Capital One 2006 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

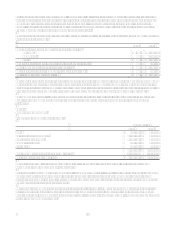

80

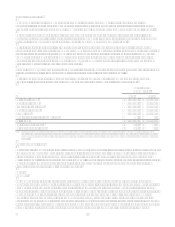

Year Ended December 31, 2004

U.S. Card Auto

Finance

Global

Financial

Services Banking Other Total

Managed Securitization

Adjustments(1) Total

Reported

Net interest

income $ 4,655,897 $ 797,936 $ 1,421,508 $ $ (240,599) $ 6,634,742 $ (3,631,764) $ 3,002,978

Non-interest

income 3,219,567 80,712 844,192 80,115 4,224,586 1,675,571 5,900,157

Provision for

loan losses 2,207,888 279,981 683,612 5,564 3,177,045 (1,956,193) 1,220,852

Non-interest

expenses 3,499,918 342,761 1,265,549 213,991 5,322,219 5,322,219

Income tax

provision

(benefit) 780,357 92,126 103,459 (159,360) 816,582 816,582

Net income

(loss) $ 1,387,301 $ 163,780 $ 213,080 $ $ (220,679) $ 1,543,482 $ $ 1,543,482

Loans held for

investment $ 48,609,571 $ 9,997,497 $ 21,240,325 $ $ 13,906 $ 79,861,299 $ (41,645,708) $ 38,215,591

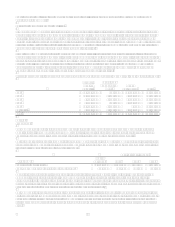

(1) Income statement adjustments for the year ended December 31, 2006 reclassify the net of finance charges of $5,485.0 million, past due fees of $938.6 million,

interest income of $(239.7) million and interest expense of $2,342.7 million; and net charge-offs of $1,747.5 million to Non-interest income from Net interest

income and Provision for loan losses, respectively.

Income statement adjustments for the year ended December 31, 2005 reclassify the net of finance charges of $5,052.8 million, past due fees of $1,006.1 million,

interest income of $(196.4) million and interest expense of $1,887.3 million; and net charge-offs of $2,176.5 million to Non-interest income from Net interest

income and Provision for loan losses, respectively.

Income statement adjustments for the year ended December 31, 2004 reclassify the net of finance charges of $4,340.1 million, past due fees of $1,042.2 million,

interest income of $(195.5) million and interest expense of $1,555.0 million; and net charge-offs of $1,956.2 million to Non-interest income from Net interest

income and Provision for loan losses, respectively.

(2) For 2006, other segment includes North Fork Bank results. For 2005, other segment includes Hibernia Bank results.

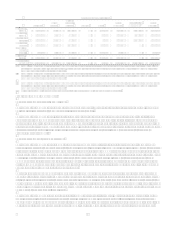

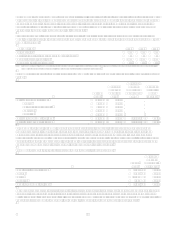

Significant Segment Adjustments

Non-recurring Non Interest Income Items

During 2005, the Company sold previously purchased charged-off loan portfolios resulting in a gain of $34.0 million which

was reported in non-interest income and held in the Other category.

During 2004, the Company sold its interest in a South African joint venture with a book value of $3.9 million to its joint

venture partner. The Company received $26.2 million in cash, was forgiven $9.2 million in liabilities and recognized a pre-

tax gain of $31.5 million. Also during 2004, the Company sold its French loan portfolio with a book value of $144.8 million

to an external party. The Company received $178.7 million in cash, recorded $7.2 million in notes receivables and recognized

a pre-tax gain of $41.1 million. The respective gains were recorded in non-interest income and reported in the Global

Financial Services segment.

Non-recurring Operating Expense Items

During 2006, the Company sold a number of Treasury and Agency securities realizing a loss of $34.9 million which was

reported in non-interest expense and held in the Other category. In addition, the Company reclassified to Mortgage loans held

for sale $4.2 billion of North Forks mortgage portfolio and $1.5 billion of CONAs residential mortgage portfolio as part of

a balance sheet downsizing plan in connection with the acquisition of North Fork resulting in a loss of $21.4 million from the

mark to lower of cost or market which was reported in mortgage banking operations income in the Other category. The

Company entered into freestanding interest rate swaps to mitigate the interest rate exposure on the mortgage loans held for

sale. The Company recognized a mark-to-market gain on the freestanding interest rates swaps of $35.7 million in Mortgage

banking operations income held in the Other category.

During the years ended December 31, 2005 and 2004, the Company recognized non-interest expense of $76.3 million and

$161.2 million, respectively, for employee termination and facility consolidation charges related to continued cost reduction

initiatives and other less material one-time charges. Of these amounts, $41.7 million and $109.6 million was allocated to the

U.S. Card segment, $24.9 million and $45.4 million was allocated to the Global Financial Services segment, $8.5 million and

$4.5 million was allocated to the Auto Finance segment and the remainder was held in the Other category for the years ended

December 31, 2005 and 2004, respectively.

During 2005, the Company closed on the sale of its Tampa, Florida facilities. The ultimate sales price was greater than the

impaired value of the held-for-sale property, and as such, the Company reversed $18.8 million of its previously recorded

2004 impairment in Occupancy expense. Of this amount, $17.4 million was allocated to the U.S. Card segment, $1.3 million

was allocated to the Global Financial Services segment, and the remainder of the balance was held in the Other category.