and consists of writedown of the book value of treasury stock to the average stock market price for the month... -

Page 176

... by Mediobanca in connection with the "Ferrari" contract described in Note 14 (15,504 thousand euros) and valuation of the Insurance Sector headed by Toro Assicurazioni S.p.A. (1,617 thousand euros), which was subsequently sold. They also include IRPEG (corporate income taxes) for fiscal 2002... -

Page 177

176 Fiat S.p.A. Financial Statements at December 31, 2003 Notes to the Financial Statements ANALYSIS OF FIXED ASSETS AND SUPPLEMENTAL INFORMATION Cost of fixed assets Gross value at beginning of fiscal year Increases Decreases Disposals, sales and contributions (in thousands of euros) Historical... -

Page 178

...10/2001) Cost of capital increase to 4,918.11 million euros (Board Resolution of 06/26/2003) Leasehold improvements Concessions, licenses, trademarks and similar rights Other Intangible fixed assets Expenses connected to convertible facility Property, plant and equipment Land and buildings Plant and... -

Page 179

... adjustments Historical cost subject to upward adjustments No. 74 of 2/11/52 Upward adjustments permitted by Law No. 72 of 3/19/83 No. 413 of 12/30/91 Upward adjustments included in book value at end of period Property, plant and equipment Land and buildings Plant and machinery Other fixed assets... -

Page 180

... fixed assets Company and registered office Capital (in euros) Result for the last fiscal year (in euros) Stockholders' equity (in euros) % owned by Fiat S.p.A Number of shares Total book value (in euros) CNH Global N.V. - Amsterdam (Netherlands) At 12/31/02 â™ Subscription of capital increase... -

Page 181

... Financial Statements at December 31, 2003 Notes to the Financial Statements List of investments (continued) Company and registered office Capital (in euros) Result for the last fiscal year (in euros) Stockholders' equity (in euros) % owned by Fiat S.p.A Number of shares Total book value (in euros... -

Page 182

... to the Financial Statements List of investments (continued) Company and registered office Capital (in euros) Result for the last fiscal year (in euros) Stockholders' equity (in euros) % owned by Fiat S.p.A Number of shares Total book value (in euros) Fiat Partecipazioni S.p.A. (formerly Fiat Auto... -

Page 183

... Financial Statements at December 31, 2003 Notes to the Financial Statements List of investments (continued) Company and registered office Capital (in euros) Result for the last fiscal year (in euros) Stockholders' equity (in euros) % owned by Fiat S.p.A Number of shares Total book value (in euros... -

Page 184

... Financial Statements List of investments in other companies and additional information specified in the Consob communication of February 23, 1994 âš Other companies included in financial fixed assets Company and registered office % owned by Fiat S.p.A. Number of shares Total book value (in euros... -

Page 185

... Notes to the Financial Statements Treasury stock at December 31, 2003 Book value % owned by Fiat S.p.A. Number of shares per share (in euros) total (in euros) per share (in euros) Par value total (in euros) Ordinary shares At 12/31/02 â™ Purchases â™ Writedown to market value during the month... -

Page 186

... generated from net income (in euros) Total (in euros) Additional paid-in capital Revaluation reserve under Law No. 413 of Dec. 30, 1991 Legal reserve Treasury stock valuation reserve Other reserves Extraordinary reserve Reserve for purchase of treasury shares Out-of-period income reserve under... -

Page 187

...to the Financial Statements Analysis of cash flow (in thousands of euros) 2003 2002 A. Initial short-term financial assets B. Cash flow - operating activities Income (loss) for the fiscal year Depreciation and amortization Capital gains on sales of fixed assets Writedowns of equity investments Net... -

Page 188

... Statements Fees paid to Directors, Statutory Auditors and Chief Operating Officers (in thousands of euros) (Article 78 of Consob Resolution No. 11971/99) First name and last name Office held in 2003 Term of office Expiration (*) Compensation for office held Non-cash Bonuses and Other benefits... -

Page 189

...Statements Stock Options granted to Directors and Chief Operating Officers (Article 78 of Consob Resolution No. 11971/99) Grantee Office held at the date of the grant Number of options Options held at the beginning of the year Average exercise price Exercise period (mm/yy) Number of options Options... -

Page 190

... standards in Italy as recommended by the Italian Regulatory Commission for Companies and the Stock Exchange ("Consob"). Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement and... -

Page 191

... standards in Italy as recommended by the Italian Regulatory Commission for Companies and the Stock Exchange ("Consob"). Those Standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement and are, as... -

Page 192

... subsidiaries and the official information provided by said subsidiaries. The financial statements communicated by the subsidiaries to the Parent Company for the purpose of compiling the consolidated financial statements were prepared by the respective management bodies, reviewed by the bodies and... -

Page 193

...with the recommendations of the Corporate Governance Code issued by the Committee for the Corporate Governance of Italian listed companies and a member of the Board of Statutory Auditors was present at all Audit Committee meetings. âš We have received confirmation from Deloitte & Touche S.p.A. that... -

Page 194

...automotive engineering, for a fee of 5,200 euros; - support activities during the diagnostic phase of the "adoption of the International Accounting Standards (IAS)" project at Fiat S.p.A. and its subsidiaries, for fees totaling 1,955,000 euros. Based on our direct audits and the information received... -

Page 195

-

Page 196

... by pursuing increasingly incisive corporate risk prevention strategies, which it implements by improving and updating its structures, monitoring the effectiveness of its internal control systems and adopting compliance programs designed to minimize risk. Nevertheless, since Directors must continue... -

Page 197

... Code, listing the address of the registered office is no longer required, and the Board of Directors may be granted authority to open or close secondary offices. Article 5 - Capital Stock The wording of the powers granted to Directors pursuant to Article 2423 ter of the Italian Civil Code no longer... -

Page 198

... changes in the law and the transfer of the Company's registered office to another location in Italy. Article 16 - Representation The Board of Directors is being expressly granted the authority to delegate power to Directors who do not hold corporate offices and to authorize them to represent the... -

Page 199

... and 79,912,800 savings shares, all with a par value of 5 euros each. Pursuant to the resolutions approved by the Board of Directors on December 10, 2001 and June 26, 2003, the amount of the Company's capital stock may be raised, through a contributory capital increase, by a maximum of 81,886,460... -

Page 200

... set by law. Increases in capital made pursuant to said powers may, within a limit of 1% of the capital stock, be reserved for employees of the Company and/or its subsidiaries, in accordance with procedures and criteria established by the Board of Directors. Capital stock increases deriving from the... -

Page 201

... number is insufficient. The Company's capital stock may also be increased by issuing ordinary and/or preference and/or savings shares in exchange for the contribution of assets or the cancellation of accounts payable. Resolutions authorizing the issuance of new preference or savings shares with... -

Page 202

... the date of a third call may also be fixed. Since the company is required to prepare consolidated financial statements, it must convene an Ordinary Stockholders' Meeting within 180 days after the end of the fiscal year. A Stockholders' Meeting may also be convened whenever the Board of Directors... -

Page 203

...' Meeting is no longer in office, the term of office of the entire Board of Directors will be deemed to have expired, and a Stockholders' Meeting will be convened on an urgent basis by the Directors still in office for the purpose of electing a new Board of Directors. Art. 14 - Corporate Offices... -

Page 204

... on the information it receives, the Board of Directors evaluates the adequacy of the Company's organization, administrative structure and accounting system; reviews the Company's strategic, industrial and financial plans; and based on reports provided by the bodies with delegated powers, assesses... -

Page 205

... signed by the Chairman of the meeting and the Secretary. Art. 14 - Resolutions of the Board of Directors UNCHANGED UNCHANGED Art. 17 - Powers of the Board of Directors The Board is vested, without any limitation, with full powers for the ordinary and extraordinary management of the Company, with... -

Page 206

... laid down by the pertinent regulations and this article, cannot be included in candidate lists. Resigning statutory auditors may be re-elected. The lists presented must be deposited at the company's offices at least ten days prior to the date set for the Meeting on first call, and mention of such... -

Page 207

...the rights, duties and prerogatives of external auditors are governed by the applicable statute. Art. 20 - Financial Year The Company's financial year ends on December 31 each year. Art. 21 - Allocation of Net Income The net income for the year resulting from the annual financial statements shall be... -

Page 208

...the Board of Directors may authorize the payment of interim dividends. Art. 23 - Payment and Statute of Limitation of Dividends Dividends shall be payable at the Company's Registered Office and at banking institutions designated by the Company. Dividends not collected within five years from the day... -

Page 209

Annual Report Consolidated and Statutory Financial Statements at December 31, 2003 Editorial Coordination: Micrograf - Turin, Italy Design by: Fantinel & Associati - Turin, Italy Printed by: Mariogros - Turin, Italy Printed in Italy May 2004 01UK