Capital One 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

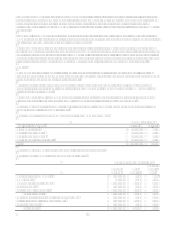

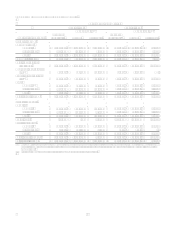

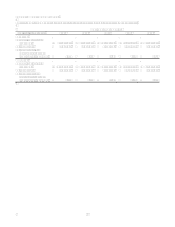

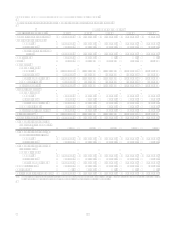

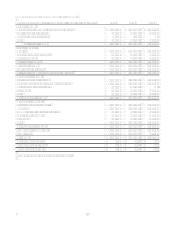

TABLE BINTEREST VARIANCE ANALYSIS

Year Ended December 31

2006 vs. 2005 2005 vs. 2004

Change due to(1) Change due to(1)

(Dollars in thousands) Increase

(Decrease) Volume Yield/Rate

Increase

(Decrease)(2) Volume Yield/Rate

Interest Income:

Consumer loans

Domestic $ 1,759,916 $ 1,969,744 $ (209,828) $ 612,475 $ 598,259 $ 14,216

International (19,526) (27,114) 7,588

62,268 60,266 2,002

Total 1,740,390 1,921,082 (180,692) 674,743 657,861 16,882

Commercial loans 295,244 404,940 (109,696) 101,676 98,202 3,474

Total loans held for

investment 2,035,634 2,573,519 (537,885) 776,419 795,804 (19,385)

Mortgage loans held for

sale(2) 62,264 72,597 (10,333) 8,799 8,799

Securities available for

sale(2) 289,816 201,138 88,678

74,595 44,860 29,735

Other

Domestic(2) 108,620 66,702 41,918

48,188 50,865 (2,677)

International (28,986) (15,214) (13,772) 24,460 26,793 (2,333)

Total 79,634 37,935 41,699

72,648 79,901 (7,253)

Total interest income 2,467,348 2,828,419 (361,071) 932,461 915,772 16,689

Interest Expense:

Deposits

Domestic 657,775 689,359 (31,584) 126,868 134,163 (7,295)

International (16,115) (10,062) (6,053) 36,724 37,769 (1,045)

Total 641,660 690,927 (49,267) 163,592 167,793 (4,201)

Senior notes (9,575) (12) (9,563) (65,594) (25,007) (40,587)

Other borrowings

Domestic 406,252 264,862 141,390

156,696 102,739 53,957

International 9,623 10,351 (728) 503 511 (8)

Total 415,875 310,748 105,127

157,199 103,292 53,907

Total interest expense 1,047,960 1,056,736 (8,776) 255,197 281,105 (25,908)

Net interest income $ 1,419,388 $ 1,773,970 $ (354,582) $ 677,264 $ 586,265 $ 90,999

(1) The change in interest due to both volume and rates has been allocated in proportion to the relationship of the absolute dollar amounts of the change in each. The

changes in income and expense are calculated independently for each line in the table. The totals for the volume and yield/rate columns are not the sum of the

individual lines.

(2) Prior period amounts have been reclassified to conform with current period presentation.