Capital One 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

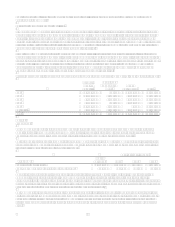

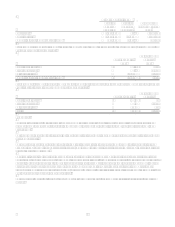

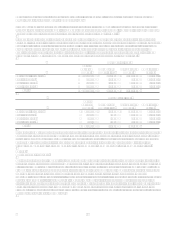

Income tax benefits of $22.0 million and $1.4 million in 2006 and 2005, respectively, were allocated directly to reduce

goodwill from acquisitions. Income tax expense (benefit) reported in shareholders equity was as follows:

Year Ended December 31

2006 2005 2004

Foreign currency translation gains (losses) $ (18,033) $ (18,004) $ 2,201

Net unrealized securities gains (losses) 16,635 (31,706) (29,048)

Net unrealized derivative gains (losses) (6,750) 21,373 26,516

Employee stock plans (77,090) (168,426) (126,058)

Employee retirement plans 1,851

Total current provision (benefit) $ (83,387) $ (196,763) $ (126,389)

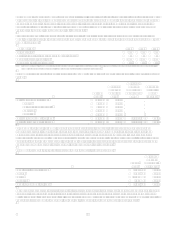

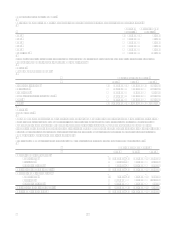

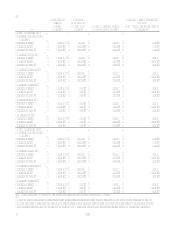

The reconciliation of income tax attributable to continuing operations computed at the U.S. federal statutory tax rate to

income tax expense was:

Year Ended December 31

2006 2005 2004

Income tax at U.S. federal statutory tax rate 35.00% 35.00% 35.00%

Resolution of federal income tax issues and audits (1.94)

Other, including state taxes 0.84 1.05 (0.40)

Income taxes 33.90% 36.05% 34.60%

During 2006, the Companys income tax expense was reduced by $70.7 million due to the resolution of certain tax issues and

audits for prior years with the Internal Revenue Service. This reduction represented the release of previous accruals for

potential audit adjustments which were subsequently settled or eliminated and further refinement of existing tax exposures.

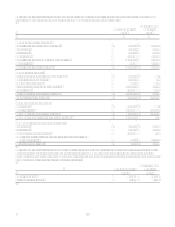

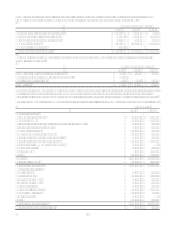

Significant components of the Companys deferred tax assets and liabilities as of December 31, 2006 and 2005 were as follows:

December 31

2006 2005

Deferred tax assets:

Allowance for loan losses $ 696,890 $ 450,463

Unearned income 112,577 125,848

Net unrealized losses on securities and derivative instruments 45,139 22,164

State taxes, net of federal benefit 16,317 31,146

Employee stock plans 110,925 61,844

Rewards & sweepstakes programs 164,506 43,059

Valuation difference of acquired securities 19,982 27,423

Valuation difference of acquired loans 155,106 124,134

Retained liabilityManufactured Housing 30,461

Employee benefits 54,948 64,353

Foreign taxes 4,686 (45,817)

Other 195,879 148,960

Subtotal 1,607,416 1,053,577

Valuation allowance (15,543) (42,531)

Total deferred tax assets 1,591,873 1,011,046

Deferred tax liabilities:

Securitizations 76,166 22,708

Deferred revenue 652,554 676,852

Property & equipment 75,156 85,572

Prepaid advertisement 43,253 24,367

Leasing activities 15,507 17,335

Core deposit intangibles 419,744 129,703

Goodwill amortization 108,942 6,856

Servicing assets 93,168

Other 100,378 54,757

Total deferred tax liabilities 1,584,868 1,018,150

Net deferred tax assets (liabilities) $ 7,005 $ (7,104)