Capital One 2006 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 102

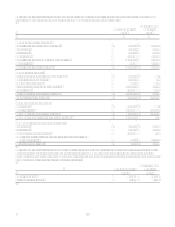

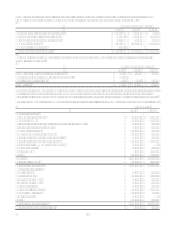

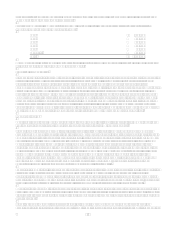

accordingly. Under the Subprime Guidelines, the Bank and Superior Bank each exceed the minimum capital adequacy

guidelines as of December 31, 2006. Failure to meet minimum capital requirements can result in mandatory and possible

additional discretionary actions by the regulators that, if undertaken, could have a material effect on the Companys

consolidated financial statements.

For purposes of the Subprime Guidelines, the Company has treated as subprime all loans in the Banks and the Savings

Banks targeted subprime programs to customers either with a FICO score of 660 or below or with no FICO score. The

Bank and the Savings Bank hold on average 200% of the total risk-based capital charge that would otherwise apply to such

assets. This results in higher levels of regulatory capital at the Bank and the Savings Bank.

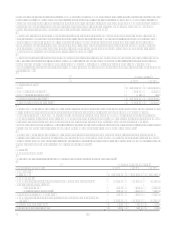

Additionally, regulatory restrictions exist that limit the ability of the Bank, Savings Bank, CONA, North Fork Bank and

Superior to transfer funds to the Corporation. As of December 31, 2006, retained earnings of the Bank, the Savings Bank,

CONA, North Fork Bank and Superior of $142.2 million, $362.0 million, $101.2 million, $37.5 million and $0.4 million,

respectively, were available for payment of dividends to the Corporation without prior approval by the regulators.

CONA is required to maintain cash on hand or non-interest bearing balances with the Federal Reserve to meet reserve

requirements. CONAs non-interest bearing balance with the Federal Reserve was $30.3 million as of December 31, 2006.

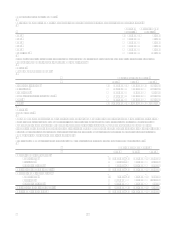

North Fork entered into an informal memorandum of understanding with the bank regulatory authorities pursuant to which it

is required to take certain actions regarding its anti-money laundering compliance program. The Company is responsible for

fulfilling the obligations of this informal memorandum of understanding.

Note 20

Commitments, Contingencies and Guarantees

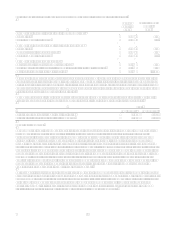

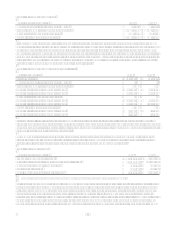

Letters of Credit and Financial Guarantees

As a result of the acquisitions of Hibernia and North Fork, the Company issues letters of credit (both standby and

commercial) and financial guarantees to meet the financing needs of its customers. Standby letters of credit and financial

guarantees written are conditional commitments issued by the Company to guarantee the performance of a customer to a third

party in a borrowing arrangement. Commercial letters of credit are short-term commitments issued primarily to facilitate

trade finance activities for customers and are generally collateralized by the goods being shipped to the client. Collateral

requirements are similar to those for funded transactions and are established based on managements credit assessment of the

customer. Management conducts regular reviews of all outstanding standby letters of credit and customer acceptances, and

the results of these reviews are considered in assessing the adequacy of the Companys allowance for loan losses.

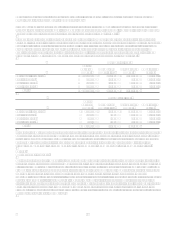

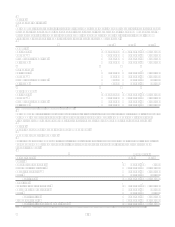

The Company had contractual amounts of standby letters of credit, commercial letters of credit, and financial guarantees of

$1.2 billion at December 31, 2006. As of December 31, 2006, financial guarantees had expiration dates ranging from 2007 to

2012. The fair value of the guarantees outstanding at December 31, 2006 that have been issued since January 1, 2003, was

$4.9 million and was included in other liabilities.

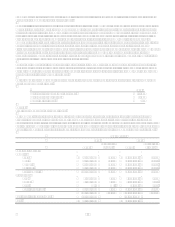

Loan and Line of Credit Commitments

As of December 31, 2006, the Company had $179.0 billion of unused credit card lines. While this amount represented the

total unused available credit card lines, the Company has not experienced, and does not anticipate, that all of its customers

will exercise their entire available line at any given point in time. The Company generally has the right to increase, reduce,

cancel, alter or amend the terms of these available lines of credit at any time.

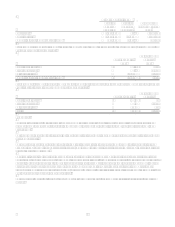

As a result of the acquisitions of Hibernia and North Fork, the Company enters into commitments to extend credit that are

legally binding conditional agreements having fixed expirations or termination dates and specified interest rates and

purposes. These commitments generally require customers to maintain certain credit standards. Collateral requirements and

loan-to-value ratios are the same as those for funded transactions and are established based on managements credit

assessment of the customer. Commitments may expire without being drawn upon. Therefore, the total commitment amount

does not necessarily represent future requirements. The outstanding unfunded commitments to extend credit other than credit

card lines were approximately $16.1 billion as of December 31, 2006.

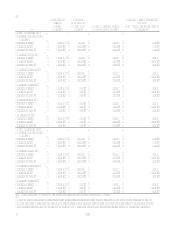

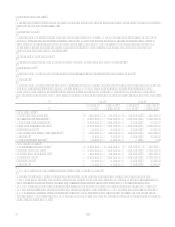

Lease Commitments

Certain premises and equipment are leased under agreements that expire at various dates through 2035, without taking into

consideration available renewal options. Many of these leases provide for payment by the lessee of property taxes, insurance

premiums, cost of maintenance and other costs. In some cases, rentals are subject to increases in relation to a cost of living