Capital One 2006 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

100

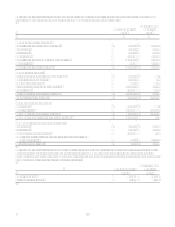

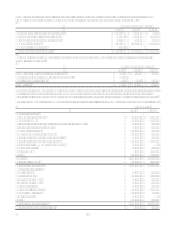

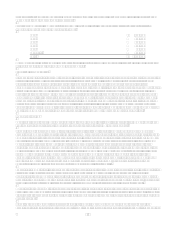

Mortgage Servicing Rights: 2006

Balance, Beginning of Period $

Acquired in Acquisitions 252,353

Originations 8,756

Amortization (8,644)

Sales (170)

Balance at End of Year $ 252,295

Fair Value at December 31 $ 267,482

Ratio of Mortgage Servicing Rights to Related Loans Serviced for Others 0.92%

Weighted Average Service Fee 0.28

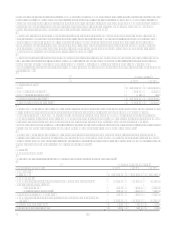

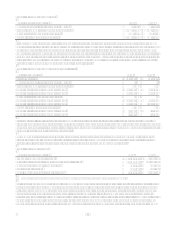

The significant assumptions used in estimating the fair value of the servicing assets at December 31, 2006 were as follows:

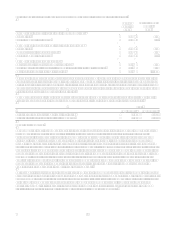

2006

Weighted average prepayment rate (includes default rate) 28.89%

Weighted average life (in years) 3.4

Discount rate 10.50%

At December 31, 2006, the sensitivities to immediate 10% and 20% increases in the weighted average prepayment rates

would decrease the fair value of mortgage servicing rights by $12.5 million and $23.6 million, respectively.

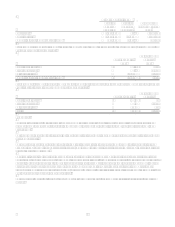

The following table summarizes our estimate of amortization of MSRs for the five-year period ending December 31, 2011.

This projection was developed using the assumptions made by management in its December 31, 2006, valuation of MSRs.

The assumptions underlying the following estimate will be affected as market conditions and portfolio composition and

behavior change, causing both actual and projected amortization levels to change over time. Therefore, the following

estimates will change in a manner and amount not presently determinable by management.

Estimated

Amortization

Year Ended December 31,

2007 $ 71,529

2008 44,823

2009 30,736

2010 22,392

2011 16,804

Five year total 186,284

Thereafter 66,011

Total $ 252,295

As of December 31, 2006, the Companys mortgage loan servicing portfolio consisted of mortgage loans with an aggregate

unpaid principal balance of $56.1 billion, of which $33.1 billion was serviced for investors other than the Company.

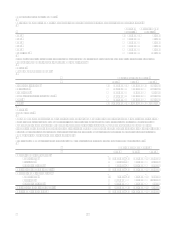

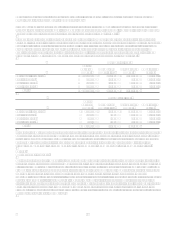

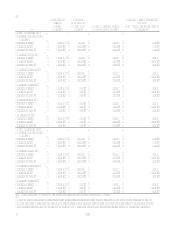

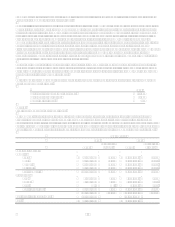

Note 19

Regulatory Matters

The Company and the Bank are subject to capital adequacy guidelines adopted by the Federal Reserve Board (the Federal

Reserve), the Savings Bank is subject to capital adequacy guidelines adopted by the Office of Thrift Supervision (the

OTS), CONA and Superior are subject to capital adequacy guidelines adopted by the Office of the Comptroller of the

Currency (the OCC), and North Fork Bank is subject to capital adequacy guidelines adopted by the Federal Deposit

Insurance Corporation (the FDIC) (collectively the regulators). The capital adequacy guidelines require the Company,

the Bank, the Savings Bank, CONA, Superior and North Fork Bank to maintain specific capital levels based upon

quantitative measures of their assets, liabilities and off-balance sheet items. In addition, the Bank, Savings Bank, CONA,

Superior and North Fork Bank must also adhere to the regulatory framework for prompt corrective action.

The most recent notifications received from the regulators categorized the Bank, the Savings Bank, CONA, Superior and

North Fork Bank as well-capitalized. As of December 31, 2006, the Companys, the Banks, the Savings Banks, CONAs,

Superiors and North Fork Banks capital exceeded all minimum regulatory requirements to which they were subject, and

there were no conditions or events since the notifications discussed above that management believes would have changed the

Companys, the Banks, the Savings Banks, CONAs, Superiors or North Fork Banks capital category.