Capital One 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 75

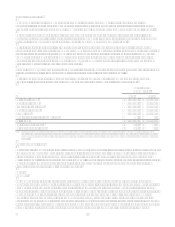

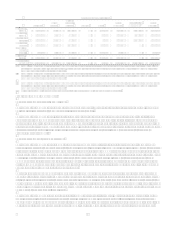

As of December 31, 2006 and 2005, the rewards liability was $1.1 billion and $0.8 billion, respectively.

Derivative Instruments and Hedging Activities

The Company recognizes all of its derivative instruments as either assets or liabilities in the balance sheet at fair value. These

instruments are recorded in other assets or other liabilities on the Consolidated Balance Sheet and in the operating section of

the Statement of Cash Flows as increases (decreases) of other assets and other liabilities. The accounting for changes in the

fair value (i.e., gains and losses) of a derivative instrument depends on whether it has been designated and qualifies as part of

a hedging relationship and, further, on the type of hedging relationship. For those derivative instruments that are designated

and qualify as hedging instruments, the Company must designate the hedging instrument, based upon the exposure being

hedged, as a fair value hedge, a cash flow hedge or a hedge of a net investment in a foreign operation.

For derivative instruments that are designated and qualify as fair value hedges (i.e., hedging the exposure to changes in the

fair value of an asset or a liability or an identified portion thereof that is attributable to a particular risk), the gain or loss on

the derivative instrument as well as the offsetting loss or gain on the hedged item attributable to the hedged risk is recognized

in current earnings during the period of the change in fair values. For derivative instruments that are designated and qualify

as cash flow hedges (i.e., hedging the exposure to variability in expected future cash flows that is attributable to a particular

risk), the effective portion of the gain or loss on the derivative instrument is reported as a component of other comprehensive

income and reclassified into earnings in the same period or periods during which the hedged transaction affects earnings. The

remaining gain or loss on the derivative instrument in excess of the cumulative change in the present value of future cash

flows of the hedged item, if any, is recognized in current earnings during the period of change. For derivative instruments

that are designated and qualify as hedges of a net investment in a foreign operation, the gain or loss is reported in other

comprehensive income as part of the cumulative translation adjustment to the extent it is effective. For derivative instruments

not designated as hedging instruments, the gain or loss is recognized in current earnings during the period of change in the

fair value.

See Note 23 for additional detail.

Revenue Recognition

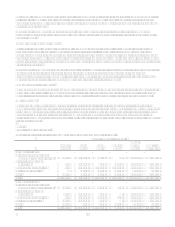

The Company recognizes earned finance charges and fee income on loans according to the contractual provisions of the

credit arrangements. When the Company does not expect full payment of finance charges and fees, it does not accrue the

estimated uncollectible portion as income (hereafter the suppression amount). To calculate the suppression amount, the

Company first estimates the uncollectible portion of finance charge and fee receivables using a formula based on historical

account migration patterns and current delinquency status. This formula is consistent with that used to estimate the allowance

related to expected principal losses on reported loans. The suppression amount is calculated by adding any current period

change in the estimate of the uncollectible portion of finance charge and fee receivables to the amount of finance charges and

fees charged-off (net of recoveries) during the period. The Company subtracts the suppression amount from the total finance

charges and fees billed during the period to arrive at total reported revenue. The amount of finance charge and fees

suppressed were $0.9 billion, $1.0 billion and $1.1 billion for the years ended December 31, 2006, 2005 and 2004,

respectively.

Interchange income is a fee paid by a merchant bank to the card-issuing bank through the interchange network. Interchange

fees are set by MasterCard International Inc. (MasterCard) and Visa U.S.A. Inc. (Visa) and are based on cardholder

purchase volumes. The Company recognizes interchange income as earned.

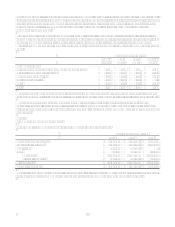

Annual membership fees and direct loan origination costs are deferred and amortized over one year on a straight-line basis.

Dealer fees and premiums are deferred and amortized over the average life of the related loans using the interest method for

auto loan originations. Direct loan origination costs consist of both internal and external costs associated with the origination

of a loan. Deferred fees (net of deferred costs) were $372.2 million and $217.8 million as of December 31, 2006 and 2005,

respectively.

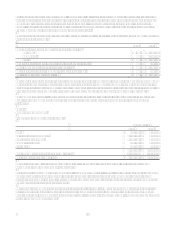

A closed end loans past due or delinquency status is determined based on its contractual terms. Commercial, small business

and some auto loans are placed in nonaccrual status at 90 days past due or sooner if, in managements opinion, there is doubt

concerning full collectibility of both principal and interest. Interest and fees accrued but not collected through the end of the

previous quarter are systematically reversed and charged against income at the time a loan is placed on non-accrual status.

The finance charge and fees accrued and not collected are reversed when the loan charges off. All other consumer loans are

subject to mandatory charge-off when any payment of principal or interest is more than 120 days delinquent and are therefore

not placed in nonaccrual status prior to charge-off. Commercial and small business nonaccrual loans are considered to be

impaired in accordance with the provisions of Statement of Financial Accounting Standards No. 114, Accounting by

Creditors for Impairment of a Loan, (SFAS 114) when it is probable that all amounts due in accordance with the