Capital One 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 28

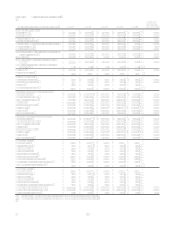

underwriting policies; seasonality; and the value of collateral supporting the loans. To the extent credit experience is not

indicative of future performance or other assumptions used by management do not prevail, loss experience could differ

significantly, resulting in either higher or lower future provision for loan losses, as applicable. The evaluation process for

determining the adequacy of the allowance for loan and lease losses and the periodic provisioning for estimated losses is

undertaken on a quarterly basis, but may increase in frequency should conditions arise that would require the Companys

prompt attention. Conditions giving rise to such action are business combinations or other acquisitions or dispositions of

large quantities of loans, dispositions of non-performing and marginally performing loans by bulk sale or any development

which may indicate an adverse trend.

As of December 31, 2006, the balance in the Allowance for loan and lease losses was $2.18 billion.

Valuation of Goodwill and Other Intangible Assets

Goodwill and other intangible assets (primarily core deposit intangibles) reflected on the Consolidated Balance Sheets arose

from previous acquisitions. At the date of acquisition, the Company recorded the assets acquired and liabilities assumed at

fair value. The excess of cost over the fair value of the net assets acquired is recorded on the balance sheet as goodwill. The

cost includes the consideration paid and all direct costs associated with the acquisition. Indirect costs relating to the

acquisition are expensed when incurred based on the nature of the item.

In accordance with the requirements specified in Statement of Financial Accounting Standards No. 142 Goodwill and Other

Intangible Assets, goodwill must be allocated to reporting units and tested for impairment. The Company tests goodwill for

impairment at least annually or more frequently if events or circumstances such as adverse changes in the business, indicate

that there may be justification for conducting an interim test. Impairment testing is performed at the reporting unit level

(which is the same level as the Companys four operating segments identified in Note 3 to the Consolidated Financial

Statements).

The first part of the test is a comparison at the reporting unit level, of the fair value of each reporting unit to its carrying

value, including goodwill. If the fair value is less than the carrying value, then the second part of the test is needed to measure

the amount of potential goodwill impairment. The implied fair value of the reporting unit goodwill is calculated and

compared to the actual carrying value of goodwill recorded within the reporting unit. If the carrying value of reporting unit

goodwill exceeds the implied fair value of that goodwill, then the Company would recognize an impairment charge for the

amount of the difference.

The fair values of reporting units are determined primarily using discounted cash flow models based on each reporting units

internal forecasts.

Intangible assets having an estimated useful life are separately recognized and amortized over their estimated useful lives.

As of December 31, 2006, goodwill of $13.6 billion and net intangibles of $1.3 billion were included in the Consolidated

Balance Sheet.

Finance Charge and Fee Revenue Recognition

The Company recognizes earned finance charges and fee income on open ended loans according to the contractual provisions

of the credit arrangements. When the Company does not expect full payment of finance charges and fees, it does not accrue

the estimated uncollectible portion as income (hereafter the suppression amount). To calculate the suppression amount, the

Company first estimates the uncollectible portion of finance charge and fee receivables using a formula based on historical

account migration patterns and current delinquency status. This formula is consistent with that used to estimate the allowance

related to expected principal losses on reported loans. The suppression amount is calculated by adding any current period

change in the estimate of the uncollectible portion of finance charge and fee receivables to the amount of finance charges and

fees charged-off (net of recoveries) during the period. The Company subtracts the suppression amount from the total finance

charges and fees billed during the period to arrive at total reported revenue.

The amount of finance charges and fees suppressed were $0.9 billion for the year ended December 31, 2006.

Valuation of Mortgage Servicing Rights

The right to service mortgage loans for others, or Mortgage servicing rights (MSRs), is recognized when mortgage loans

are sold in the secondary market and the rights to service these loans are retained for a fee. The MSRs initial carrying value

is determined by allocating the recorded investment in the underlying mortgage loans between the assets sold and the interest

retained based on their relative fair values at the date of transfer. Fair value of the MSRs is determined using the present

value of the estimated future cash flows of net servicing income. The Company uses assumptions in the valuation model that