Capital One 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

81

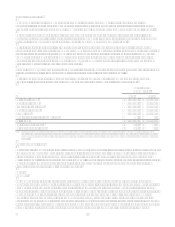

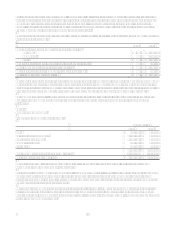

During 2005, the Company recognized a $20.6 million prepayment penalty for the refinancing of the McLean Headquarters

facility. Of this amount, $16.8 million was allocated to the U.S. Card segment, $2.7 million was allocated to the Global

Financial Services segment, $0.6 million was allocated to the Auto Finance segment, and the remainder of the balance was

held in the Other category.

During 2005, the Company recognized a $28.2 million impairment charge related to the write-off of the Companys

insurance brokerage business. The charge was recorded in non-interest expense and fully allocated to the Global Financial

Services segment.

The Gulf Coast Hurricanes Impacts

As a result of the Gulf Coast Hurricanes of 2005, the Company recorded a $28.5 million allowance for loan losses and

recognized a $15.6 million write-down on retained interests related to its loan securitization programs in 2005. Of the

additional allowance build, $10.0 million was allocated to the U.S. Card segment, $2.5 million was allocated to the Global

Financial Services segment, and $16.0 million was allocated to the Auto Finance segment. The $15.6 million write-down of

retained interests was held in the Other category. The impact of the hurricanes on Hibernia was reflected in Hibernias results

prior to the acquisition

During 2006, the Company determined that $25.7 million of allowance for loan losses previously established by Hibernia to

cover expected losses in the portion of the loan portfolio impacted by the hurricanes was no longer needed. This

determination was driven by improvements in credit performance of the impacted portfolios since the time those reserves

were established. As a result, the Banking segment includes the reversal of this allowance.

Bankruptcy Legislation Impacts

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (new bankruptcy legislation) became effective in

October 2005. As a result, the Company experienced a significant increase in bankruptcy related charge-offs during 2005

which is reflected in the provision for loan losses. The majority of the increase was allocated to the U.S. Card segment.

MasterCard IPO

During 2006, MasterCard, Inc. completed an initial public offering of its stock. In connection with this transaction, the

Company received 2,305,140 Class B shares of which 1,360,032 Class B shares were immediately redeemed by MasterCard,

Inc. The Company recognized a $20.5 million gain from the share redemption, which was reported in non-interest expense

and held in the Other category. In addition, the Company sold a combination of previously purchased charged-off loan

portfolios and Company originated charged-off loans resulting in the recognition of $83.8 million of non-interest income held

in the Other category.

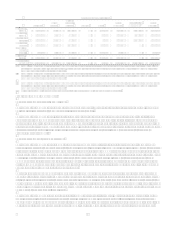

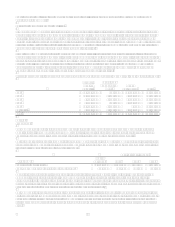

Note 4

Securities Available for Sale

Securities available for sale as of December 31, 2006, 2005 and 2004 were as follows:

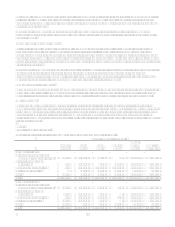

Expected Maturity Schedule

1 Year

or Less

15

Years

510

Years

Over 10

Years

Market

Value

Totals

Amortized

Cost Totals

December 31, 2006

U.S. Treasury and other U.S.

government agency obligations $ 422,352 $ 1,404,961 $ 239,127 $ 991 $ 2,067,431 $ 2,091,601

Collateralized mortgage

obligations 2,009 2,197,964 96,820 543,189 2,839,982 2,860,302

Mortgage backed securities 4,858 1,207,529 1,470,515 5,914,861 8,597,763 8,692,290

Asset backed securities 284,275 157,770 161,713 603,758 606,558

Other 573,830 204,781 154,542 409,960 1,343,113 1,293,580

Total $ 1,003,049 $ 5,299,510 $ 2,118,774 $ 7,030,714 $ 15,452,047 $ 15,544,331

December 31, 2005

U.S. Treasury and other U.S.

government agency obligations $ 867,737 $ 2,741,771 $ 789,664 $ 4,020 $ 4,403,192 $ 4,480,536

Collateralized mortgage

obligations 84,531 3,840,768 85,777 4,011,076 4,084,633

Mortgage backed securities 4,528 3,601,471 509,398 9,683 4,125,080 4,138,804

Asset backed securities 231,395 1,064,668 92,506 1,388,569 1,391,930

Other 108,748 10,349 20,722 177,282 317,101 281,350

Total $ 1,296,939 $ 11,259,027 $ 1,498,067 $ 190,985 $ 14,245,018 $ 14,377,253