Capital One 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

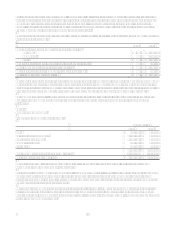

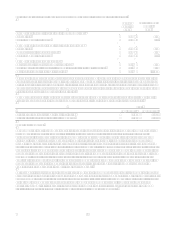

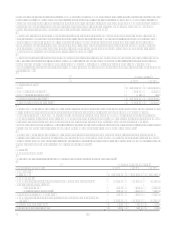

Expected future benefit payments

The following benefit payments, which reflect expected future service as appropriate, are expected to be paid:

Pension

Benefits

Postretirement

Benefits

2007 $ 14,594 $ 3,869

2008 15,308 4,085

2009 16,254 4,344

2010 16,271 4,578

2011 17,265 4,913

2012 - 2016 99,378 27,877

In 2007, $0.9 million in contributions are expected to be made to the pension plans and $3.9 million in contributions are

expected to be made to the other postretirement benefit plans.

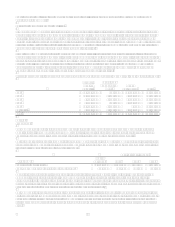

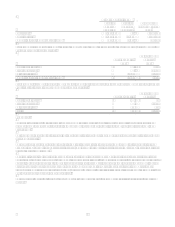

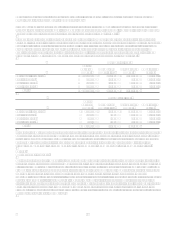

Note 13

Other Non-Interest Expense

Year Ended December 31

2006 2005 2004

Professional services $ 683,440

$ 490,617 $ 415,169

Collections 525,680

537,772 530,909

Fraud losses 103,010

53,744 55,981

Bankcard association assessments 166,512

136,318 122,934

Other 412,064

281,330 184,836

Total $ 1,890,706 $ 1,499,781 $ 1,309,829

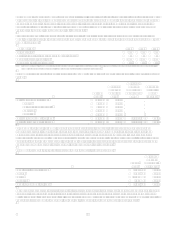

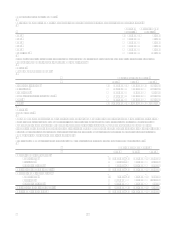

Note 14

Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes, recognizing the

current and deferred tax consequences of all transactions that have been recognized in the financial statements using the

provisions of the enacted tax laws. Deferred tax assets and liabilities are determined based on differences between the

financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in

effect when the differences are expected to reverse. Valuation allowances are recorded to reduce deferred tax assets to an

amount that is more likely than not to be realized.

Significant components of the provision for income taxes attributable to continuing operations were as follows:

Year Ended December 31

2006 2005 2004

Current income tax provision:

Federal taxes $ 1,181,884 $ 899,646 $ 749,800

State taxes 65,741 30,180 33,849

International taxes 61,661 (19,558) 35,107

Total current provision (benefit) $ 1,309,286 $ 910,268 $ 818,756

Deferred income tax provision:

Federal taxes $ 3,678 $ 45,021 $ 12,337

State taxes (25,395) 11,312 (23,944)

International taxes (49,331) 53,254 9,433

Total deferred provision (benefit) $ (71,048) $ 109,587 $ (2,174)

Total income tax provision $ 1,238,238 $ 1,019,855 $ 816,582