Capital One 2006 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

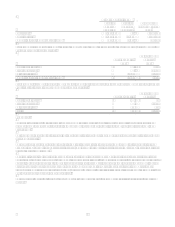

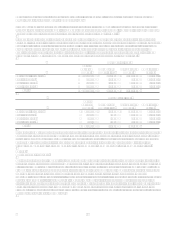

Included in Other deferred tax assets at December 31, 2006, the Company has a $12.1 million net operating loss carryforward

for U.S. federal income taxes purposes with a tax value of $4.2 million that expires in 2020. The Company has capital loss

carryforwards of $4.2 million with a tax value of $1.5 million that expire in 2007 and 2008. The Company has net operating

loss carryforwards for state purposes with a tax value of $5.4 million that expire from 2006 to 2025. The Company has

foreign tax credit carryforwards of $12.1 million that expire in 2014 and 2015.

During 2006, the valuation allowance for certain loss and tax credits carryforwards decreased by a net $26.9 million. The

valuation allowance decreased due to an $18.5 million reduction to the allowance for capital loss carryforwards, of which

$7.8 million was applied to goodwill. The valuation allowance was further decreased by an $11.9 million reduction for

timing differences for state tax purposes and a $1.1 million reduction for state net operating loss carryforwards. The state

valuation allowance was increased by $4.6 million acquired through the purchase of North Fork Bancorporation, Inc. for

which subsequently recognized tax benefits will reduce goodwill.

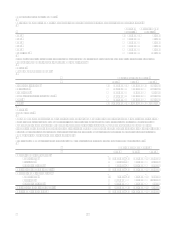

The deferred tax liability for deferred revenue represents late fees, interchange, cash advance fees and overlimit fees. These

items are treated as original issue discount (OID) for tax purposes and recognized over the life of the related credit card

receivables. These items are recognized in the income statement as income in the year earned. For income statement

purposes, late fees are reported as interest income, and interchange, cash advance fees and overlimit fees are reported as non-

interest income.

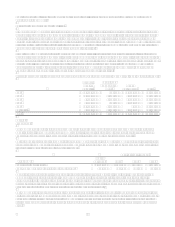

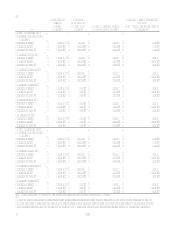

December 31

2006 2005

Deferred revenue:

OID $ 1,769,466 $ 1,854,753

OIDcash advance fees 94,974

79,153

OIDaccretion adjustment

(43)

Gross deferred tax liability $ 1,864,440 $ 1,933,863

Net federal deferred tax liability $ 652,554

$ 676,852

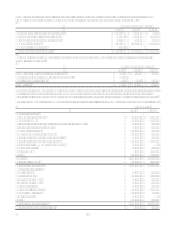

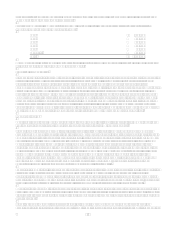

As of December 31, 2006, U.S. income taxes and foreign withholding taxes have not been provided on approximately $275.0

million of unremitted earnings of subsidiaries operating outside the U.S., in accordance with APB Opinion No. 23,

Accounting for Income TaxesSpecial Areas. These earnings are considered by management to be invested indefinitely.

Upon repatriation of these earnings, the Company could be subject to both U.S. income taxes (subject to possible adjustment

for foreign tax credits) and withholding taxes payable to various foreign countries. Determination of the amount of

unrecognized deferred U.S. income tax liability and foreign withholding tax on these unremitted earnings is not practicable at

this time because such liability is dependent upon circumstances existing if and when remittance occurs.

As of December 31, 2006, U.S. income taxes have not provided for approximately $276.0 million of previously acquired

thrift bad debt reserves created for tax purposes as of December 31, 1987. These amounts, acquired as a result of the merger

with North Fork Bancorporation, Inc., are subject to recapture in the unlikely event that North Fork Bank makes distributions

in excess of earnings and profits, redeems its stock, or liquidates.

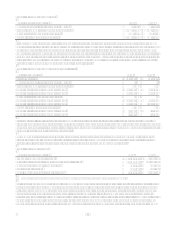

Note 15

Earnings Per Share

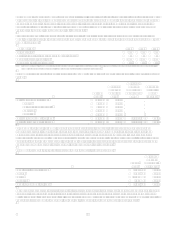

The following table sets forth the computation of basic and diluted earnings per share:

Year Ended December 31

(Shares in Thousands) 2006 2005 2004

Numerator:

Net income $ 2,414,493 $ 1,809,147 $ 1,543,482

Denominator:

Denominator for basic earnings per share-Weighted-average shares 309,584 259,159 235,613

Effect of dilutive securities:

Stock options 6,171 7,367 10,594

Restricted stock and units 1,268 2,382 2,560

Dilutive potential common shares 7,439 9,749 13,154

Denominator for diluted earnings per share-Adjusted weighted-average

shares 317,023 268,908 248,767

Basic earnings per share $ 7.80 $ 6.98 $ 6.55

Diluted earnings per share $ 7.62 $ 6.73 $ 6.21