Capital One 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 72

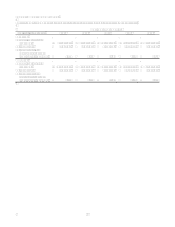

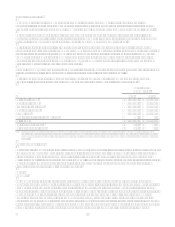

As a result of adopting SFAS 123(R) on January 1, 2006, the Companys income before income taxes and net income for the

year ended December 31, 2006 are $35.3 million and $23.3 million lower, respectively, than if it had continued to account for

share-based compensation under SFAS 123. Basic and diluted earnings per share for 2006 would have been $7.87 and $7.69,

respectively, if the Company had not adopted SFAS 123(R), compared to reported basic and diluted earnings per share of

$7.80 and $7.62, respectively.

Prior to the adoption of SFAS 123(R), the Company presented all tax benefits of deductions resulting from the exercise of

stock options as operating cash flows in the Statement of Cash Flows. SFAS 123(R) requires the cash flows resulting from

the tax benefits resulting from tax deductions in excess of the compensation cost recognized for those options (excess tax

benefits) to be classified as financing cash flows.

Significant Accounting Policies

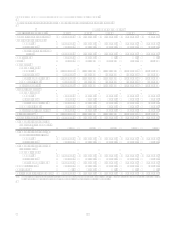

Cash and Cash Equivalents

Cash and cash equivalents includes cash and due from banks, federal funds sold and resale agreements and interest-bearing

deposits at other banks. Cash paid for interest for the years ended December 31, 2006, 2005 and 2004 was $2.9 billion, $1.9

billion and $1.8 billion, respectively. Cash paid for income taxes for the years ended December 31, 2006, 2005 and 2004 was

$1.5 billion, $654.8 million and $705.1 million, respectively.

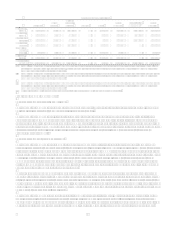

Securities Available for Sale

The Company classifies all debt securities as securities available for sale. These securities are stated at fair value, with the

unrealized gains and losses, net of tax, reported as a component of cumulative other comprehensive income. The amortized

cost of debt securities is adjusted for amortization of premiums and accretion of discounts to maturity. Such amortization or

accretion is included in interest income. Realized gains and losses on sales of securities are determined using the specific

identification method. The Company evaluates its unrealized loss positions for impairment in accordance with FASB Staff

Position No. 115-1, The Meaning of Other-Than-Temporary Impairment and its Application to Certain Investments. See Note

4 for additional details.

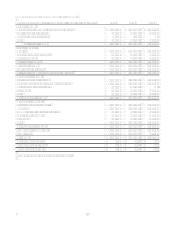

Mortgage Loans Held for Sale

Mortgage loans held for sale consist primarily of residential mortgage loans, secured by one-to-four family residential

properties located throughout the United States. Loans originated with the intent of selling in the secondary market are

classified as held for sale. Mortgage loans held for sale are carried at the lower of aggregate cost, net of deferred fees,

deferred origination costs and effects of hedge accounting, or fair value. The fair value of mortgage loans held for sale is

determined using current secondary market prices for loans with similar coupons, maturities and credit quality.

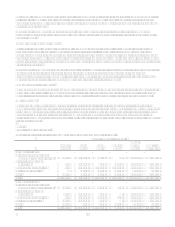

The fair value of mortgage loans held for sale is impacted by changes in market interest rates. The exposure to changes in

market interest rates is hedged primarily by selling forward contracts on agency securities. These derivative instruments,

designated as fair value hedges, are recorded on the balance sheet at fair value with changes in fair value being recorded in

mortgage banking operations in current earnings. Also changes in the fair value of mortgage loans held for sale are recorded

as an adjustment to the loans carrying basis through mortgage banking operations income in current earnings.

As part of the Companys mortgage banking operations, commitments to purchase or originate loans are entered into

whereby the interest rate on the loans is determined prior to funding (interest rate lock commitments). Interest rate lock

commitments on loans the Company intends to sell are recorded as derivative instruments as defined in Statement of

Financial Accounting Standards No. 133Accounting for Derivative Instruments and Hedging Activities and the fair value

of interest rate lock commitments is determined using current secondary market prices for underlying loans with similar

coupons, maturity and credit quality, subject to the anticipated loan funding probability, or the pull through rate.

Similar to mortgage loans held for sale, the fair value of interest rate lock commitments is subject to change due to changes in

market interest rates. In addition, the value of interest rate lock commitments is affected by changes in the anticipated loan

funding probability or pull through rate. These changes in fair value are also hedged primarily by selling forward contracts on

agency securities. Both the interest rate lock commitments and the related forward contracts are recorded at fair value with

changes in fair value being recorded in current earnings in gain on sale of loans.

Loans originated for sale are primarily sold in the secondary market as whole loans. Whole loan sales are executed with

either the servicing rights being retained or released to the buyer. For sales where the loans are sold with the servicing

released to the buyer, the gain or loss on the sale is equal to the difference between the proceeds received and the carrying

value of the loans sold. If the loans are sold with the servicing rights retained, the gain or loss on the sale is also impacted by

the fair value attributed to the servicing rights.