Capital One 2006 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 107

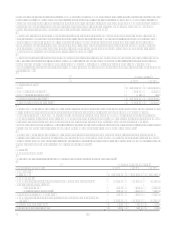

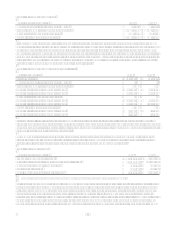

generated by the transferred receivables, less the related net losses on the transferred receivables and interest expense related

to the securitization debt.

Note 23

Derivative Instruments and Hedging Activities

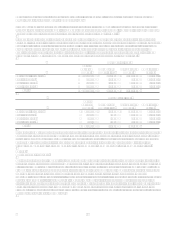

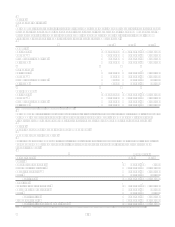

The Company maintains a risk management strategy that incorporates the use of derivative instruments to minimize

significant unplanned fluctuations in earnings caused by interest rate and foreign exchange rate volatility. The Companys

goal is to manage sensitivity to changes in rates by modifying the repricing or maturity characteristics of certain balance sheet

assets and liabilities, thereby limiting the impact on earnings. By using derivative instruments, the Company is exposed to

credit and market risk. The Company manages the market risk associated with interest rate and foreign exchange contracts by

establishing and monitoring limits as to the types and degree of risk that may be undertaken. Credit risk is equal to the extent

of the fair value gain in a derivative, if the counterparty fails to perform. When the fair value of a derivative contract is

positive, this generally indicates that the counterparty owes the Company, and, therefore, creates a repayment risk for the

Company. When the fair value of a derivative contract is negative, the Company owes the counterparty, and therefore, has no

repayment risk. The Company minimizes the credit (or repayment) risk in derivative instruments by entering into transactions

with high-quality counterparties that are reviewed periodically by the Companys Asset and Liability Committee, a

committee of Senior Management. The Company also maintains a policy of requiring that all derivative contracts be

governed by an International Swaps and Derivatives Association Master Agreement; depending on the nature of the

derivative transaction, bilateral collateral agreements may be required as well.

The Company periodically uses interest rate swaps as part of its interest rate risk management strategy. Interest rate swaps

generally involve the exchange of fixed and variable rate interest payments between two parties, based on a common notional

principal amount and maturity date. As a result of interest rate fluctuations, hedged assets and liabilities will appreciate or

depreciate in market value. To the extent that there is a high degree of correlation between the hedged asset or liability and

the derivative instrument, the income or loss generated will generally offset the effect of this unrealized appreciation or

depreciation.

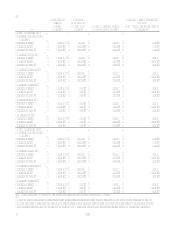

The Companys foreign currency denominated assets and liabilities expose it to foreign currency exchange risk. The

Company enters into various foreign exchange derivative contracts for managing foreign currency exchange risk. Changes in

the fair value of the derivative instrument effectively offset the related foreign exchange gains or losses on the items to which

they are designated.

The Company has non-trading derivatives that do not qualify as hedges. These derivatives are carried at fair value and

changes in value are included in current earnings.

The Asset and Liability Management Committee, as part of that committees oversight of the Companys asset/liability and

treasury functions, monitors the Companys derivative activities. In accordance with the Companys asset/liability

management policies, the Company reviews its risk profile on a monthly basis. The Companys Asset and Liability

Management Committee is responsible for approving hedging strategies. The resulting strategies are then incorporated into

the Companys overall interest rate risk management strategies.

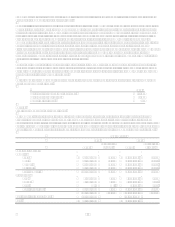

Fair Value Hedges

The Company has entered into forward exchange contracts to hedge foreign currency denominated investments against

fluctuations in exchange rates. The purpose of the Companys foreign currency hedging activities is to protect the Company

from the risk of adverse effects from movements in exchange rates.

The Company has also entered into interest rate swap agreements that modify the Companys exposure to interest rate risk by

effectively converting a portion of the Companys public fund certificates of deposit, senior notes, and U.S. Agency

investments from fixed rates to variable rates over the next ten years.

For the years ended December 31, 2006 and 2005, net gains or losses related to the ineffective portion of the Companys fair

value hedging instruments were not material.

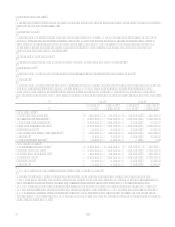

Cash Flow Hedges

The Company has entered into interest rate swap agreements that effectively modify the Companys exposure to interest rate

risk by converting floating rate debt to a fixed rate over the next seven years. The agreements involve the receipt of floating

rate amounts in exchange for fixed rate interest payments over the life of the agreement without an exchange of underlying

principal amounts.