Capital One 2006 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

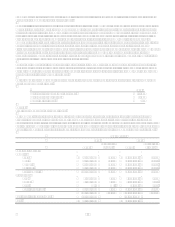

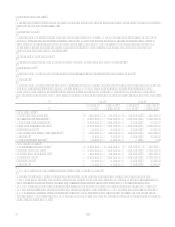

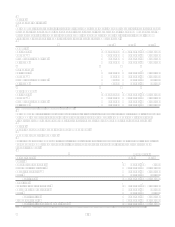

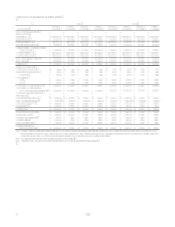

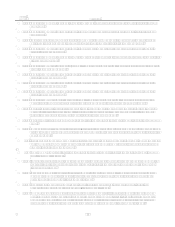

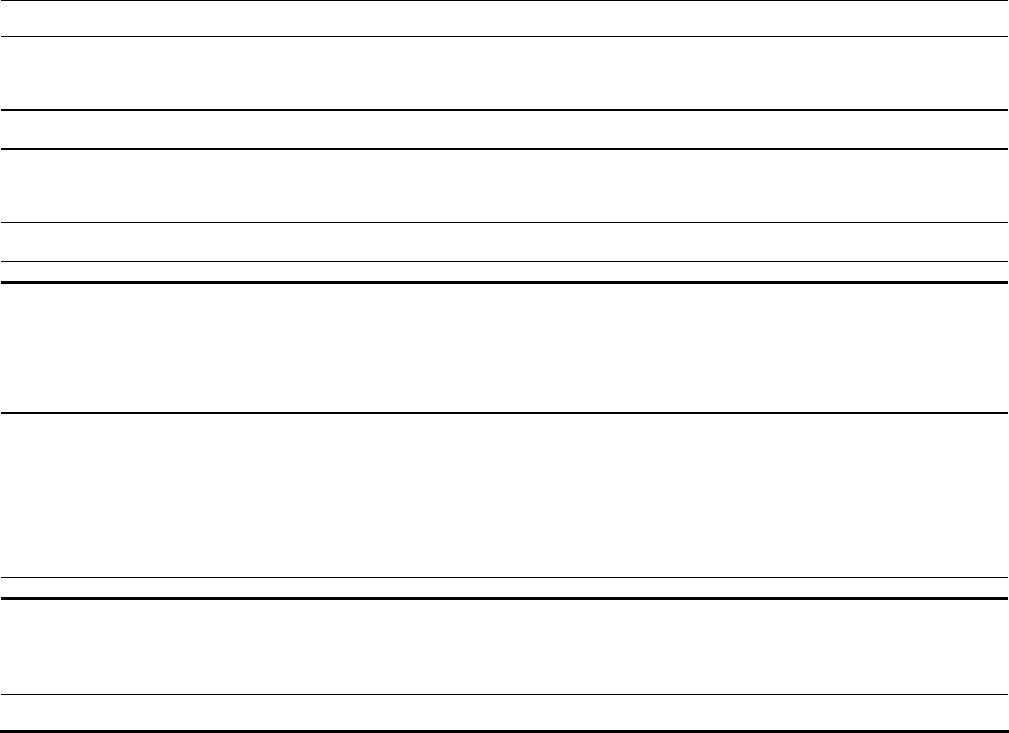

Selected Quarterly Financial Data (1)

2006 2005

(Unaudited) Fourth

Quarter Third

Quarter Second

Quarter First

Quarter Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

Summary of Operations:

(In Thousands)

Interest income $ 2,353,419 $ 2,065,071 $ 1,897,157 $ 1,878,582 $ 1,634,098 $ 1,404,615 $ 1,351,900 $ 1,336,268

Interest expense 952,263 770,556 700,075 671,705 597,099 494,396 479,397 475,747

Net interest income 1,401,156 1,294,515 1,197,082 1,206,877 1,036,999 910,219 872,503 860,521

Provision for loan losses 513,157 430,566 362,445 170,270 565,674 374,167 291,600 259,631

Net interest income after provision

for loan losses 887,999 863,949 834,637 1,036,607 471,325 536,052 580,903 600,890

Non-interest income 1,667,183 1,761,385 1,709,913 1,858,251 1,665,514 1,594,616 1,581,996 1,515,979

Non-interest expense 1,986,188 1,726,629 1,680,897 1,573,479 1,689,186 1,365,638 1,335,617 1,327,832

Income before income taxes 568,994 898,705 863,653 1,321,379 447,653 765,030 827,282 789,037

Income taxes 178,266 310,866 311,066 438,040 167,335 273,881 296,164 282,475

Net income $ 390,728 $ 587,839 $ 552,587 $ 883,339 $ 280,318 $ 491,149 $ 531,118 $ 506,562

Per Common Share:

Basic earnings per share $ 1.16 $ 1.95 $ 1.84 2.95 $ 1.01 $ 1.88 $ 2.10 2.08

Diluted earnings per share 1.14 1.89 1.78 2.86 0.97 1.81 2.03 1.99

Dividends 0.03 0.03 0.03 0.03 0.03 0.03 0.03 0.03

Market prices

High 82.72 86.17 87.23 89.92 88.56 85.97 80.42 84.75

Low 74.97 69.88 81.10 80.52 71.15 77.89 69.10 73.15

Average common shares (000s) 336,470 301,571 300,829 299,257 278,752 260,918 252,585 243,978

Average common shares and

common equivalent shares (000s) 343,779 310,386 309,988 309,121 287,694 270,693 261,664 255,181

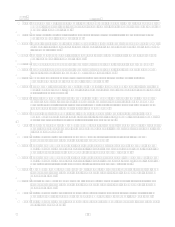

Average Balance Sheet Data:

(In Millions)

Loans held for investment $ 74,738 $ 62,429 $ 58,833 $ 58,142 $ 48,701 $ 38,556 $ 38,237 $ 38,204

Allowance for loan losses (1,929 ) (1,767) (1,678 ) (1,789) (1,585) (1,405) (1,439 ) (1,510)

Liquidity portfolio(2)(3) 22,619 16,683 17,870 17,686 15,791 12,844 11,578 10,800

Other assets(3) 18,214 14,950 14,619 14,856 11,536 9,209 8,587 8,794

Total assets $ 113,642 $ 92,295 $ 89,644 $ 88,895 $ 74,443 $ 59,204 $ 56,963 $ 56,288

Interest-bearing deposits $ 53,735 $ 42,984 $ 42,797 $ 43,357 $ 34,738 $ 26,618 $ 26,391 $ 25,655

Other borrowings 20,556 18,011 16,928 16,074 13,703 10,698 10,839 10,698

Senior and deposit notes 9,035 6,545 5,576 6,098 6,707 6,684 6,988 6,909

Other liabilities 12,005 8,445 8,762 8,754 6,767 4,402 3,820 4,458

Stockholders equity 18,311 16,310 15,581 14,612 12,528 10,802 8,925 8,568

Total liabilities and

stockholders equity $ 113,642 $ 92,295 $ 89,644 $ 88,895 $ 74,443 $ 59,204 $ 56,963 $ 56,288

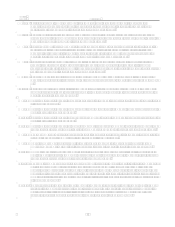

(1) The above schedule is a tabulation of the Companys unaudited quarterly results for the years ended December 31, 2006 and 2005. The Companys common

shares are traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were

19,763 and 11,856 common stockholders of record as of December 31, 2006 and 2005, respectively.

(2) Liquidity portfolio includes $9.5 billion of pledged securities.

(3) Prior period amounts have been reclassified to conform with current period presentation.