Capital One 2006 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 43

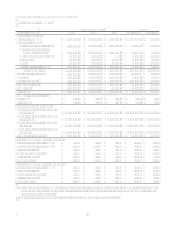

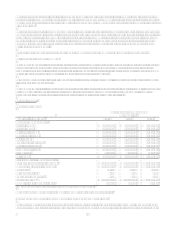

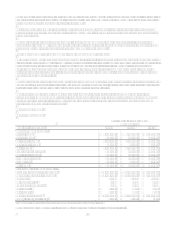

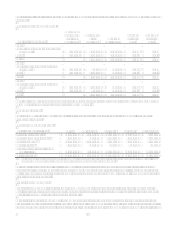

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

The Auto Finance segments loan portfolio increased 33% year over year as a result of the 2006 addition of Hibernias

indirect auto loan portfolio, as well as strong organic originations growth within the dealer marketing channels.

Auto Finance net income increased $101.5 million, or 77% for the year ended December 31, 2006, as a result of portfolio

growth, improvement in loan loss performance and additional scale gained in non interest expense. The increase was partially

offset by margin compression due to the increasing rate environment and heightened competition.

For the year ended, December 31, 2006, the Auto Finance segments net charge-off rate was down 42 basis points from the

prior year. Net charge-offs of Auto Finance segment loans increased $84.4 million, or 22%, while average Auto Finance

loans for the year ended December 31, 2006 grew $6.3 billion, or 45%, compared to the prior year. The decrease in the

charge-off rate was primarily driven by improved loan quality through the acquisition of Hibernias indirect auto loans,

which increased the Auto Finance segment mix of prime loans, and decreases in bankruptcy related charge-offs which were

lower than historical levels following the bankruptcy filing spike experienced in the fourth quarter of 2005. The provision for

loan losses increased $35.3 million, or 8% for the year ended December 31, 2006. This increase was driven by growth in the

loan portfolio, partially offset by a reduction in allowance for loan losses as a result of implementing a consistent reserve

policy on the Hibernia indirect auto portfolio.

Non-interest expense increased 18% for the year ended December 31, 2006, due to growth in the loan portfolio. However,

loan growth versus prior year outpaced the increase in non-interest expense as the Auto Finance segment experienced greater

cost efficiency, while 2005 included incremental operating and integration expenses related to the 2005 acquisitions.

The 30-plus day delinquency rate for the Auto Finance segment was up 64 basis points at December 31, 2006. The increase

in delinquencies was the result of the gradual normalization of delinquencies following the 2005 bankruptcy spike and

targeted risk expansion in non-prime markets.

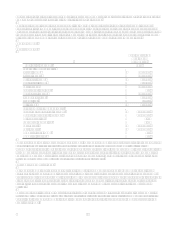

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

The Auto Finance segments loan portfolio increased 64% year over year as a result of 2005 acquisitions of Onyx Acceptance

Corporation and the Key Bank non-prime auto loan portfolio, as well as, strong organic originations growth aided, in part, by

auto manufacturers employee-pricing initiatives and other discount programs in 2005.

Auto Finance net income decreased for the year ended December 31, 2005, as a result of increases in the provision for loan

losses and non-interest expense, as well as lower gains from the sale of auto loans.

Growth in the loan portfolio also resulted in a significant increase in revenue. However, this increase was offset by a decrease

in non-interest income primarily related to $24.7 million reduction in gains from the sale of auto loans, inclusive of

allocations related to funds transfer pricing, compared to the prior year.

For the year ended, December 31, 2005, the Auto Finance segments net charge-off rate was down 58 basis points from the

prior year. Net charge-offs of Auto Finance segment loans increased $77.1 million, or 25%, while average Auto Finance

loans for the year ended December 31, 2005 grew $4.9 billion, or 52%, compared to the prior year. The decrease in the

charge-off rate was primarily driven by the acquisition of Onyx Acceptance Corporation, which originates and services a

portfolio of mostly prime auto receivables, improved loan quality, collections performance and favorable industry trends, and

a $20.4 million one-time acceleration of charge-offs in 2004 related to a change in the charge-off recognition process for auto

loans in bankruptcy. The provision for loan losses increased 64% for the year ended December 31, 2005, as a result of

significant organic loan growth, $16.0 million of estimated future incremental losses resulting from the Gulf Coast

Hurricanes, and losses related to the enactment of the new bankruptcy legislation.

Non-interest expense increased 48% for the year ended December 31, 2005, driven by growth in the loan portfolio and

incremental operating and integration expenses related to the 2005 acquisitions.

The 30-plus day delinquency rate for the Auto Finance segment was up 21 basis points at December 31, 2005. The increase

in delinquencies was the result of a spike in bankruptcy filings prior to the enactment of the new bankruptcy legislation in

October 2005 and the $20.4 million one-time acceleration of charge-offs in December 2004, which moved delinquent

accounts to charge-off status in that year.