Capital One 2006 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

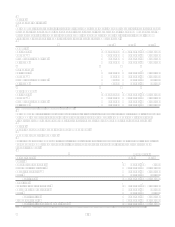

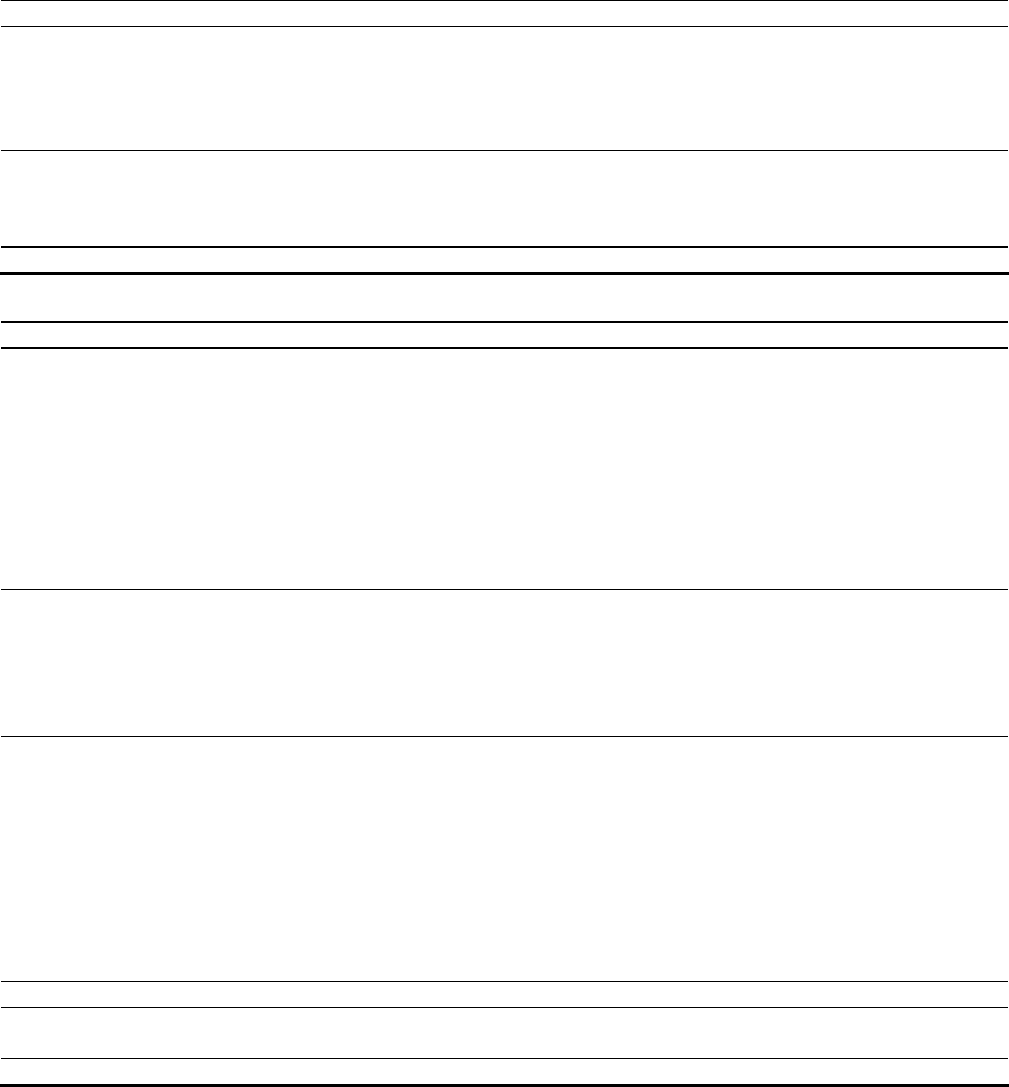

113

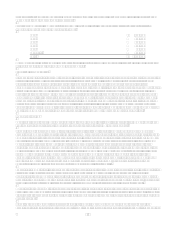

Year Ended December 31

Statements of Income 2006 2005 2004

Interest from temporary investments $ 323,870

$ 201,196 $ 84,982

Interest expense (265,585) (152,531) (152,656)

Dividends, principally from bank subsidiaries 1,950,000

1,170,000 1,000,013

Non-interest income 4,807

371 11,929

Non-interest expense (129,491) (27,065) (12,891)

Income before income taxes and equity in undistributed earnings of

subsidiaries 1,883,601

1,191,971 931,377

Income tax (expense) benefit 67,653

(5,032) 37,971

Equity in undistributed earnings of subsidiaries 463,239

622,208 574,134

Net income $ 2,414,493 $ 1,809,147 $ 1,543,482

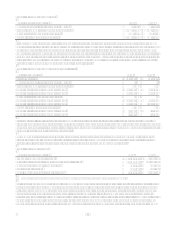

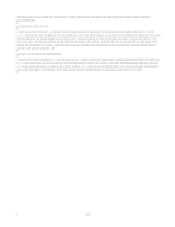

Year Ended December 31

Statements of Cash Flows 2006 2005 2004

Operating Activities:

Net income $ 2,414,493

$ 1,809,147 $ 1,543,482

Adjustments to reconcile net income to net cash provided by operating

activities:

Equity in undistributed earnings of subsidiaries (463,239) (622,208) (574,134)

Loss on repurchase of senior notes

12,444

Amortization of discount of senior notes 1,347

2,818 12,671

Stock plan compensation expense 212,317

149,496 127,174

Decrease in other assets 19,159

212,019 77,122

(Decrease) increase in other liabilities (448,363) 43,452 (7,088)

Net cash provided by operating activities 1,735,714

1,607,168 1,179,227

Investing Activities:

Decrease (increase) in investment in subsidiaries 68,953

(911,348) (80,379)

Purchases of securities available for sale (52,686)

(Increase) decrease in loans to subsidiaries (1,065,622) 115,952 (1,975,131)

Net cash used for acquisitions (5,010,821) (2,261,757)

Net cash used in investing activities (6,060,176) (3,057,153) (2,055,510)

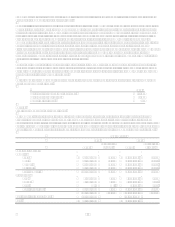

Financing Activities:

Increase (decrease) in borrowings from subsidiaries 1,379,497

(81,463) 381,205

Issuance of senior notes 3,185,588

1,262,035

Maturities of senior notes (225,000) (162,500)

Repurchases of senior notes

(597,196)

Dividends paid (32,324) (27,504) (25,618)

Purchases of treasury stock (21,615) (40,049) (17,232)

Net proceeds from issuances of common stock 36,751

770,311 23,910

Proceeds from share based payment activities 238,355

312,176 497,003

Net cash provided by financing activities 4,561,252

1,435,810 859,268

Increase (decrease) in cash and cash equivalents 236,790

(14,175) (17,015)

Cash and cash equivalents at beginning of year 2,683

16,858 33,873

Cash and cash equivalents at end of year $ 239,473

$ 2,683 $ 16,858

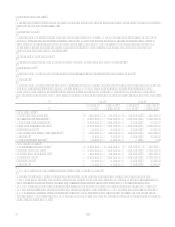

Note 28

Subsequent Events

Junior Subordinated Capital Income Securities

On February 5, 2007, the Company and Capital One Capital IV, a subsidiary of the Company created as a Delaware statutory

business trust, issued $500.0 million aggregate principal amount of 6.745% Capital Securities. The securities represent a

preferred beneficial interest in the assets of the trust. The proceeds from the sale of the Capital Securities were invested in

Capital Efficient Notes (CENts) due 2082. In connection with the closing of the Capital Securities offering, the Company

entered into a Replacement Capital Covenant, whereby the Company agreed it would not redeem or repurchase the CENts