Capital One 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

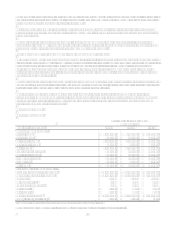

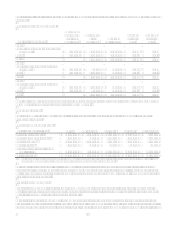

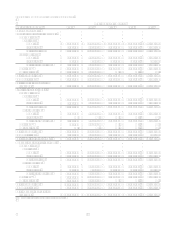

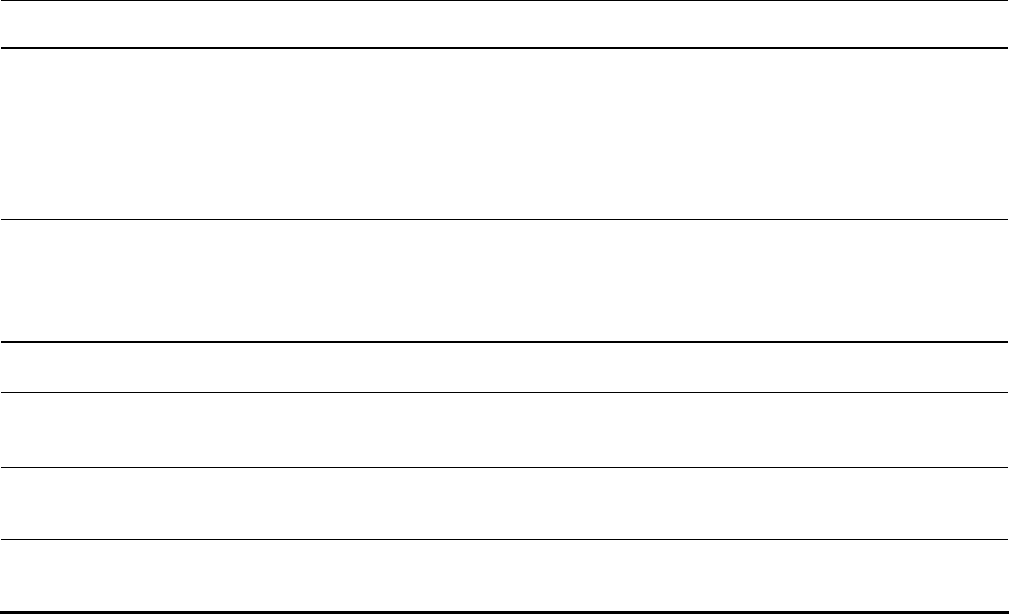

Table 11: Interest Rate Sensitivity

As of December 31, 2006

Subject to Repricing

(Dollars in Millions) Within

180 Days

>180 Days-

1 Year

>1 Year-

5 Years

Over

5 Years

Earning assets:

Federal funds sold and resale agreements $ 1,099 $ $ $

Interest-bearing deposits at other banks 744

Securities available for sale 1,800 1,432 7,954 4,266

Mortgage loans held for sale 6,201 566 2,697 971

Other 237 52 434 97

Loans held for investment 39,169 8,666 32,541 16,136

Total earning assets 49,250 10,716 43,626 21,470

Interest-bearing liabilities:

Interest-bearing deposits 39,491 8,725 20,558 5,349

Senior and subordinated notes 462 5,265 3,998

Other borrowings 17,155 2,353 4,735 14

Total interest-bearing liabilities 57,108 11,078 30,558 9,361

Non-rate related net items 4,197 (1,489) (7,562) (12,103)

Interest sensitivity gap (3,661) (1,851) 5,506 6

Impact of swaps 10,812 (1,217) (10,171) 576

Impact of consumer loan securitizations (9,168) 3,256 1,882 4,030

Interest sensitivity gap adjusted for impact of

securitizations and swaps (2,017) 188 (2,783) 4,612

Adjusted gap as a percentage of managed assets (1.01)% 0.09% (1.40)% 2.32%

Adjusted cumulative gap (2,017) (1,829) (4,612)

Adjusted cumulative gap as a percentage of managed

assets (1.01)% (0.92)% (2.32)% 0.00%

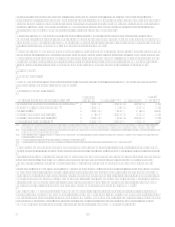

Foreign Exchange Risk

The Company is exposed to changes in foreign exchange rates which may impact translated income and expense associated

with foreign operations. In order to limit earnings exposure to foreign exchange risk, the Companys Asset/Liability

Management Policy requires that material foreign currency denominated transactions be hedged. As of December 31, 2006,

the estimated reduction in 12-month earnings due to adverse foreign exchange rate movements corresponding to a 95%

probability is less than 1%. The precision of this estimate is also limited due to the inherent uncertainty of the underlying

forecast assumptions.

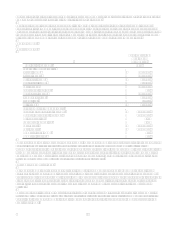

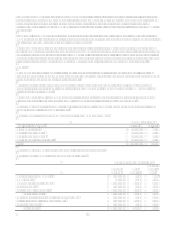

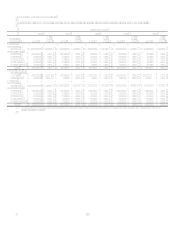

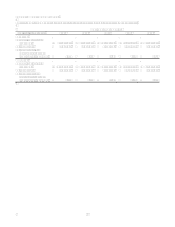

X. Capital

Capital Adequacy

The Company and the Bank are subject to capital adequacy guidelines adopted by the Federal Reserve Board (the Federal

Reserve), the Savings Bank is subject to capital adequacy guidelines adopted by the Office of Thrift Supervision (the

OTS), CONA and Superior are subject to capital adequacy guidelines adopted by the Office of the Comptroller of the

Currency (the OCC), and North Fork Bank is subject to capital adequacy guidelines adopted by the Federal Deposit

Insurance Corporation (the FDIC) (collectively the regulators). The capital adequacy guidelines require the Company,

the Bank, the Savings Bank, CONA, Superior and North Fork Bank to maintain specific capital levels based upon

quantitative measures of their assets, liabilities and off-balance sheet items. In addition, the Bank, Savings Bank, CONA,

Superior and North Fork Bank must also adhere to the regulatory framework for prompt corrective action.

The most recent notifications received from the regulators categorized the Bank, the Savings Bank, CONA, Superior and

North Fork Bank as well-capitalized. As of December 31, 2006, the Companys, the Banks, the Savings Banks, CONAs,

Superiors and North Fork Banks capital exceeded all minimum regulatory requirements to which they were subject, and

there were no conditions or events since the notifications discussed above that management believes would have changed

either the Companys, the Banks, the Savings Banks, CONAs, Superiors or North Fork Banks capital category.