Capital One 2006 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 74

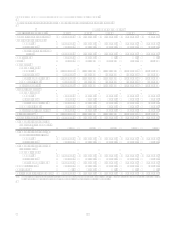

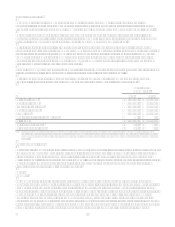

Goodwill and Other Intangible Assets

The Company performs annual impairment tests on acquisition goodwill in accordance with Statement of Financial

Accounting Standards No. 142, Goodwill and Other Intangible Assets (SFAS 142). As of December 31, 2006 and 2005,

Goodwill of $13.6 billion and $3.9 billion, respectively, were included in the Consolidated Balance Sheet. See Note 17 for

additional detail.

Other intangible assets that have a finite life are amortized either on a straight-line or on an accelerated basis over their

respective estimated useful lives and evaluated for impairment whenever events or changes in circumstances indicate the

carrying amount of the assets may not be recoverable. At December 31, 2006 and 2005, net intangible assets included in

Other assets on the Consolidated Balance Sheet of $1.3 billion and $394 million, respectively, consist of core deposit

intangibles, trust intangibles, lease intangibles and other intangibles.

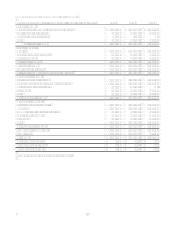

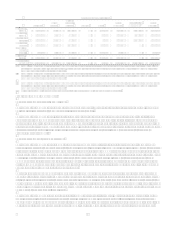

Representation and Warranty Reserve

The representation and warranty reserve is available to cover probable losses inherent with the sale of loans in the secondary

market. In the normal course of business, certain representations and warranties are made to investors at the time of sale,

which permit the investor to return the loan to the seller or require the seller to indemnify the investor for any losses incurred

by the investor while the loan remains outstanding.

The evaluation process for determining the adequacy of the representation and warranty reserve and the periodic provisioning

for estimated losses is performed for each product type on a quarterly basis. Factors considered in the evaluation process

include historical sales volumes, aggregate repurchase and indemnification activity and actual losses incurred. Additions to

the reserve are recorded as a reduction to the gain on sale of loans. Losses incurred on loans that the Company is required to

either repurchase or make payments to the investor under the indemnification provisions are charged against the reserve. The

representation and warranty reserve is included in other liabilities in the consolidated balance sheet.

As of December 31, 2006, the representation and warranty reserve carried a balance of $156.0 million.

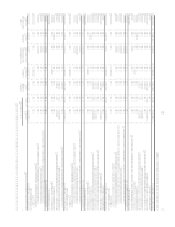

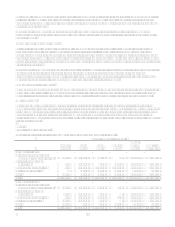

Mortgage Servicing Rights

The right to service mortgage loans for others, or Mortgage Servicing Rights (MSRs), is recognized when mortgage loans

are sold in the secondary market and the rights to service these loans are retained for a fee. The MSRs initial carrying value is

determined by allocating the recorded investment in the underlying mortgage loans between the assets sold and the interest

retained based on their relative fair values at the date of transfer. Fair value of the MSRs is determined using the present

value of the estimated future cash flows of net servicing income. The Company uses assumptions in the valuation model that

market participants use when estimating future net servicing income, including prepayment speeds, discount rates, default

rates, cost to service, escrow account earnings, contractual servicing fee income, ancillary income and late fees. MSRs are

carried at the lower of the initial carrying value, adjusted for amortization, or fair value. MSRs are amortized in proportion to,

and over the period of, estimated net servicing income. The amortization of MSRs is analyzed quarterly and adjusted to

reflect changes in prepayment speeds.

MSRs are periodically evaluated for impairment based on the difference between the carrying amount and current fair value.

To evaluate and measure impairment, the underlying loans are stratified based on certain risk characteristics, including loan

type, note rate and investor servicing requirements. If it is determined that temporary impairment exists, a valuation

allowance is established by risk stratification through a charge to earnings for any excess of amortized cost over the current

fair value. If determined in future periods that all or a portion of the temporary impairment no longer exists for a particular

risk stratification, the valuation allowance is reduced by increasing earnings. However, if impairment for a particular risk

stratification is deemed other-than- temporary, a direct write-down, permanently reducing the carrying value of the MSRs is

recorded. The periodic evaluation of MSRs for other-than-temporary impairment considers both historical and projected

trends in interest rates, payoff activity and whether impairment could be recovered through increases in market interest rates.

The MSR balance was $252.3 million at December 31, 2006. See Note 18 for additional detail.

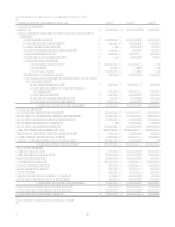

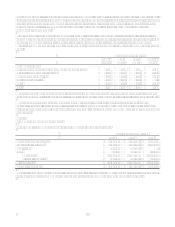

Rewards Liability

The Company offers credit cards that provide reward program members with various rewards such as airline tickets, free or

deeply discounted products or cash rebates, based on purchase volume. The Company establishes a rewards liability based

upon points earned which are ultimately expected to be redeemed and the average cost per point redemption. As points are

redeemed, the rewards liability is relieved. The estimated cost of reward programs is reflected as a reduction to interchange

income. The cost of reward programs related to securitized loans is deducted from servicing and securitizations income.