Capital One 2006 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

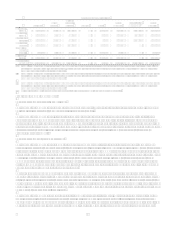

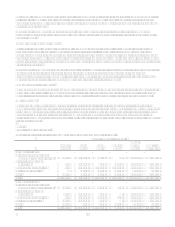

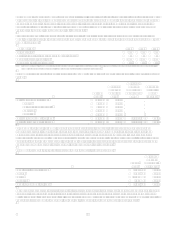

businesses not included in the reportable segments, the mortgage and banking business recently added through the acquisition

of North Fork Bancorporation, investments in external companies, and various non-lending activities. The Other category

also includes the net impact of transfer pricing, certain unallocated expenses and gains/losses related to the securitization of

assets.

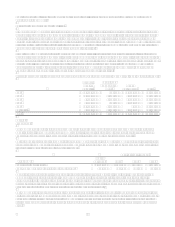

As management makes decisions on a managed basis within each segment, information about reportable segments is

provided on a managed basis. An adjustment to reconcile the managed financial information to the reported financial

information in the consolidated financial statements is provided. This adjustment reclassifies a portion of net interest income,

non-interest income and provision for loan losses into non-interest income from servicing and securitizations.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in conformity

with GAAP. The following tables present information prepared from the Companys internal management information

system, which is maintained on a line of business level through allocations from the consolidated financial results.

See Note 1, Significant Accounting Policies, for the accounting policies of the reportable segments.

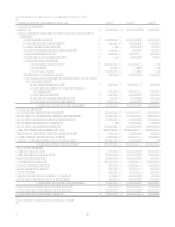

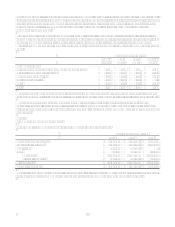

Year Ended December 31, 2006

U.S. Card Auto

Finance

Global

Financial

Services Banking Other Total

Managed Securitization

Adjustments(1)

Total

Reported

Net interest

income $ 4,715,798 $ 1,437,795 $ 1,817,871 $ 996,929 $ (27,517) $ 8,940,876 $ (3,841,246) $ 5,099,630

Non-interest

income 3,255,681 16,106 1,187,087 446,071 (1,955) 4,902,990 2,093,742 6,996,732

Provision for

loan losses 1,644,619 494,835 1,068,395 399 15,694 3,223,942 (1,747,504) 1,476,438

Non-interest

expenses 3,521,627 599,807 1,509,666 1,167,873 168,220 6,967,193 6,967,193

Income tax

provision

(benefit) 981,833 125,740 152,945 96,155 (118,435) 1,238,238 1,238,238

Net income

(loss) $ 1,823,400 $ 233,519 $ 273,952 $ 178,573 $ (94,951) $ 2,414,493 $ $ 2,414,493

Loans held for

investment $ 53,623,680 $ 21,751,827 $ 26,983,673 $ 12,145,533 $ 31,646,555 $ 146,151,268 $ (49,639,129) $ 96,512,139

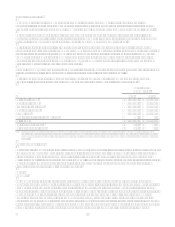

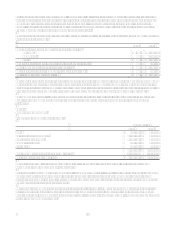

Year Ended December 31, 2005

U.S. Card Auto

Finance

Global

Financial

Services Banking Other Total

Managed Securitization

Adjustments(1)

Total

Reported

Net interest

income $ 4,793,956 $ 1,149,377 $ 1,680,522 $ $ 31,599 $ 7,655,454 $ (3,975,212) $ 3,680,242

Non-interest

income 3,321,457 19,951 1,022,756 195,234 4,559,398 1,798,707 6,358,105

Provision for

loan losses 2,279,109 459,513 925,777 3,178 3,667,577 (2,176,505) 1,491,072

Non-interest

expenses 3,356,600 506,480 1,496,678 358,515 5,718,273 5,718,273

Income tax

provision

(benefit) 870,351 71,268 94,796 (16,560) 1,019,855 1,019,855

Net income

(loss) $ 1,609,353 $ 132,067 $ 186,027 $ $ (118,300) $ 1,809,147 $ $ 1,809,147

Loans held for

investment $ 49,463,522 $ 16,372,019 $ 23,386,490 $ $ 16,305,460 $ 105,527,491 $ (45,679,810) $ 59,847,681