Capital One 2006 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Securitization Guarantees

In connection with certain installment loan securitization transactions, the transferee (off-balance sheet special purpose entity

receiving the installment loans) entered into interest rate hedge agreements (the swaps) with a counterparty to reduce

interest rate risk associated with the transactions. In connection with the swaps, the Corporation entered into letter

agreements guaranteeing the performance of the transferee under the swaps. If at anytime the Class A invested amount equals

zero and the notional amount of the swap is greater than zero resulting in an Early Termination Date (as defined in the

securitization transactions Master Agreement), then (a) to the extent that, in connection with the occurrence of such Early

Termination Date, the transferee is obligated to make any payments to the counterparty pursuant to the Master Agreement,

the Corporation shall reimburse the transferee for the full amount of such payment and (b) to the extent that, in connection

with the occurrence of an Early Termination Date, the transferee is entitled to receive any payment from the counterparty

pursuant to the Master Agreement, the transferee will pay to the Corporation the amount of such payment.

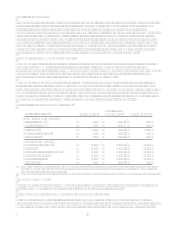

IV. Reconciliation to GAAP Financial Measures

The Companys consolidated financial statements prepared in accordance with accounting principles generally accepted in

the United States (GAAP) are referred to as its reported financial statements. Loans included in securitization

transactions which qualify as sales under GAAP have been removed from the Companys reported balance sheet. However,

servicing fees, finance charges, and other fees, net of charge-offs, and interest paid to investors of securitizations are

recognized as servicing and securitizations income on the reported income statement.

The Companys managed consolidated financial statements reflect adjustments made related to effects of securitization

transactions qualifying as sales under GAAP. The Company generates earnings from its managed loan portfolio which

includes both the on-balance sheet loans and off-balance sheet loans. The Companys managed income statement takes the

components of the servicing and securitizations income generated from the securitized portfolio and distributes the revenue

and expense to appropriate income statement line items from which it originated. For this reason, the Company believes the

managed consolidated financial statements and related managed metrics to be useful to stakeholders.

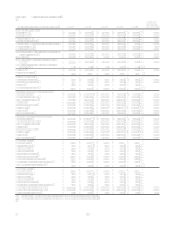

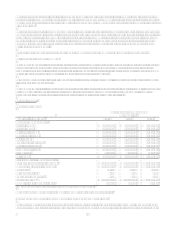

As of and for the year Ended December 31, 2006

(Dollars in millions) Total Reported

Securitization

Adjustments(1) Total Managed(2)

Income Statement Measures

Net interest income $ 5,100 $ 3,841 $ 8,941

Non-interest income $ 6,997 $ (2,094) $ 4,903

Total revenue $ 12,097 $ 1,747 $ 13,844

Provision for loan losses $ 1,476 $ 1,748 $ 3,224

Net charge-offs $ 1,407 $ 1,751 $ 3,158

Balance Sheet Measures

Loans held for investment $ 96,512 $ 49,639 $ 146,151

Total assets $ 149,739 $ 48,906 $ 198,645

Average loans held for investment $ 63,577 $ 47,752 $ 111,329

Average earning assets $ 84,522 $ 45,726 $ 130,248

Average total assets $ 95,810 $ 47,172 $ 142,982

Delinquencies $ 2,648 $ 1,766 $ 4,414

(1) Income statement adjustments for the year ended December 31, 2006 reclassify the net of finance charges of $5,485.0 million, past due fees of $938.6 million,

interest income of $(239.7) million and interest expense of $2,342.7 million; and net charge-offs of $1,747.5 million to Non-interest income from Net interest

income and Provision for loan losses, respectively.

(2) The managed loan portfolio does not include auto loans which have been sold in whole loan sale transactions where the Company has retained servicing rights.

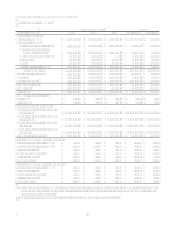

V. Management Summary

The following discussion provides a summary of 2006 results compared to 2005 results and 2005 results compared to 2004

results. Each component is discussed in further detail in subsequent sections of this analysis.

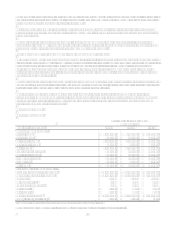

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

Net income increased 33% to $2.4 billion for the year ended December 31, 2006. The Company reported 13% diluted

earnings per share growth in 2006, while achieving a number of significant milestones, including the successful integration of

Hibernia, the acquisition of North Fork, upgraded credit ratings, and a significant upgrade of the systems infrastructure.