Capital One 2006 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 35

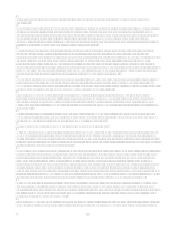

Sale of Mortgage Loans

During the fourth quarter, the Company entered agreements and established the price with third parties to sell $1.5 billion of

CONAs residential mortgage portfolio and $4.2 billion of North Fork Banks mortgage portfolio as part of a balance sheet

downsizing related to the acquisition of North Fork. In December 2006, $0.2 billion of loans were sold, resulting in a loss of

$9.2 million. The Company recognized a loss of $21.4 million resulting from the mark to lower of cost or market on the

remaining $5.5 billion of mortgage loans held for sale which was recorded in mortgage banking operations income. The

Company entered into freestanding interest rate swaps to mitigate the interest rate exposure on the mortgage loans held for

sale. The Company recognized a mark-to-market gain on the freestanding interest rates swaps of $35.7 million in mortgage

banking operations income.

MasterCard, Inc. Initial Public Offering

In May 2006, MasterCard, Inc. completed an initial public offering of its stock. In connection with this transaction the

Company received 2,305,140 Class B shares of which 1,360,032 Class B shares were immediately redeemed by MasterCard,

Inc. The Company recognized a $20.5 million gain from the share redemption, which was recorded in other non-interest

income. The Class B shares carry certain trading restrictions which lapse in 2010.

Charged-Off Loan Portfolio Sale

In February 2006, the Company recognized $83.8 million of income from the sale of a combination of previously purchased

charged-off loan portfolios and Company originated charged-off loans. The sale resulted in the acceleration of certain future

portfolio returns. The pre-tax income is reflected in the following income statement line items: an increase of $66.4 million to

various revenue line items, the majority of which was recorded to other non-interest income for the portion related to

purchased charged-off loan portfolios; a $7.0 million reduction in the provision for loan losses through an increase in

recoveries for the portion of charged-off loans originated by the Company and not securitized; and an increase of $10.4

million to servicing and securitizations income for the portion of charged-off loans originated by the Company and

securitized.

Resolution of Tax Issues

During 2006, the Companys income tax expense was reduced by $70.7 million due to the resolution of certain tax issues and

audits for prior years with the Internal Revenue Service. This reduction represented the release of previous accruals for

potential audit adjustments which were subsequently settled or eliminated and further refinement of existing tax exposures.

Release of Hurricane Reserve

During 2006, the Company determined that $25.7 million of allowance for loan losses previously established to cover

expected losses in the portion of the loan portfolio impacted by the 2005 hurricanes was no longer needed. This

determination was driven by improvements in credit performance of the impacted portfolios since the time those reserves

were established. As a result, results for the Banking segment include the reversal of this allowance.

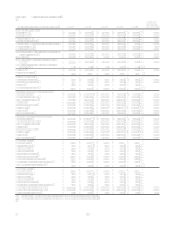

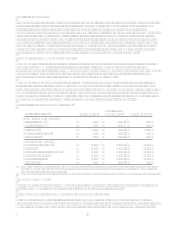

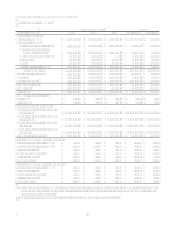

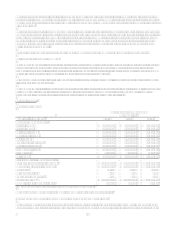

VI. Financial Summary

Table 1 provides a summary view of the consolidated income statement and selected metrics at and for the years ended

December 31, 2006, 2005 and 2004.