Capital One 2006 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

under the Credit Facility. All borrowings under the Credit Facility are based upon varying terms of London Interbank

Offering Rate (LIBOR).

Collateralized Revolving Credit Facilities

In March 2005, COAF entered into a revolving warehouse credit facility collateralized by a security interest in certain auto

loan assets (the Capital One Auto Loan Facility II). The Capital One Auto Loan Facility II has the capacity to issue up to

$1.8 billion in secured notes. The Capital One Auto Loan Facility II has multiple participants each with separate renewal

dates. The facility does not have a final maturity date. Instead, the participant may elect to renew the commitment for another

set period of time. Interest on the facility is based on commercial paper rates. At December 31, 2006 and 2005, $1.2 billion

and $599.0 million, respectively, were outstanding under the facility.

In April 2002, COAF entered into a revolving warehouse credit facility collateralized by a security interest in certain auto

loan assets (the Capital One Auto Facility I). As of December 31, 2006, the Capital One Auto Facility I had the capacity to

issue up to $3.3 billion in secured notes. The Capital One Auto Facility I has multiple participants each with separate renewal

dates. The facility does not have a final maturity date. Instead, each participant may elect to renew the commitment for

another set period of time. Interest on the facility is based on commercial paper rates. At December 31, 2006 and 2005,

$461.0 million and $381.0 million, respectively, were outstanding under the facility.

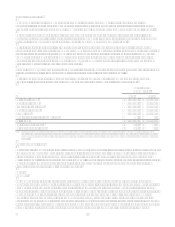

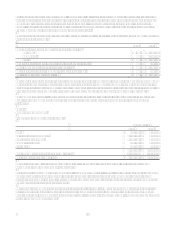

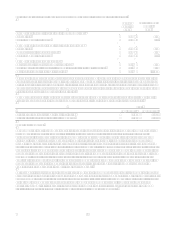

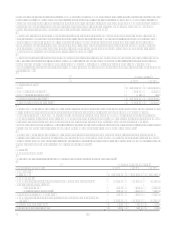

Interest-bearing deposits, Senior and subordinated notes and Other borrowings as of December 31, 2006, mature as follows:

Interest-

Bearing

Deposits

Senior and

Subordinated

Notes Other

Borrowings Total

2007 $ 31,405,210 $ 461,546 $ 13,303,627 $ 45,170,383

2008 10,628,671 1,817,740 4,727,961 17,174,372

2009 7,189,683 1,599,046 3,543,696 12,332,425

2010 3,426,194 749,046 1,032,863 5,208,103

2011 13,493,907 3,199,046 2,905 16,695,858

Thereafter 7,979,157 1,899,046 1,645,955 11,524,158

Total $ 74,122,822 $ 9,725,470 $ 24,257,007 $ 108,105,299

Note 10

Stock Plans

The Company has two active stock-based compensation plans, one employee plan and one non-employee director plan.

Under the plans, the Company reserves common shares for issuance in various forms including incentive stock options,

nonstatutory stock options, stock appreciation rights, restricted stock awards and restricted stock units.

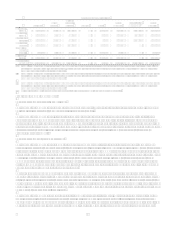

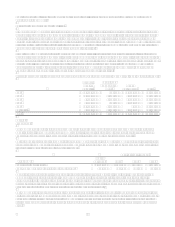

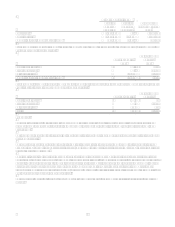

The following table provides the number of reserved common shares and the number of common shares available for future

issuance for the Companys active stock-based compensation plans as of December 31, 2006, 2005 and 2004. The ability to

issue grants from other plans was terminated in 2004.

Available For Issuance

Plan Name Shares

Reserved 2006 2005 2004

2004 Stock Incentive Plan 20,000,000 12,287,294 4,313,190 7,068,515

1999 Non-Employee Directors Stock Incentive Plan 825,000 134,600 166,500 193,430

Generally the exercise price of stock options, or value of restricted stock awards, will equal the fair market value of the

Companys stock on the date of grant. The maximum contractual term for options is ten years, and option vesting is

determined at the time of grant. The vesting for most options is 33 1/3 percent per year beginning with the first anniversary of

the grant date. For restricted stock, the vesting is usually 25 percent on the first and second anniversaries of the grant date and

50 percent on the third anniversary date or three years from the date of grant.

The Company also issues cash equity units which are recorded as liabilities as expense is recognized. Cash equity units are

not issued out of the Companys stock-based compensation plans because they are settled with a cash payment for each unit

vested equal to the fair market value of the Companys stock on the vesting date. Cash equity units vest 25 percent on the

first and second anniversaries of the grant date and 50 percent on the third anniversary date or three years from the date of

grant.