Capital One 2006 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

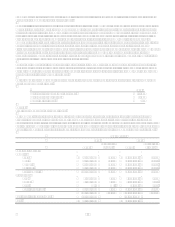

99

Corporation was being held in the Other category while all other 2005 acquisitions were allocated to Auto Finance and

Global Financial Services segments at December 31, 2005.

In December 2005, based on a change in strategic direction related to the Companys insurance brokerage business held in

the Global Financial Services segment, the Company recognized a $25.5 million goodwill impairment loss. The impairment

charge was recorded in other non-interest expense in the consolidated income statement.

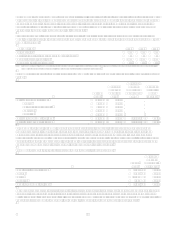

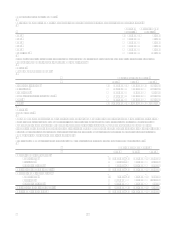

In connection with the acquisitions of Hibernia and North Fork, the Company recorded intangible assets that consisted of

core deposit intangibles, trust intangibles, lease intangibles, and other intangibles, which are subject to amortization. The core

deposit and trust intangibles reflect the value of deposit and trust relationships. The lease intangibles reflect the difference

between the contractual obligation under current lease contracts and the fair market value of the lease contracts at the

acquisition date. The other intangible items relate to customer lists, brokerage relationships and insurance contracts. The

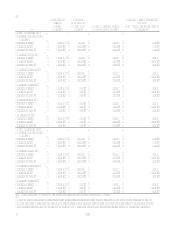

following table summarizes the Companys purchase accounting intangible assets subject to amortization.

December 31, 2006

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Amortization

Period

Core deposit intangibles $ 1,306,806 $ (80,364) $ 1,226,442 11.1 years

Trust intangibles 10,500 (1,270) 9,230 17.0 years

Lease intangibles 15,911 (1,647) 14,264 9.0 years

Other intangibles 11,474 (2,154) 9,320 9.3 years

Total $ 1,344,691 $ (85,435) $ 1,259,256

December 31, 2005

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Amortization

Period

Core deposit intangibles $ 380,000 $ (9,421) $ 370,579 10.0 years

Trust intangibles 10,500 (145) 10,355 18.0 years

Lease intangibles 5,209 (148) 5,061 9.6 years

Other intangibles 8,351 (168) 8,183 11.5 years

Total $ 404,060 $ (9,882) 394,178

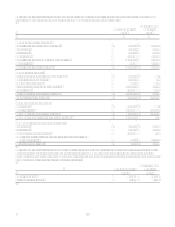

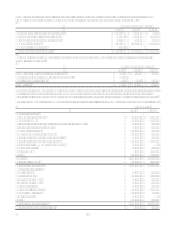

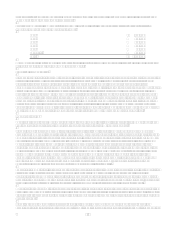

Intangibles are amortized on an accelerated basis over their respective estimated useful lives. Intangible assets are recorded in

Other assets on the balance sheet. Amortization expense related to purchase accounting intangibles totaled $88.8 million for

the year ended December 31, 2006. Amortization expense for intangibles is recorded to non-interest expense. The weighted

average amortization period for all purchase accounting intangibles is 11.0 years. Estimated future amortization is as

follows: 2007$217.6 million, 2008$196.2 million, 2009$174.5, 2010$152.9 million, 2011$132.3 million.

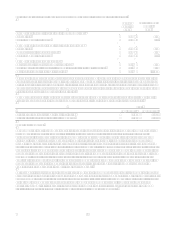

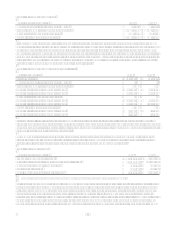

Note 18

Mortgage Servicing Rights

Mortgage Servicing Rights (MSRs), are recognized when mortgage loans are sold in the secondary market and the right to

service these loans are retained for a fee. MSRs are carried at the lower of the initial carrying value, adjusted for amortization

or fair value. MSRs are amortized in proportion to, and over the period of, estimated net servicing income. The amortization

of MSRs is periodically analyzed and adjusted to reflect changes in prepayment speeds. MSRs are periodically evaluated for

impairment based on the difference between the carrying amount and current fair value. To evaluate and measure

impairment, the underlying loans are stratified based on certain risk characteristics, including loan type, note rate and investor

servicing requirements. If it is determined that temporary impairment exists, a valuation allowance is established by risk

stratification through a charge to earnings for any excess of amortized cost over the current fair value. If determined in future

periods that all or a portion of the temporary impairment no longer exists for a particular risk stratification, the valuation

allowance is reduced by increasing earnings. The following table sets forth the changes in the carrying value and fair value of

mortgage servicing rights at December 31: