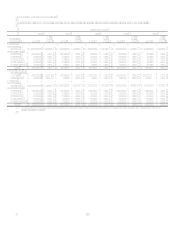

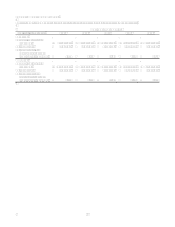

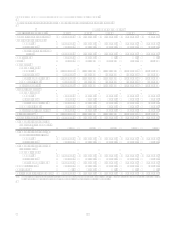

Capital One 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 55

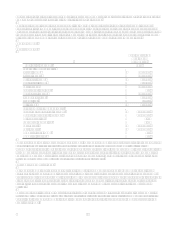

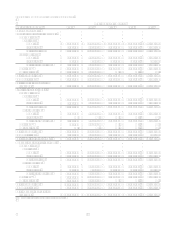

areas is partially offset by the run off of deposits in the hurricane-impacted areas since customers continue to use these funds

for rebuilding and recovery efforts in the hurricane-impacted Gulf Coast region. This run off began in the second quarter, and

continued through 2006.

Managed loans in the Banking segment grew modestly in the fourth quarter, but that loan growth was more than offset by

$1.5 billion in mortgage sales which were part of the Companys balance sheet downsizing in conjunction with the North

Fork acquisition. Loan balances in the areas most impacted by the Gulf Coast hurricanes continued to decline, while loan

balances continued to grow in other parts of Louisiana and in Texas. Late in the year, the Company began to see encouraging

signs of renewed growth in small business and commercial loans in the hurricane impacted areas.

The Company believes the integration of Hibernia is largely complete, and is on track to achieve the expected run-rate

synergies of $135 million in 2007.

On March 13, 2006, Capital One announced its intention to acquire North Fork Bancorporation, and closed the transaction on

December 1, 2006. Because the transaction closed in the middle of the fourth quarter of 2006, North Forks results were not

separately reported in the Banking segment in the fourth quarter results. Beginning in the first quarter of 2007, North Forks

results will be reported in the Companys segments.