Capital One 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

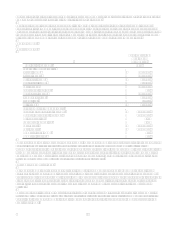

were established. As a result, results for the Banking segment include the reversal of this allowance. In addition, during the

fourth quarter the Company aligned the allowance for loss methodology for CONAs indirect auto portfolio with the Capital

One legacy auto portfolio. The resulting impact of the methodology alignment was a decrease to the allowance for loan losses

of $36.8 million.

During the fourth quarter, the Company completed a review of the loan portfolios deemed to be impaired in accordance with

SOP 03-3 associated with the acquisition of Hibernia National Bank. Based upon the information available at the time of this

review, the majority of the consumer portfolio and a portion of the commercial portfolio were determined not to have been

impaired at the acquisition date. Therefore, the related SOP 03-3 contra accounts were adjusted, with reclassifications of

approximately $30.8 million of contra asset balances to increase the allowance for loan losses, and approximately $68.8

million to decrease Goodwill.

For additional information, see section XII, Tabular Summary, Table H (Summary of Allowance for Loan Losses).

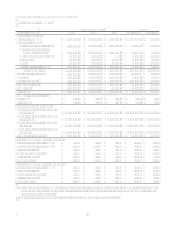

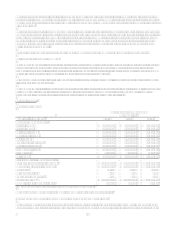

VII. Reportable Segment Summary

The Company manages its business as four distinct operating segments: U.S. Card, Auto Finance, Global Financial Services

and Banking. The U.S. Card, Auto Finance, Global Financial Services and Banking segments are considered reportable

segments based on quantitative thresholds applied to the managed loan portfolio for reportable segments provided by SFAS

No. 131, Disclosures about Segments of an Enterprise and Related Information.

As management makes decisions on a managed portfolio basis within each segment, information about reportable segments

is provided on a managed basis.

The Company maintains its books and records on a legal entity basis for the preparation of financial statements in conformity

with GAAP. The following table presents information prepared from the Companys internal management information

system, which is maintained on a line of business level through allocations from legal entities.

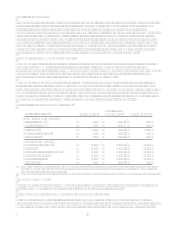

US Card Segment

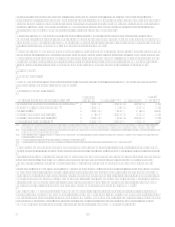

Table 2: U.S. Card

As of and for the Year Ended

December 31,

(Dollars in thousands) 2006 2005 2004

Earnings (Managed Basis)

Interest income $ 6,872,507 $ 6,614,854 $ 6,368,944

Interest expense 2,156,709 1,820,898 1,713,047

Net interest income 4,715,798 4,793,956 4,655,897

Non-interest income 3,255,681 3,321,457 3,219,567

Total revenue 7,971,479 8,115,413 7,875,464

Provision for loan losses 1,644,619 2,279,109 2,207,888

Non-interest expense 3,521,627 3,356,600 3,499,918

Income before taxes 2,805,233 2,479,704 2,167,658

Income taxes 981,833 870,351 780,357

Net income $ 1,823,400 $ 1,609,353 $ 1,387,301

Selected Metrics (Managed Basis)

Period end loans held for investment $ 53,623,680 $ 49,463,522 $ 48,609,571

Average loans held for investment $ 49,484,223 $ 46,827,775 $ 45,812,973

Loan Yield 13.89% 14.13% 13.90%

Net charge-off rate 3.37% 5.01% 5.05%

30+ day delinquency rate 3.74% 3.44% 3.97%

Purchase Volume(1) $ 83,126,876 $ 73,687,136 $ 64,039,668

Number of Total Accounts (000s) 37,630 37,645 38,269

(1) Includes purchase transactions net of returns and excludes cash advance transactions.

The U.S. Card segment consists of domestic consumer credit card lending activities.

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

U.S. Card segment earnings increased year over year primarily due to the favorable credit environment. Throughout 2006,

charge-offs remained at historically low levels following the change in bankruptcy legislation in the fourth quarter of 2005.