Capital One 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

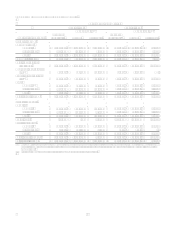

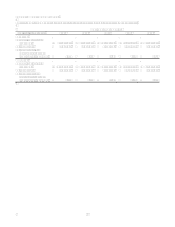

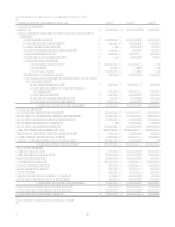

CONSOLIDATED STATEMENTS OF INCOME

Year Ended December 31 (In Thousands, Except Per Share Data) 2006 2005 2004

Interest Income:

Loans held for investment, including past-due fees $ 7,046,473 $ 5,010,839 $ 4,234,420

Securities available for sale 676,712

386,896 312,301

Mortgage loans held for sale 71,063

8,799

Other 399,981

320,347 247,699

Total interest income 8,194,229

5,726,881 4,794,420

Interest Expense:

Deposits 1,814,797

1,173,137 1,009,545

Senior and subordinated notes 411,643

421,218 486,812

Other borrowings 868,159

452,284 295,085

Total interest expense 3,094,599

2,046,639 1,791,442

Net interest income 5,099,630

3,680,242 3,002,978

Provision for loan losses 1,476,438

1,491,072 1,220,852

Net interest income after provision for loan losses 3,623,192

2,189,170 1,782,126

Non-Interest Income:

Servicing and securitizations 4,209,637

3,945,183 3,635,465

Service charges and other customer-related fees 1,770,340

1,493,690 1,482,658

Mortgage banking operations 173,320

142,894

Interchange 549,074

514,196 475,810

Other 294,361

262,142 306,224

Total non-interest income 6,996,732

6,358,105 5,900,157

Non-Interest Expense:

Salaries and associate benefits 2,239,468

1,749,738 1,642,721

Marketing 1,444,635

1,379,938 1,337,780

Communications and data processing 713,439

580,992 475,355

Supplies and equipment 460,680

355,734 349,920

Occupancy 218,265

152,090 206,614

Other 1,890,706

1,499,781 1,309,829

Total non-interest expense 6,967,193

5,718,273 5,322,219

Income before income taxes 3,652,731

2,829,002 2,360,064

Income taxes 1,238,238

1,019,855 816,582

Net income $ 2,414,493 $ 1,809,147 $ 1,543,482

Basic earnings per share $ 7.80

$ 6.98 $ 6.55

Diluted earnings per share $ 7.62

$ 6.73 $ 6.21

Dividends paid per share $ 0.11

$ 0.11 $ 0.11

See Notes to Consolidated Financial Statements.