Capital One 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 87

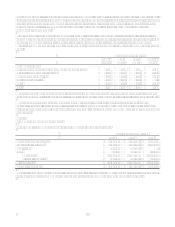

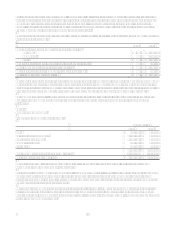

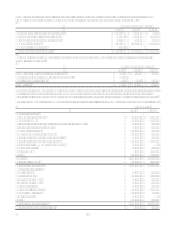

Corporation Shelf Registration Statement

As of December 31, 2006, the Corporation had an effective shelf registration statement under which the Corporation from

time to time may offer and sell an indeterminate aggregate amount of senior or subordinated debt securities, preferred stock,

depositary shares representing preferred stock, common stock, trust preferred securities, junior subordinated debt securities,

guarantees of trust preferred securities and certain back-up obligations, purchase contracts and units. There is no limit under

this shelf registration statement to the amount or number of such securities that the Corporation may offer and sell. As of

December 31, 2006, the Corporation had one effective shelf registration statement under which the Corporation from time to

time may offer and sell senior or subordinated debt securities, preferred stock, common stock, common equity units and stock

purchase contracts. This shelf registration statement was updated in October 2005 to increase capacity to an aggregate

amount not to exceed $2.5 billion.

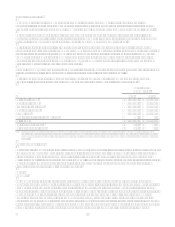

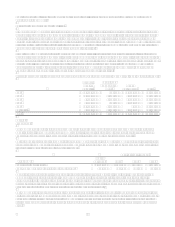

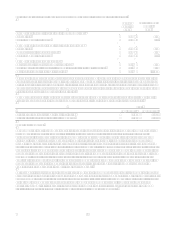

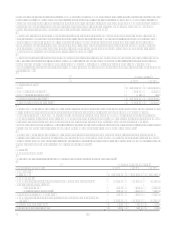

Other Borrowings

Secured Borrowings

COAF, a subsidiary of the Company, maintained twenty agreements to transfer pools of consumer loans accounted for as

secured borrowings at December 31, 2006. The agreements were entered into between 2003 and 2006, relating to the

transfers of pools of consumer loans totaling $26.3 billion. Principal payments on the borrowings are based on principal

collections, net of losses, on the transferred consumer loans. The secured borrowings accrue interest predominantly at fixed

rates and mature between April 2007 and December 2011, or earlier depending upon the repayment of the underlying

consumer loans. At December 31, 2006 and 2005, $14.5 billion and $11.9 billion, respectively, of the secured borrowings

were outstanding.

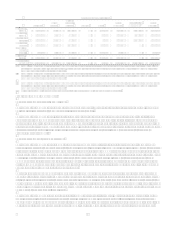

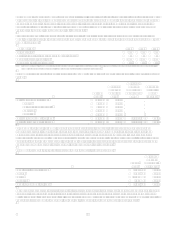

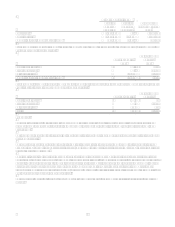

Junior Subordinated Capital Income Securities and Junior Subordinated Debentures

Prior to 2006, the Company issued junior subordinated capital income securities and junior subordinated debentures that as of

December 31, 2006 had a par amount of $160.0 million.

In June 2006, the Company and Capital One Capital II, a subsidiary of the Company created as a Delaware statutory business

trust, issued $345.0 million aggregate principal amount of 7.5% Enhanced TRUPS® that are scheduled to mature on June 15,

2066. The securities represent a preferred beneficial interest in the assets of the trust.

In August 2006, the Company and Capital One Capital III, a subsidiary of the Company created as a Delaware statutory

business trust, issued $650.0 million aggregate principal amount of 7.686% Capital Securities that are scheduled to mature on

August 15, 2036. The securities represent a preferred beneficial interest in the assets of the trust.

In December 2006, in connection with the North Fork acquisition, the Company assumed $100.0 million of 8.70% junior

subordinated debentures due December 15, 2026, $200.0 million of 9.10% junior subordinated debentures due June 1, 2027,

$100.0 million of 8.0% junior subordinated debentures due December 15, 2027 and $45.0 million of 8.17% junior

subordinated debentures due May 1, 2028.

In November 2005, as part of the Hibernia acquisition, the Company assumed $51.5 million aggregate principal amount of

9.0% junior subordinated debentures due June 30, 2032 and $10.3 million aggregate principal amount of floating rate

(LIBOR plus 3.05%, reset quarterly) junior subordinated debentures due June 30, 2033. The junior subordinated debentures

were issued by a subsidiary of Hibernia to Coastal Capital Trust I (CCTI) and Coastal Capital Trust II (CCTII). CCTI and

CCTII are considered business trusts. The trust preferred securities represent a beneficial interest in the assets of the business

trusts.

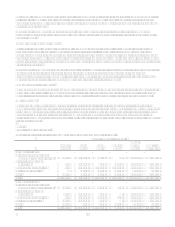

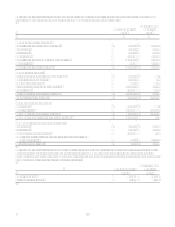

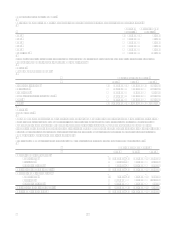

FHLB Advances

During 2006, the Company utilized Federal Reserve Home Loan Bank (FHLB) advances of $2.6 billion which are secured by

the Companys investment in FHLB stock and by a blanket floating lien on portions of the Companys residential mortgage

loan portfolio. FHLB stock totaled $236.4 million at December 31, 2006 and is included in Other assets.

Other Short-Term Borrowings

Revolving Credit Facility

In June 2004, the Company terminated its Domestic Revolving and Multicurrency Credit Facilities and replaced them with a

new revolving credit facility (Credit Facility) providing for an aggregate of $750.0 million in unsecured borrowings from

various lending institutions to be used for general corporate purposes. The Credit Facility is available to the Corporation, the

Bank, the Savings Bank, and Capital One Bank, plc. The Corporations availability has been increased to $500.0 million