Capital One 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

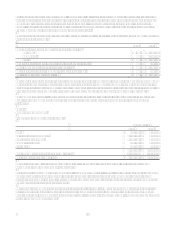

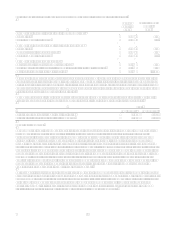

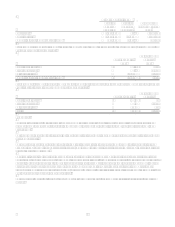

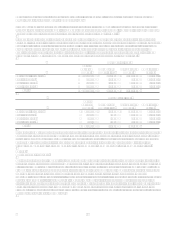

The Company recognizes compensation expense on a straight line basis over the entire awards vesting period for any awards

with graded vesting. Total compensation expense recognized for share based compensation during the years 2006, 2005 and

2004 was $211.1 million, $154.5 million and $95.9 million, respectively. The total income tax benefit recognized in the

consolidated statement of income for share based compensation arrangements during the years 2006, 2005 and 2004 was

$73.9 million, $54.1 million and $33.6 million, respectively.

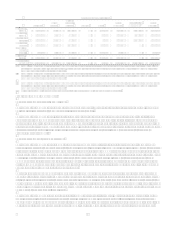

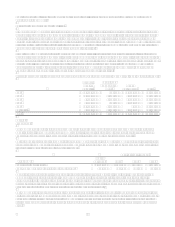

Stock option expense is based on per option fair values, estimated at the grant date using a Black-Scholes option-pricing

model. The fair value of options granted during 2006, 2005 and 2004 was estimated using the weighted average assumptions

summarized below:

Assumptions 2006 2005 2004

Dividend yield .13% .14% .15%

Volatility factors of stocks expected market price(1) 29% 46% 55%

Average risk-free interest rate 4.68% 4.26% 3.57%

Expected option lives (in years) 4.5 5.3 5.8

(1) In December 2005, the Company started using the implied volatility of publicly traded and over-the-counter stock options as a basis for the expected volatility

assumption. Previously, expected volatility was based on historical stock price observations.

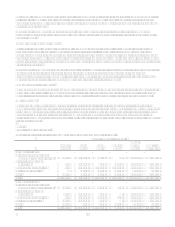

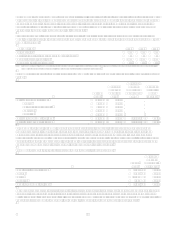

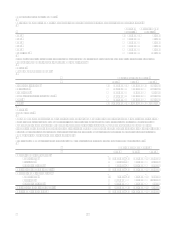

A summary of option activity under the plans as of December 31, 2006, and changes during the year then ended is presented

below:

Options

(000s)

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(000,000)

Outstanding January 1, 2006 26,785 $ 51.39

Granted 3,000 86.05

Options of acquired entity 3,482 58.83

Exercised (4,071) 48.54

Cancelled (1,084) 69.38

Outstanding December 31, 2006 28,112 $ 55.77 5.0 years $ 630.3

Exercisable December 31, 2006 21,180 $ 49.50 4.4 years $ 582.2

At December 31, 2006, the number, weighted average exercise price, aggregate intrinsic value and weighted average

remaining contractual terms of options vested and expected to vest approximate amounts for options outstanding. The

weighted-average fair value of options granted during the years 2006, 2005 and 2004 was $26.94, $37.07 and $42.29,

respectively. Cash proceeds from the exercise of stock options were $182.3 million for 2006. Tax benefits realized from the

exercise of stock options were $50.4 million for 2006. The total intrinsic value of options exercised during the years 2006,

2005 and 2004 was $143.1 million, $502.0 million, and $368.5 million, respectively.

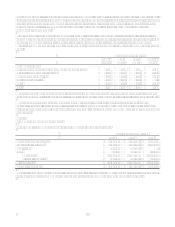

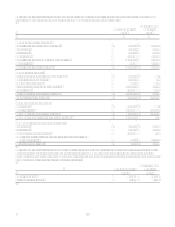

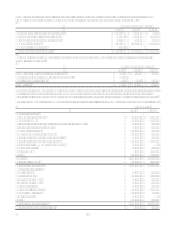

A summary of 2006 activity for restricted stock awards and units is presented below:

Shares

(000)

Weighted-

Average

Grant Date

Fair Value

Unvested at January 1, 2006 2,466 $ 62.83

Granted 1,573 $ 82.54

Vested (1,304) $ 78.61

Cancelled (389) $ 69.55

Unvested December 31, 2006 2,346 $ 77.48

The weighted-average grant date fair value of restricted stock granted for the years 2006, 2005 and 2004 was $82.54, $78.68

and $67.68, respectively. The total fair value of restricted stock vesting during the years 2006, 2005 and 2004 was $100.9

million, $205.4 million and $87.3 million, respectively. At December 31, 2006 there was unrecognized compensation cost for

unvested restricted awards of $117.3 million. That cost is expected to be recognized over the next 3 years.