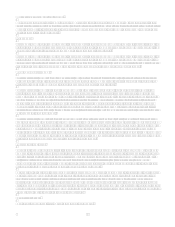

Capital One 2006 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 33

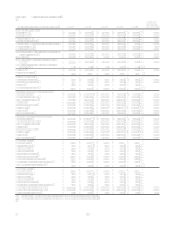

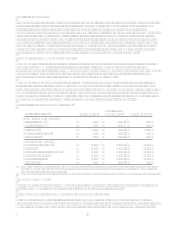

Diluted earnings per share were $7.62 for the full year, which included a $0.32 dilutive impact from the North Fork

acquisition.

Revenue growth was fueled by managed loan growth in the Auto Finance and Global Financial Services segments and a full

year of Hibernia results, offset by declining revenues in U.S. Card driven by ongoing changes in product strategy. The

provision for loan losses slightly declined year over year, despite reported loan growth, due to the continued increase in the

concentration of higher credit quality loans in the reported loan portfolio combined with a continued favorable loss

environment resulting from, in part, a slower than expected return of bankruptcy related charge-offs to historical levels, and

the alignment of allowance methodologies across acquired businesses.

Non-interest expense increased $1.2 billion in 2006 driven by increases in operating expense. The increase in operating

expense was driven primarily by a full year of Hibernias results which contributed $951.3 million (which includes

integration costs and costs to support the branch expansion efforts) of the overall increase, the one month impact of the North

Fork acquisition which added $97.4 million of operating expense, and increased costs for infrastructure investments,

including the conversion of the Companys cardholder transaction and account processing platform. Although operating

expenses increased for the year, operating expense as a percentage of average managed assets continued to decline, reflecting

the Companys improved operating efficiency. The Companys return on managed assets of 1.69% is consistent with prior

years and reflects the sustainability and diversification of the Companys earnings stream.

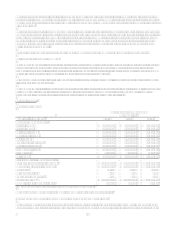

Managed loans as of December 31, 2006 were $146.2 billion, up 39% from 2005. Excluding the $31.7 billion of loans from

the North Fork acquisition, managed loans grew to $114.4 billion, with organic loan growth at 10% year over year. The

Company ended the year with $85.8 billion in deposits which included $38.5 billion of deposits from the acquisition of North

Fork. These deposits represent approximately 50% of 2006 total managed liabilities.

In 2006, the Company made additional progress to become a diversified financial services company. The successful

integration of Hibernia and the acquisition of North Fork have expanded the Companys local banking presence. Strong

growth in Auto Finance and domestic Global Financial Services segments and the addition of GreenPoints nationwide

mortgage business bolster the Companys national lending position. The Company delivered solid results and built a strong

balance sheet.

As a result of the corporate strategies and banking acquisitions, the Companys debt ratings were upgraded during 2006.

Moodys raised its rating to A2 and A3 at the Bank and the Corporation respectively. Two Standard & Poor upgrades now

have the Company rated A- at the Bank entities and BBB+ at the Corporation.

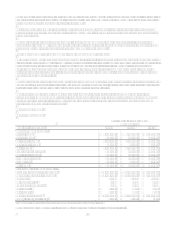

Year Ended December 31, 2005 Compared to Year Ended December 31, 2004

Net income increased 17% to $1.8 billion for the year ended December 31, 2005, while diluted earnings per share increased

8% compared to the prior year. The growth in earnings for 2005 was driven by growth in the managed loan portfolio and

contributions from 2005 acquisitions. Earnings per share growth was constrained by the increase in share count as a result of

the issuance of shares in connection with the execution of the forward purchase contracts related to the mandatory convertible

debt securities and stock option exercise activity.

Revenue growth was driven by growth in the managed loan portfolio and contributions from 2005 acquisitions. Provision for

loan losses increased due to growth in the reported loan portfolio, estimated losses from the Gulf Coast Hurricanes, and an

increase in net charge-offs resulting from the enactment of the Bankruptcy Abuse Prevention and Consumer Act of 2005

(new bankruptcy legislation). Non-interest expense increased in 2005 driven by increases in operating expense. The

increase in operating expense was driven primarily by the 2005 acquisitions, which contributed 86% of the overall increase,

and slightly higher one-time charges in 2005, offset by lower 2005 charges related to the corporate-wide cost initiatives.

Although operating expenses increased for the year, operating expense as a percentage of average managed assets continued

to decline, reflecting the Companys improved operating efficiency. The Companys return on managed assets of 1.72% was

consistent with prior years and reflected the sustainability and diversification of the Companys earnings stream.

The Company continued to achieve strong loan growth in its Auto Finance and Global Financial Services segments, which

accounted for 91% of the loan growth in 2005 and represented 45% of managed loans at December 31, 2005, excluding

$16.3 billion in loans added through the Hibernia acquisition. This growth was achieved through organic originations and the

acquisition of Onyx Acceptance Corporation (Onyx), a specialty auto loan originator and the Key Bank portfolio which

were included in the Auto Finance segment.

In 2005, the Company expanded its lending and deposit products and its distribution channels while delivering strong results

and maintaining a strong balance sheet. Total assets continued to grow and the Company continued to maintain significant