Capital One 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

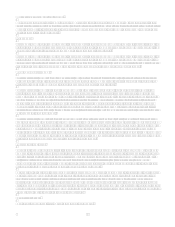

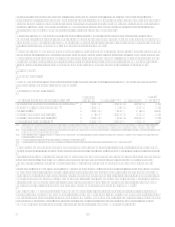

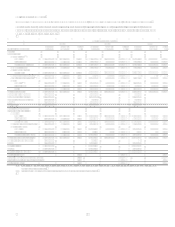

Table 9 reflects the costs of other borrowings of the Company as of and for each of the years ended December 31, 2006, 2005

and 2004.

Table 9: Short Term Borrowings

(Dollars in Thousands)

Maximum

Outstanding

as of any

Month-End

Outstanding

as of

Year-End

Average

Outstanding

Average

Interest

Rate

Year-End

Interest

Rate

2006:

Federal funds purchased and resale

agreements $ 3,736,470 $ 3,736,470 $ 1,662,961 4.20% 5.27%

Other 3,198,710 1,716,055 1,323,998 5.75 5.89

Total $ 5,452,525 $ 2,986,959 4.89% 5.28%

2005:

Federal funds purchased and resale

agreements $ 2,332,173 $ 745,719 $ 704,458 2.69% 3.62%

Other 1,453,181 1,271,014 840,860 4.88 2.09

Total $ 2,016,733 $ 1,545,318 3.88% 2.66%

2004:

Federal funds purchased and resale

agreements $ 1,154,073 $ 1,154,073 $ 503,482 1.29% 1.78%

Other 1,318,404 201,622 763,303 3.85 2.10

Total $ 1,355,695 $ 1,266,785 2.83% 1.83%

Additional information regarding funding can be found on pages 86-88 in Item 8 Financial Statements and Supplementary

DataNotes to the Consolidated Financial StatementsNote 9.

Funding Obligations

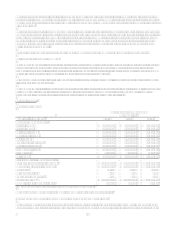

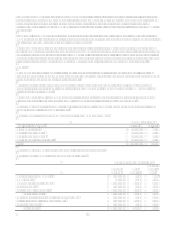

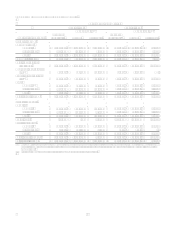

Table 10 summarizes the amounts and maturities of the contractual funding obligations of the Company, including off-

balance sheet funding.

Table 10: Funding Obligations

As of December 31, 2006 Total Up to 1 year 1-3 years 4-5 years After 5 years

Interest-bearing deposits $ 74,122,822 $ 31,405,210 $ 17,818,354 $ 16,920,101 $ 7,979,157

Senior and subordinated notes 9,725,470 461,546 3,416,786 3,948,092 1,899,046

Other borrowings(1) 24,257,007 13,303,627 8,271,657 1,035,768 1,645,955

Operating leases 1,121,572 141,116 261,879 103,082 615,495

Off-balance sheet securitization

amortization 48,993,094 7,922,199 18,458,879 12,317,776 10,294,240

Total obligations $ 158,219,965 $ 53,233,698 $ 48,227,555 $ 34,324,819 $ 22,433,893

(1) Other borrowings includes secured borrowings for the Companys on-balance sheet auto loan securitizations, junior subordinated capital income securities and

debentures, FHLB advances, federal funds purchased and resale agreements and other short-term borrowings.

The terms of the lease and credit facility agreements related to certain other borrowings and operating leases in Table 10

require several financial covenants (including performance measures and equity ratios) to be met. If these covenants are not

met, there may be an acceleration of the payment due dates noted above. As of December 31, 2006, the Company was not in

default of any such covenants.

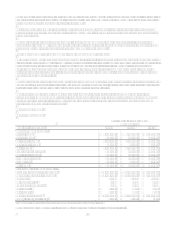

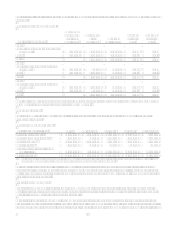

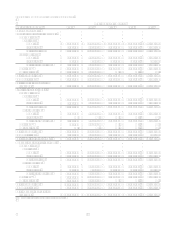

Liquidity Risk Management

Liquidity risk management refers to the way the Company manages the use and availability of various funding sources to

meet its current and future operating needs. These needs are largely a result of asset growth, securitization, debt and deposit

maturities, and payments of other corporate obligations.

To facilitate liquidity risk management, the Company uses a variety of funding sources to establish a maturity pattern that

provides a prudent mixture of short-term and long-term funds. The Company obtains funds through the gathering of deposits,

issuing debt and equity, and securitizing assets. Further liquidity is provided to the Company through committed facilities. As