Capital One 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

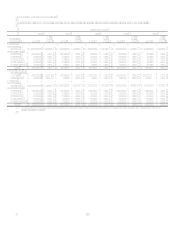

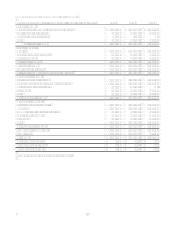

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended December 31 (In Thousands) 2006 2005 2004

Operating Activities:

Net Income $ 2,414,493

$ 1,809,147 $ 1,543,482

Adjustments to reconcile net income to cash provided by operating

activities:

Provision for loan losses 1,476,438

1,491,072 1,220,852

Depreciation and amortization, net 542,090

425,640 381,852

Impairment of long-lived assets

13,272 69,769

Losses on sales of securities available for sale 29,203

6,817 23,049

Gains on sales of auto loans (28,609) (14,087) (40,342)

Losses on repurchase of senior notes

12,444 4,287

Mortgage loans held for sale:

Transfers in and originations (4,402,957) (197,444)

Loss on sales 9,230

Proceeds from sales 3,525,000

Stock plan compensation expense 211,117

149,496 127,174

Changes in assets and liabilities, net of effects from purchase of

companies acquired:

Increase in interest receivable (45,311) (180,867) (38,562)

Decrease (increase) in accounts receivable from

securitizations 314,425

(658,805) 664,204

Decrease in other assets 158,060

164,229 282,960

Increase (decrease) in interest payable 87,005

92,906 (18,788)

(Decrease) increase in other liabilities (913,446) 550,043 269,373

Net cash provided by operating activities 3,376,738

3,663,863 4,489,310

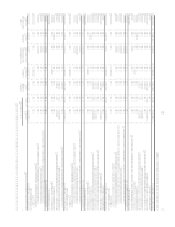

Investing Activities:

Purchases of securities available for sale (7,777,082) (3,688,180) (6,539,370)

Proceeds from maturities of securities available for sale 4,289,139

2,009,517 1,713,373

Proceeds from sales of securities available for sale 6,891,187

909,697 1,274,862

Proceeds from sale of automobile loans

257,230 931,003

Proceeds from securitizations of loans 12,343,771

9,482,333 10,854,927

Net increase in loans held for investment (19,073,474) (16,627,879) (18,927,583)

Principal recoveries of loans previously charged off 547,304

448,351 453,705

Additions of premises and equipment, net (712,190) (159,823) (208,975)

Net (payment for) receipt from companies acquired (3,635,356) 450,562

Net cash used in investing activities (7,126,701) (6,918,192) (10,448,058)

Financing Activities:

Net increase in deposits 184,830

2,239,553 3,233,915

Net increase in other borrowings 2,006,101

2,923,270 1,840,148

Issuances of senior notes 3,185,272

1,262,035 998,190

Maturities of senior notes (1,226,882) (876,567) (1,031,892)

Repurchases of senior notes (31,296) (648,840) (128,747)

Purchases of treasury stock (21,615) (40,049) (17,232)

Dividends paid (32,324) (27,504) (25,618)

Net proceeds from issuances of common stock 36,751

770,311 23,910

Proceeds from share based payment activities 238,355

312,176 497,003

Net cash provided by financing activities 4,339,192

5,914,385 5,389,677

Increase (decrease) in cash and cash equivalents 589,229

2,660,056 (569,071)

Cash and cash equivalents at beginning of year 4,071,267

1,411,211 1,980,282

Cash and cash equivalents at end of year $ 4,660,496

$ 4,071,267 $ 1,411,211

See Notes to Consolidated Financial Statements.