Capital One 2006 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

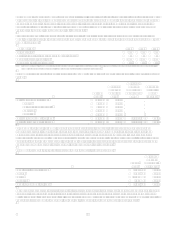

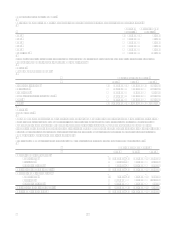

anticipated losses and a decrease to goodwill. The $30.8 million is related to the allowance for loan losses that existed for

those loans prior to the hurricanes. In addition, the estimate of fair value of the loans continuing to be accounted for under

SOP 03-3 was finalized during the allocation period. Together, the adjustments resulted in a $68.8 million decrease to

goodwill. Also in the fourth quarter of 2006, loans totaling approximately $376.5 million continuing to be accounted for

under SOP 03-3 were transferred to mortgage loans held for sale.

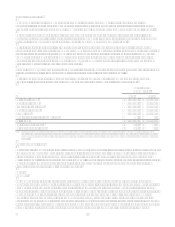

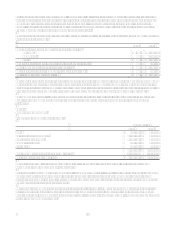

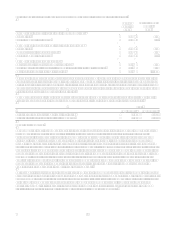

Loans acquired during each year for which it was probable at acquisition that all contractually required payments would not

be collected are as follows:

2006 2005

Contractually required payments receivable at acquisition

Consumer $ $ 2,932,051

Commercial 2,100,306

Total $ $ 5,032,357

Nonaccretable difference (expected losses and foregone interest) 215,025

Cash flows expected to be collected at acquisition $ $ 4,817,332

Accretable yield (interest component of expected cash flows) $ $ 602,729

Basis in acquired loans at acquisition $ $ 4,214,603

There were no loans acquired that were not accounted for using the income recognition model of SOP 03-03. The Company

was able to reasonably estimate cash flows expected to be collected. Judgmental prepayment assumptions were applied to

both contractually required payments and cash flows expected to be collected at acquisition for each portfolio to account for

higher than average prepayments resulting from insurance proceeds for loans impacted by Gulf Coast Hurricanes.

The Company considered if there was evidence of deterioration in credit quality for the loans acquired in the North Fork

acquisition. The Company determined that none of these loans were required to be accounted for in accordance with

SOP 03-3.

Note 8

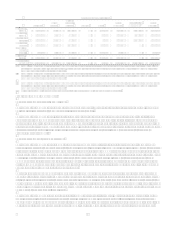

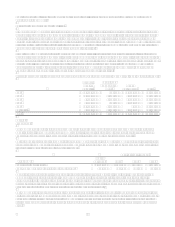

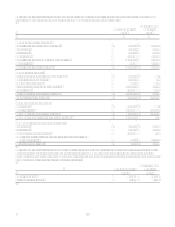

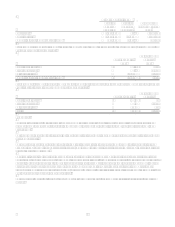

Premises and Equipment

Premises and equipment were as follows:

December 31

2006 2005

Land $ 396,554 $ 214,696

Buildings and improvements 1,265,524 722,679

Furniture and equipment 1,003,142 796,668

Computer software 786,626 568,731

In process 245,883 134,525

3,697,729 2,437,299

Less: Accumulated depreciation and amortization (1,494,449) (1,245,893)

Total premises and equipment, net $ 2,203,280 $ 1,191,406

Depreciation and amortization expense was $270.5 million, $210.2 million, and $224.3 million, for the years ended

December 31, 2006, 2005 and 2004, respectively.

As discussed in Note 2Business Combinations, the Company completed its acquisition of North Fork Bank in December

2006. The acquisition added: $168.5 million in land, $299.4 million in buildings and improvements, $87.2 million of

furniture and equipment, $24.8 million of computer software and $24.8 million of construction in process at December 31,

2006, which are reflected in the table above.

During 2005, the Company closed on the sale of certain facilities in Seattle, Washington and Tampa, Florida as part of its

facility consolidation efforts. The final sales price of the Tampa, Florida facility was greater than the recorded impaired

value, and as such, the Company reversed $18.8 million of its previously recorded impairment in Occupancy expense during

the year ended December 31, 2005.