Capital One 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

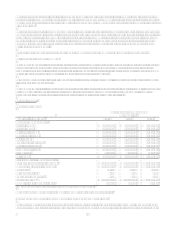

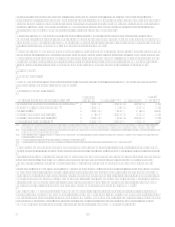

The provision for loan losses increased 35% for the year ended December 31, 2005, as a result of growth in the loan portfolio

combined with deteriorating credit quality metrics in the U.K. during 2005.

Non-interest expense in 2005 included a $28.2 million impairment charge related to the write-off of goodwill and other

charges related to the Companys insurance brokerage business. Non-interest expense in 2004 included expense associated

with a change in fixed asset capitalization thresholds and impairment of internally developed software. Exclusive of these one

time charges and a $20.5 million reduction in employee termination and facility consolidation charges, non-interest expense

for the year ended December 31, 2005, increased 18% in line with the 19% growth in average managed loans.

Banking Segment

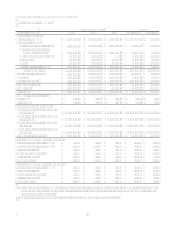

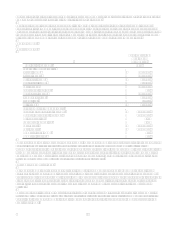

Table 5: Banking

As of and for the

Year ended

December 31

(Dollars in thousands) 2006

Earnings (Managed Basis)

Interest income $ 2,773,973

Interest expense 1,777,044

Net interest income $ 996,929

Non-interest income 446,071

Total revenue 1,443,000

Provision for loan losses 399

Non-interest expense 1,167,873

Income before taxes 274,728

Income taxes 96,155

Net income $ 178,573

Selected Metrics (Managed Basis)

Period end loans held for investment $ 12,145,533

Average loans held for investment 13,225,559

Net charge-off rate 0.43%

30+ day delinquency rate 0.31%

Core deposits $ 27,071,324

Total deposits $ 35,334,610

Number of active ATMs 661

Number of locations 358

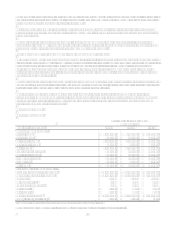

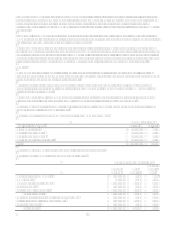

Beginning in 2006, Capital One added a Banking segment. The Banking segment represents the results of the legacy Hibernia

business lines except for the indirect auto business, which is included in the Auto Finance segment results, and the

investment portfolio results which are included in the Other category. In addition, the Banking segment includes the results of

the Companys branchless deposit business which were previously included as part of the Other category. On December 1,

2006, the Company completed its acquisition of North Fork Bancorporation. The impacts of the North Fork acquisition for

the one month ended December 31, 2006 are included in the Other category.

Year Ended December 31, 2006

The Banking segment contributed $178.6 million of income to the Company during 2006. At December 31, 2006, loans

outstanding in the Banking segment totaled $12.1 billion while deposits outstanding totaled $35.3 billion. Banking segment

profits are primarily generated from net interest income, which represents the spread between loan yields and the internal cost

of funds charged to the business for those loans, plus the spread between deposit interest costs and the funds transfer price

credited to the business for those deposits. During 2006, the Banking segment generated net interest income of $996.9

million.

During 2006, overall loan growth was relatively flat as new loan originations were offset by significant loan repayments in

the areas most impacted by Hurricanes Katrina and Rita. In addition, during the fourth quarter the Company decided to sell

$1.5 billion of the Banking segments residential mortgage portfolio as part of the balance sheet downsizing related to the

acquisition of NFB.