Capital One 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 34

levels of liquidity. Capital ratios remained well above the regulatory well capitalized thresholds following the acquisition

of Hibernia.

2006 Significant Events

Acquisition of North Fork Bancorporation

On December 1, 2006, Capital One acquired 100% of the outstanding common stock of North Fork Bancorporation, a bank

holding company with more than 350 bank branches in the New York metropolitan area and a nationwide mortgage business.

Pursuant to the Merger Agreement, each share of North Fork common stock outstanding at the effective time of the merger

was converted into the right to receive either $28.144 in cash or 0.3692 of a share of Capital One common stock, at the

election of each North Fork stockholder, subject to proration due to limitations on the aggregate amount of cash to be paid by

Capital One in the merger and depending on the election of other North Fork stockholders, as specified in the Merger

Agreement. Capital One paid $13.2 billion in cash and Capital One common stock to North Fork stockholders.

The average of the closing prices of Capital One common stock on the NYSE for the five trading days ending the day before

the completion of the merger was $76.24. The total consideration of $13.2 billion included the value of outstanding stock

options and was paid with the issuance of 104.0 million shares of Capital Ones common stock and $5.2 billion in cash

consideration. Upon completion of the merger, outstanding options of North Fork were exchanged for options of Capital One

with the number of options and option price adjusted for the exchange ratio. Capital One financed the cash portion of the

acquisition through a combination of short term liquidity conversions and debt offerings. Specifically, Capital One acquired

the common shares by liquidating $1.0 billion of federal funds sold and resale agreements and by issuing $995.0 million of

trust preferred capital securities and $3.2 billion of senior and subordinated debt.

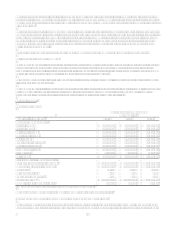

Debt Issuance to fund North Fork Acquisition

In June 2006, the Company and Capital One Capital II, a subsidiary of the Company created as a Delaware statutory business

trust, issued $345.0 million aggregate principal amount of 7.5% Enhanced Trust Preferred Securities (the Enhanced

TRUPS®) that are scheduled to mature on June 15, 2066. The securities represent a preferred beneficial interest in the assets

of the trust and are recorded in other borrowings in the balance sheet. For regulatory capital purposes the securities are treated

as equity and serve to increase Tier 1 and Total Risk Based Capital at the holding company level.

In July 2006, the Company and Capital One Capital III, a subsidiary of the Company created as a Delaware statutory business

trust, issued $650.0 million aggregate principal amount of 7.686% Capital Securities that are scheduled to mature on

August 15, 2036. The securities represent a preferred beneficial interest in the assets of the trust and are recorded in other

borrowings in the balance sheet. For regulatory capital purposes the securities are treated as equity and serve to increase Tier

1 and Total Risk Based Capital at the holding company level.

In August 2006, the Company issued $1.0 billion aggregate principal amount of 6.150% Subordinated Notes due

September 1, 2016.

In September 2006, the Company issued $1.1 billion of Floating Rate Senior Notes due September 10, 2009 and $1.1 billion

of 5.7% Senior Notes due September 15, 2011.

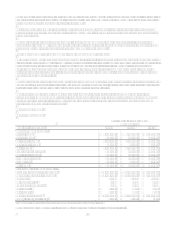

North Fork Balance Sheet Derivative

In April 2006, the Company entered into derivative instruments to mitigate certain exposures it faced as a result of the

expected acquisition of North Fork. The position was designed to protect the Companys tangible capital ratios from falling

below a desired level in the event that subsequent increases in interest rates had reduced the mark-to-market value of North

Forks balance sheet prior to closing. The Companys maximum negative exposure was expected to be no more than

approximately $50 million. The derivative instruments were not treated as designated hedges under Statement of Financial

Accounting Standard No. 133, Accounting for Derivative Instruments and Hedging Activities, and as such were marked to

market through the income statement until the derivatives were terminated. The derivative instruments expired out of the

money and unexercised on October 2, 2006 with a $50.1 million reduction to non-interest income.

Loss on Sale of Securities

Subsequent to the North Fork acquisition, in December the Company sold a number of Treasury and Agency securities

realizing a loss of $34.9 million.