Capital One 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

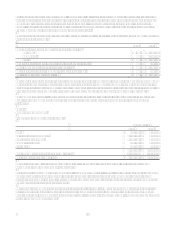

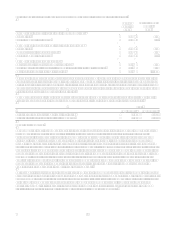

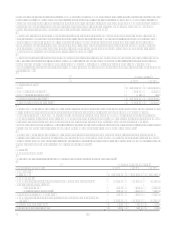

At December 31, 2006

Prior to

Adopting

SFAS 158

Effect of

Adopting

SFAS 158

As Reported

at December 31,

2006

Other assets 3,614,850 82 3,614,932

Other liabilities 4,181,207 (5,260) 4,175,947

Cumulative other comprehensive income 260,838 5,342 266,180

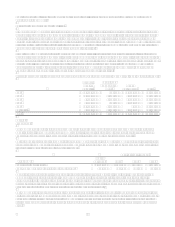

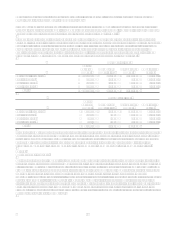

Pretax amounts recognized in cumulative other comprehensive income that have not yet been recognized as a component of

net periodic benefit cost consist of:

Pension Benefits

Postretirement

Benefits

2006 2006

Transition obligation $ $ (331)

Prior service credit 14,712

Net actuarial loss (2,928) (6,163)

Cumulative other comprehensive income $ (2,928) $ 8,218

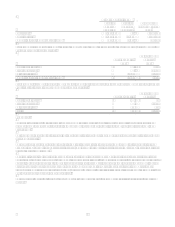

Pretax amounts in cumulative other comprehensive income that are expected to be recognized as components of net periodic

benefit cost for the year ending December 31, 2007 consist of:

Pension Benefits

Postretirement

Benefits

Transition obligation $ $ 55

Prior service credit (4,570)

Net actuarial loss 149 207

Total $ 149 $ (4,308)

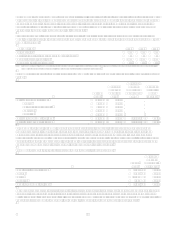

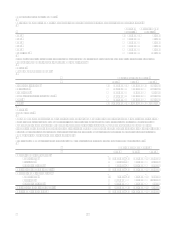

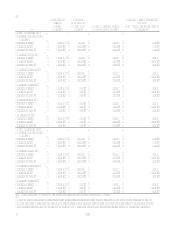

Plan Assets

The actual asset allocation for the year ended December 31, 2006 for the qualified defined benefit pension plan obtained

through the North Fork acquisition as of the measurement date was equity securities of 60%, debt securities of 38%, and

other of 2%.

The investment guidelines for this plan limit equity securities to not more than 60% of assets and debt securities to not more

than 40% of assets.

The guidelines specify equity allocations as follows: (1) large capitalization value of 30% to 40%, (2) large capitalization

growth of 20% to 30%, (3) middle capitalization of 10% to 20%, (4) smaller capitalization of 5% to 15%, and (5) diversified

international of 10% to 20%.

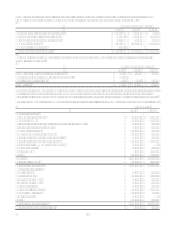

Debt securities are limited by the investment guidelines to United States Government obligations or corporate issues rated

Baa or higher by Standard & Poors or Moodys. Cash equivalent securities may be viewed as alternative investment vehicles

and are limited by the guidelines to mutual funds consisting of instruments issued by the United States Government, United

States Treasury, Federal Reserve System or Federal Home Loan Bank, or mutual funds consisting of commercial paper

issued by a domestic corporation rated prime by the National Credit Office, or of individual fixed income instruments rated

A or P1 or higher, maturing in 180 days or less.

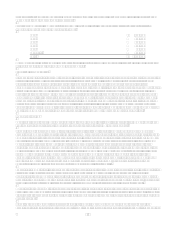

The guidelines require that the plans performance be reviewed periodically by comparing total rates of return to specified

indices.