Capital One 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 54

Company now expects to start the program in the second quarter of 2007, and increase the expected portion of the share buy-

back, which will occur in 2007, to approximately $2.25 billion.

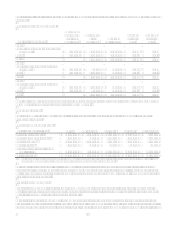

The Companys earnings are a function of its revenues (net interest income and non-interest income), consumer usage,

payment and attrition patterns, the credit quality and growth rate of its earning assets (which affect fees, charge-offs and

provision expense), the growth rate of its branches and deposits, and the Companys marketing and operating expenses.

Specific factors likely to affect the Companys 2007 earnings are the portion of its loan portfolio it holds in higher credit

quality assets, the level of off-balance sheet securitizations, changes in consumer payment behavior, the amount of and

quality of deposits it generates, the competitive, legal, regulatory and reputational environment, the level of investments,

growth in its businesses, and the health of the economy and its labor markets.

The Company expects to achieve these results based on the continued success of its business strategies and its current

assessment of the competitive, regulatory and funding market environments that it faces (each of which is discussed

elsewhere in this document), as well as the expectation that the geographies in which the Company competes will not

experience significant consumer credit quality erosion, as might be the case in an economic downturn or recession.

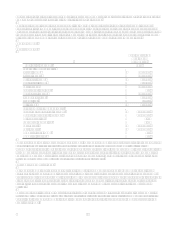

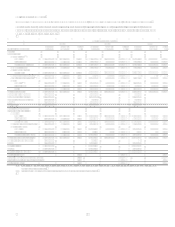

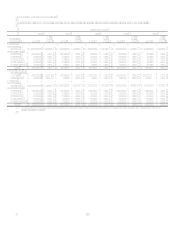

U.S. Card Segment Outlook

The Companys U.S. Card segment consisted of $53.6 billion of managed U.S. consumer credit card loans as of

December 31, 2006. The Companys strategy for its U.S. Card segment is to offer compelling, value-added products to its

customers. Growth in the year resulted from a combination of new customer acquisitions as well as growth and retention of

balances from existing customers. For the full year of 2006, purchase volume was up 13% from 2005, primarily as a result of

continued growth in the Rewards business.

Revenue margin for the U.S. Card business was down 122 basis points from 2005 driven by two product strategy changes

and one-time effects. For several years, the Company has focused on marketing products that build long- term customer

loyalty, including rewards cards. These products have relatively high acquisition costs, build balances relatively slowly, and

have thinner revenue margins. However, they have low charge-off rates, and tend to stay around for many years. Rewards

accounts also bring credit leverage, resulting in sustained profitability while enhancing the Companys brand and creating

enduring customer relationships.

Another significant part of the U.S. Cards product strategy has been the Companys shift upmarket within the subprime

portion of its U.S. Card business to include more products with no annual fees and competitive rates. The Company believes

the payoff in this strategy results in lower servicing costs, lower credit costs, and lower attrition rates.

The Company believes these changes made over the last several years position the U.S. Card business to deliver sustainable

bottom-line returns through low credit losses, long-term customer relationships, diversified revenue streams, and improving

operating efficiency.

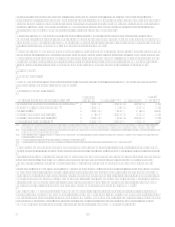

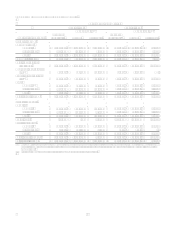

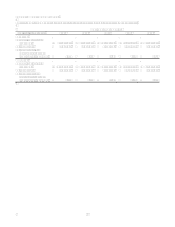

Auto Finance Segment Outlook

The Companys Auto Finance segment consisted of $21.8 billion of managed U.S. auto loans as of December 31, 2006,

marketed across the full credit spectrum, via direct and dealer marketing channels.

The Company believes that its strong risk management skills, increasing operating scale, full credit spectrum product

offerings and multi-channel marketing approach will enable it to continue to increase market share in the Auto Finance

industry.

Global Financial Services Segment Outlook

The Global Financial Services segment consisted of $27.0 billion of managed loans as of December 31, 2006, including

international lending activities, small business lending, installment loans, home loans, healthcare finance and other consumer

financial service activities.

The Company expects continued loan, credit and profit pressure from a deteriorating credit environment in its U.K. business.

Despite this pressure, the Company expects profitable long term growth from its U.K. business. The Company also expects

continued growth from its North American businesses due to its wide range of full credit spectrum product offers, ability to

leverage the Capital One brand, and continued improvement in operating scale.

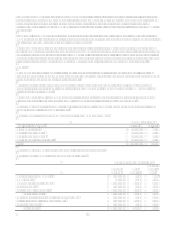

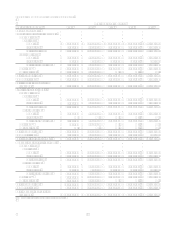

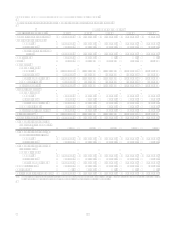

Banking Segment Outlook

Deposits in the Banking segment increased $170.8 million to $35.3 billion in the fourth quarter and continued to grow in

Texas and parts of Louisiana that were not significantly disrupted by the Gulf Coast hurricanes of 2005. Growth in these