Capital One 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

Note 6

Loans Held for Investment

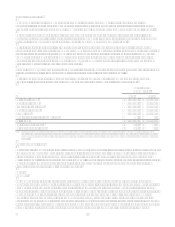

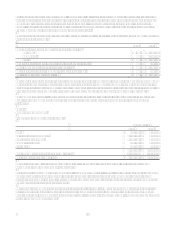

The composition of the loans held for investment portfolio was as follows:

December 31

2006 2005

Year-End Balances:

Reported loans:

Consumer loans:

Credit cards

Domestic $ 18,102,140 $ 16,389,054

International 3,203,148 3,356,415

Total credit cards 21,305,288 19,745,469

Installment loans

Domestic 7,057,270 5,763,538

International 637,982 551,460

Total installment loans 7,695,252 6,314,998

Auto loans 23,180,455 18,041,894

Mortgage loans 12,586,905 5,281,009

Total consumer loans 64,767,900 49,383,370

Commercial loans 31,744,239 10,464,311

Total reported loans held for investment $ 96,512,139 $ 59,847,681

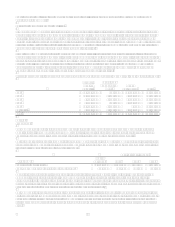

Note 7

Loans Acquired in a Transfer

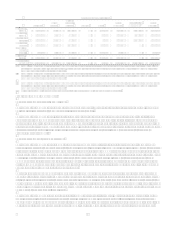

In conjunction with the Hibernia merger transaction in 2005, the Company acquired certain loans for which there was, at

acquisition, evidence of deterioration of credit quality since origination and for which it was probable, at acquisition, that all

contractually required payments would not be collected. Those loans are segregated into pools apart from the remaining

portfolio and accounted for under Statement of Position 03-3, Accounting for Certain Loans or Debt Securities Acquired in a

Transfer (SOP 03-3).

The carrying amount of those loans is included in loans held for investment in the consolidated balance sheet at December 31

and is as follows:

December 31

2006 2005

Consumer $ $ 2,428,886

Commercial 607,540 1,695,151

Total Outstanding $ 607,540 $ 4,124,037

Total carrying amount $ 560,054 $ 3,938,394

Accretable Yield

2006 2005

Balance at beginning of year $ 565,739 $

Additions 602,729

Accretion (183,092) (36,990)

Adjustments during allocation period (269,850)

Transfers to held for sale (24,093)

Balance at end of year $ 88,704 $ 565,739

The majority of these loans were accounted for under SOP 03-3 because of the expected impact of the Gulf Coast Hurricanes.

During the one year allocation period following the merger date, the Company determined that certain loans, for which it was

considered probable at acquisition that all contractually required payments would not be collected, did not have the evidence

of deterioration of credit quality originally considered. As a result, the Company reclassified $2.0 billion of loans out of the

existing SOP 03-3 loan pools at par with a corresponding $30.8 million increase to the allowance for loan losses to cover