Capital One 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 50

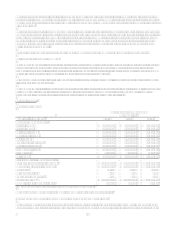

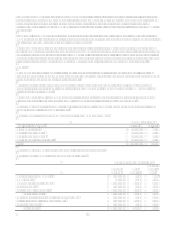

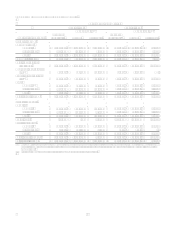

Included in senior and subordinated notes on the Companys balance sheet, the Bank has a global bank note program. Notes

may be issued under this program with maturities of thirty days or more from the date of issue. At December 31, 2006, the

Bank had $3.4 billion in bank notes outstanding.

Subsidiary banks are members of various Federal Home Loan Banks (FHLB) that provide a source of funding through

advances. These advances carry maturities from one month to 30 years. At December 31, 2006, the Company had $2.6 billion

of advances from the FHLBs. All FHLB borrowings are collateralized with mortgage-related assets which may include

residential and commercial mortgages and home equity loans.

The Company also held $6.0 billion in available-for-sale investment securities, net of $9.5 billion in pledged available-for-

sale investment securities and $4.7 billion of cash and cash equivalents at December 31, 2006, compared to $9.2 billion in

available-for-sale investment securities, net of $5.1 billion in pledged available-for-sale investment securities and $4.1 billion

of cash and cash equivalents at December 31, 2005. As of December 31, 2006, the weighted average life of the investment

securities was approximately 3.6 years. These investment securities, along with cash and cash equivalents, provide increased

liquidity and flexibility to support the Companys funding requirements.

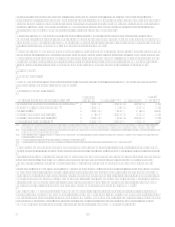

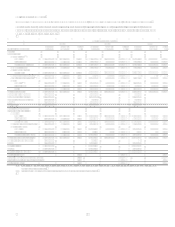

The Company has a $750.0 million credit facility committed through June 2007. The Company may take advances under the

facility subject to covenants and conditions customary in a transaction of this nature. This facility may be used for general

corporate purposes and was not drawn upon at December 31, 2006.

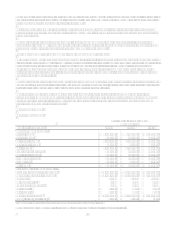

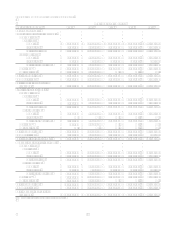

On June 6, 2006, August 1, 2006 and February 5, 2007, the Corporation and certain of its subsidiary trusts (Capital One

Capital II, Capital One Capital III and Capital One Capital IV, respectively) completed offerings of trust preferred securities,

representing preferred beneficial interests in the assets of the subsidiary trusts. The proceeds from the sale of the trust

preferred securities to investors, and of certain common trust securities to the Corporation, were invested by the subsidiary

trusts in junior subordinated debt securities of the Corporation.

Simultaneously with the closing of each of these offerings of trust preferred securities, the Corporation entered into a

replacement capital covenant for the benefit of persons that buy, hold or sell a specified series of long-term indebtedness of

the Corporation or certain of its depositary institution subsidiaries. The Company will provide a copy of the replacement

capital covenant to holders of the covered debt upon request made to Investor Relations.

The replacement capital covenants provide that the Corporation will not repay, redeem or purchase, and will cause its

subsidiaries not to repay, redeem or purchase, all or any part of the relevant trust preferred securities or junior subordinated

debt securities prior to a defined termination date except, with certain limited exceptions, to the extent that, during the

180 days prior to the date of that repayment, redemption or purchase, the Corporation or its subsidiaries have received

proceeds from the sale of qualifying securities that (i) have equity-like characteristics that are the same as, or more equity-

like than, the applicable characteristics of the relevant junior subordinated debt securities at the time of redemption or

repurchase, and (ii) the Corporation has obtained prior approval of the Federal Reserve Board, if such approval is then

required by the Federal Reserve Board.

As of the date of this Annual Report, the Corporations 5.35% Subordinated Notes, due May 1, 2014, is the series of long-

term indebtedness whose holders are entitled to the benefits of the replacement capital covenants.

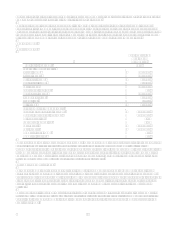

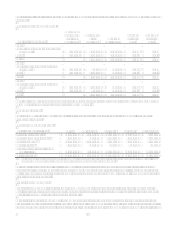

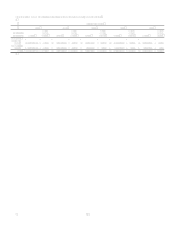

Derivative Instruments

The Company enters into interest rate swap agreements in order to manage interest rate exposure. In most cases, this

exposure is related to the funding of fixed rate assets with floating rate obligations, including off-balance sheet

securitizations. The Company also enters into forward foreign currency exchange contracts to reduce sensitivity to changing

foreign currency exchange rates. The hedging of foreign currency exchange rates is limited to certain intercompany

obligations related to international operations. These derivatives expose the Company to certain credit risks. The Company

has established policies and limits, as well as collateral agreements, to manage credit risk related to derivative instruments.

In April 2006, the Company entered into derivative instruments to mitigate certain exposures it faced as a result of the

expected acquisition of North Fork. The position was designed to protect the Companys tangible capital ratios from falling

below a desired level. The Companys maximum negative exposure was expected to be no more than approximately $50

million. The derivative instruments expired out of the money and unexercised on October 2, 2006.

Additional information regarding derivative instruments can be found on pages 107-109 in Item 8 Financial Statements and

Supplementary DataNotes to the Consolidated Financial StatementsNote 23.