Capital One 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 53

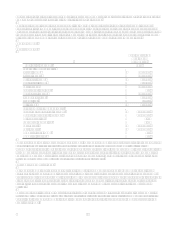

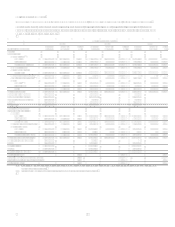

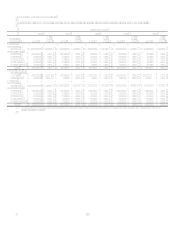

The Bank and Savings Bank treat a portion of their loans as subprime under the Expanded Guidance for Subprime

Lending Programs (the Subprime Guidelines) issued by the four federal banking agencies that comprise the Federal

Financial Institutions Examination Council (FFIEC), and have assessed their capital and allowance for loan losses

accordingly. Under the Subprime Guidelines, the Bank and Savings Bank each exceed the minimum capital adequacy

guidelines as of December 31, 2006. Failure to meet minimum capital requirements can result in mandatory and possible

additional discretionary actions by the regulators that, if undertaken, could have a material effect on the Companys

consolidated financial statements.

For purposes of the Subprime Guidelines, the Company has treated as subprime all loans in the Banks and the Savings

Banks targeted subprime programs to customers either with a FICO score of 660 or below or with no FICO score. The

Bank and the Savings Bank hold on average 200% of the total risk-based capital charge that would otherwise apply to such

assets. This results in higher levels of regulatory capital at the Bank and the Savings Bank.

Additionally, regulatory restrictions exist that limit the ability of the Bank, Savings Bank, CONA, North Fork Bank and

Superior to transfer funds to the Corporation. As of December 31, 2006, retained earnings of the Bank, the Savings Bank,

CONA, North Fork Bank and Superior of $142.2 million, $362.0 million, $101.2 million, $37.5 million and $0.4 million,

respectively, were available for payment of dividends to the Corporation without prior approval by the regulators.

Additional information regarding capital adequacy can be found on pages 100-102 in Item 8 Financial Statements and

Supplementary DataNotes to the Consolidated Financial StatementsNote 19.

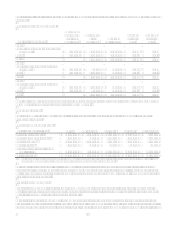

Dividend Policy

Although the Company expects to reinvest a substantial portion of its earnings in its business, the Company also intends to

continue to pay regular quarterly cash dividends on its common stock. The declaration and payment of dividends, as well as

the amount thereof, are subject to the discretion of the Board of Directors of the Company and will depend upon the

Companys results of operations, financial condition, cash requirements, future prospects and other factors deemed relevant

by the Board of Directors. Accordingly, there can be no assurance that the Corporation will declare and pay any dividends.

As a holding company, the ability of the Corporation to pay dividends is dependent upon the receipt of dividends or other

payments from its subsidiaries. Applicable banking regulations and provisions that may be contained in borrowing

agreements of the Corporation or its subsidiaries may restrict the ability of the Corporations subsidiaries to pay dividends to

the Corporation or the ability of the Corporation to pay dividends to its stockholders.

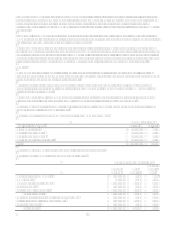

XI. Business Outlook

This business outlook section summarizes the Companys expectations for earnings for 2007, and its primary goals and

strategies for continued growth. The statements contained in this section are based on managements current expectations and

do not take into account any acquisitions that might occur during the year. Certain statements are forward looking, and

therefore actual results could differ materially from those in the Companys forward looking statements. Factors that could

materially influence results are set forth throughout this section and in Item 1A BusinessRisk Factors.

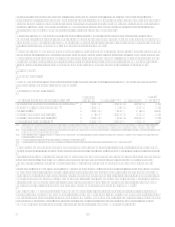

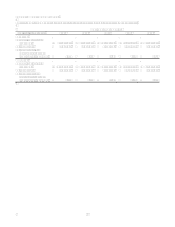

Expected Earnings

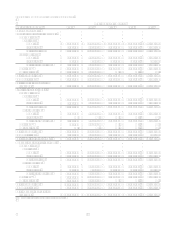

The Company expects to deliver diluted earnings per share between $7.40 and $7.80 in 2007. This guidance includes the

expected impact of about $140 million in intangibles amortization and about $100 million of integration expenses both

related to the acquisitions of both Hibernia and North Fork.

Inclusive in this guidance is the assumption that unsecured credit in the U.S. returns to more normal levels in 2007. In

addition, the Company expects that the yield curve will remain inverted early in the year and stay relatively flat through the

balance of 2007. Finally, the Company assumes that the cyclical downturn in the residential mortgage market continues into

2007, and is likely to be further impacted by the recently issued federal regulatory guidance on non-traditional mortgages.

The Companys 2007 results will also be impacted by the targeted $275 million pre-tax in net synergies, consistent with the

announcement of the deal in March 2006. The Company now expects the full run-rate synergies will be realized later in 2008,

and there is a reduced level of opportunity to achieve cost and revenue synergies in 2007. This is partially a result of the

impact of the expected yield curve environment on near-term balance sheet synergies. It also results from the scheduling of

the conversion to a single deposit platform and brand in the first quarter of 2008. This timing is driven by the interest of a

smooth and effective integration.

The share count used to translate the Companys expected GAAP NIAT to earnings per share assumes the beginning of the

previously announced $3 billion in share buy-backs in the second quarter of 2007. The Company previously announced its

intention to execute $3 billion in share buy-backs, split evenly between the second half of 2007 and the first half of 2008. The