Capital One 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148

|

|

13

global financial services

Global Financial Services, or GFS, is our portfolio of emerging national scale growth

businesses, including small business lending, home loans, installment lending, and

healthcare finance, along with our international businesses in Canada and the UK.

Overall, GFS had a strong year in 2006 and continues to provide growth and

diversification to the company.

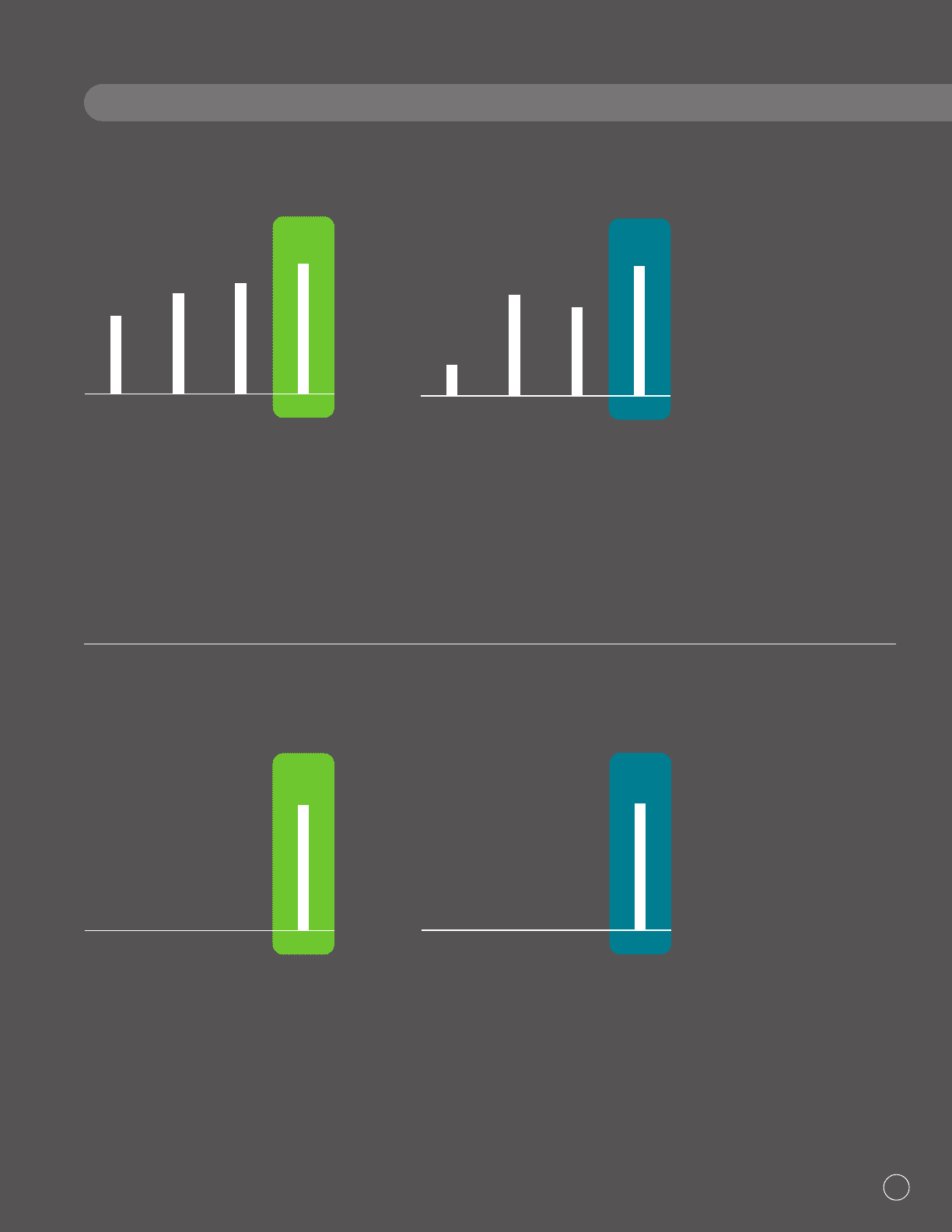

managed loans ($ in billions) net income ($ in millions)

2006200520042003

$16.5

$21.2 $23.4

$27.0

2006200520042003

$64.8

$213.1 $186.0

$274.0

SEGMENT RESULTS

banking

In 2006, we transformed our company with the integration of Hibernia and the

acquisition of North Fork. We have a strong foundation to build on, with over 700

branches in New York, New Jersey,Connecticut, Louisiana and Texas and $85.8

billion in total deposits. Our imperative is to bring together the best of each of our

businesses to create a winning bank.

On December 1, 2006, the Company completed its acquisition of North Fork Bancorporation. The impacts

of the North Fork acquisition for the one month ended December 31, 2006 are included in the Other

category in the 2006 10-K filing.

net income ($ in millions)

2006200520042003

$178.6

total deposits ($ in billions)

2006200520042003

$35.3