Capital One 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 70

Note 1

Significant Accounting Policies

Business

The Consolidated Financial Statements include the accounts of Capital One Financial Corporation (the Corporation) and its

subsidiaries. The Corporation is a diversified financial services company whose banking and non-banking subsidiaries

market a variety of financial products and services. The Corporations principal subsidiaries include Capital One Bank (the

Bank), a Virginia state chartered bank that currently offers credit card products and deposit products and also can engage in

a wide variety of lending and other financial activities; Capital One, F.S.B. (the Savings Bank), a federally chartered

savings bank that offers consumer and commercial lending and consumer deposit products; Capital One Auto Finance, Inc.

(COAF), which offers automobile and other motor vehicle financing products; Capital One, N.A. (CONA), a national

association that offers a broad spectrum of financial products and services to consumers, small businesses and commercial

clients; and North Fork Bank (North Fork Bank), a New York state chartered non-member bank that provides a broad

range of deposit and lending services for consumer, commercial and small business customers. The Corporation and its

subsidiaries are collectively referred to as the Company.

Another subsidiary of the Corporation, Superior Savings of New England, N.A. (Superior) focuses on telephonic and

media-based generation of deposits. In addition, a subsidiary of North Fork Bank, GreenPoint Mortgage Funding, Inc.

(GreenPoint) offers residential and commercial mortgages.

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally

accepted in the United States (GAAP) that require management to make estimates and assumptions that affect the amounts

reported in the financial statements and accompanying notes. Actual results could differ from these estimates.

All significant intercompany balances and transactions have been eliminated. Certain prior years amounts have been

reclassified to conform to the 2006 presentation. All amounts in the following notes, excluding per share data, are presented

in thousands.

The following is a summary of the significant accounting policies used in preparation of the accompanying Consolidated

Financial Statements.

Recent Accounting Pronouncements

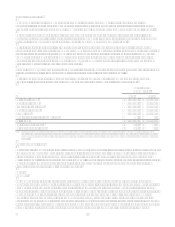

In September 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standard

No. 158, Employers Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB

Statements No 87, 88, 106, and 132(R), (SFAS 158). SFAS 158 requires plan sponsors of defined benefit pension and other

postretirement benefit plans (collectively, defined benefit plans) to recognize the funded status of their defined benefit

plans in the Consolidated Balance Sheet, measure the fair value of plan assets and benefit obligations as of the date of the

fiscal year-end Consolidated Balance Sheet, and provide additional disclosures. On December 31, 2006, the Company

adopted the recognition and disclosure provisions of SFAS 158. The effect of adopting SFAS 158 on the Companys

financial condition at December 31, 2006, has been included in the accompanying consolidated financial statements. SFAS

158 did not have an effect on the Companys consolidated financial condition at December 31, 2005 or 2004. SFAS 158s

provisions regarding the change in the measurement date of defined benefit plans are effective for fiscal years ending after

December 15, 2008. The adoption of SFAS 158 did not have a material impact on the consolidated earnings or financial

position of the Company. See Note 12 for further discussion.

In September 2006, the FASB issued Statement of Financial Accounting Standard No. 157, Fair Value Measurements

(SFAS 157). This statement defines fair value, establishes a framework for measuring fair value in GAAP, and expands

disclosures about fair value measurements. SFAS 157 is effective for financial statements issued for fiscal years beginning

after November 15, 2006. Management is still evaluating the impact of adoption of SFAS 157 on the consolidated earnings

and financial position of the Company.

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an Interpretation

of FASB Statement No. 109, (FIN 48). FIN 48 clarifies the accounting treatment for uncertainty in income taxes recognized

in an enterprises financial statements in accordance with FASB Statement No. 109, Accounting for Income Taxes. This

interpretation prescribes a recognition threshold and measurement attribute for the financial statement recognition and

measurement of a tax position taken or expected to be taken in a tax return. This interpretation also provides guidance on

derecognition, classification, interest and penalties, accounting in interim periods, disclosure, and transition. Effective