Capital One 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 76

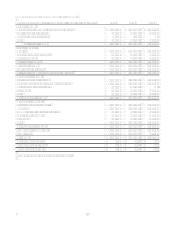

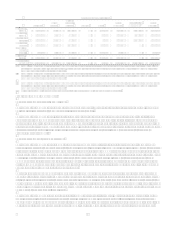

contractual terms will not be collected. For purposes of determining impairment, consumer loans are collectively evaluated as

they are considered to be comprised of large groups of smaller-balance homogeneous loans and therefore are not individually

evaluated for impairment under the provisions of SFAS 114. Nonaccrual loans are charged off when deemed uncollectible by

management. Interest payments received on nonaccrual loans are applied to principal if there is doubt as to the collectibility

of the principal; otherwise, these receipts are recorded as interest income. A loan remains in nonaccrual status until it is

current as to principal and interest and the borrower demonstrates the ability to fulfill the contractual obligation.

Marketing

The Company expenses marketing costs as incurred. Television advertising costs are expensed during the period in which the

advertisements are aired. The amount of marketing expense was $1.4 billion, $1.4 billion and $1.3 billion for the years ended

December 31, 2006, 2005 and 2004, respectively.

Credit Card Fraud Losses

The Company experiences fraud losses from the unauthorized use of credit cards. Transactions suspected of being fraudulent

are charged to non-interest expense after a 60 day investigation period. The amount of fraud losses were $103.0 million,

$

53.7 million, and $56.0 million for the years ended December 31, 2006, 2005 and 2004, respectively.

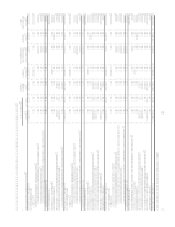

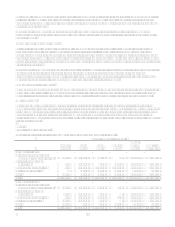

Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes, recognizing the

current and deferred tax consequences of all transactions that have been recognized in the financial statements using the

provisions of the enacted tax laws. Deferred tax assets and liabilities are determined based on differences between the

financial reporting and tax bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in

effect when the differences are expected to reverse. Valuation allowances are recorded to reduce deferred tax assets to an

amount that is more likely than not to be realized. See Note 14 for additional detail.

Segments

The accounting policies of operating and reportable segments, as defined by the Statement of Financial Accounting Standard

No. 131, Disclosures about Segments of an Enterprise and Related Information, (SFAS 131) are the same as those

described elsewhere in this footnote. Revenue for all segments is derived from external parties. Performance evaluation of

and resource allocation to each reportable segment is based on a wide range of indicators to include both historical and

forecasted operating results. See Note 3 for further discussion of the Companys operating and reportable segments.

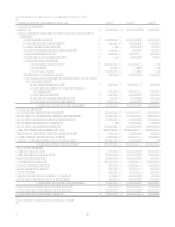

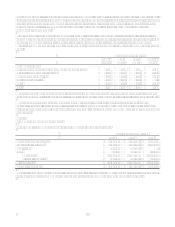

Note 2

Business Combinations

North Fork Bancorporation

On December 1, 2006, the Company acquired 100% of the outstanding common stock of North Fork Bancorporation (North

Fork), a regional bank holding company headquartered in New York conducting commercial and retail banking from branch

locations in the New York, New Jersey, and Connecticut, with a complementary national mortgage banking business.

The acquisition was accounted for under the purchase method of accounting, and, as such, the assets and liabilities of North

Fork were recorded at their respective fair values as of December 1, 2006. The results of North Forks operations were

included in the Companys Consolidated Statement of Income commencing December 1, 2006.

The total consideration of $13.2 billion, which includes the value of outstanding stock options, was settled through the

issuance of 104.0 million shares of the Companys common stock and payment of $5.2 billion in cash. Under the terms of the

transaction, each share of North Fork common stock was exchanged for $28.14 in cash or 0.3692 shares of the Companys

common stock or a combination of common stock and cash based on the aforementioned conversion rates, based on the

average of the closing prices on the NYSE of the Companys common stock during the five trading days ending the day

before the completion of the merger, which was $76.24.