Capital One 2006 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 30

Treatment of Derivative Instruments and Hedging Activities

The Company utilizes certain derivative instruments to minimize significant unplanned fluctuations in earnings caused by

interest rate and foreign exchange rate volatility. The Companys goal is to manage sensitivity to changes in rates by

modifying the repricing or maturity characteristics of certain balance sheet assets and liabilities, thereby limiting the impact

on earnings. By using derivative instruments, the Company is exposed to credit and market risk. The Company manages the

market risk associated with interest rate and foreign exchange contracts by establishing and monitoring limits as to the types

and degree of risk that may be undertaken in conjunction with the risks which are being hedged. The Company manages

credit risk through strict counterparty credit risk limits and/or collateralization agreements.

At inception, the Company determines if a derivative instrument meets the criteria for hedge accounting under SFAS

No. 133. Ongoing effectiveness evaluations are made for instruments that are designated and qualify as hedges. If the

derivative is free standing, no assessment of effectiveness is needed by management.

Accounting for Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes, recognizing the

current and deferred tax consequences of all transactions that have been recognized in the financial statements using the

provisions of the enacted tax laws. Deferred tax assets and liabilities are determined based on differences between the

financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in

effect when the differences are expected to reverse. Valuation allowances are recorded to reduce deferred tax assets to an

amount that is more likely than not to be realized.

The calculation of the Companys income tax provision is complex and requires the use of estimates and judgments. When

analyzing business strategies, the Company considers the tax laws and regulations that apply to the specific facts and

circumstances for any transaction under evaluation. This analysis includes the amount and timing of the realization of income

tax provisions or benefits. Management closely monitors tax developments in order to evaluate the effect they may have on

its overall tax position and the estimates and judgments utilized in determining the income tax provision and records

adjustments as necessary.

The Company records valuation allowances to reduce deferred tax assets to the amount that is more likely than not to be

realized. In making this assessment, management analyzes future taxable income, reversing temporary differences and

ongoing tax planning strategies. Should a change in circumstances lead to a change in judgment about the realizability of

deferred tax assets in future years, the Company would adjust related valuation allowances in the period that the change in

circumstances occurs, along with a corresponding increase or charge to income.

For the year ended December 31, 2006, the provision for income taxes was $1.2 billion, and as of December 31, 2006, the

valuation allowance was $15.5 million.

III. Off-Balance Sheet Arrangements

Off-Balance Sheet Securitizations

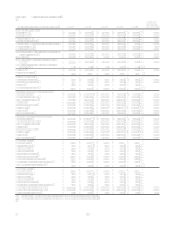

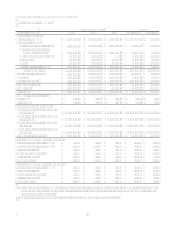

The Company actively engages in off-balance sheet securitization transactions of loans for funding purposes. The Company

receives the proceeds from third party investors for securities issued from the Companys securitization vehicles which are

collateralized by transferred receivables from the Companys portfolio. Securities outstanding totaling $49.0 billion as of

December 31, 2006, represent undivided interests in the pools of consumer loan receivables that are sold in underwritten

offerings or in private placement transactions.

The securitization of consumer loans has been a significant source of liquidity for the Company. Maturity terms of the

existing securitizations vary from 2007 to 2025 and, for revolving securitizations, have accumulation periods during which

principal payments are aggregated to make payments to investors. As payments on the loans are accumulated and are no

longer reinvested in new loans, the Companys funding requirements for such new loans increase accordingly. The Company

believes that it has the ability to continue to utilize off-balance sheet securitization arrangements as a source of liquidity;

however, a significant reduction or termination of the Companys off-balance sheet securitizations could require the

Company to draw down existing liquidity and/or to obtain additional funding through the issuance of secured borrowings or

unsecured debt, the raising of additional deposits or the slowing of asset growth to offset or to satisfy liquidity needs.