Capital One 2006 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

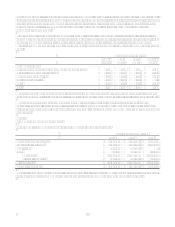

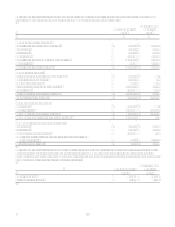

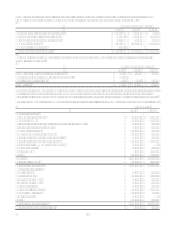

The following table sets forth, on an aggregated basis, changes in the benefit obligations and plan assets, how the funded

status is recognized in the balance sheet, and the components of net periodic benefit cost.

Pension Benefits

2006

Postretirement

Benefits

2006

Change in benefit obligation:

Benefit obligation at beginning of year $ 7,597 $ 47,989

Service cost 1,087 6,942

Interest cost 1,347 2,708

Benefits paid (3,450) (1,430)

Benefit obligation assumed through acquisition 214,478 33,248

Actuarial loss (318) (5,247)

Benefit obligation at end of year $ 220,741 $ 84,210

Change in plan assets:

Fair value of plan assets t beginning of year $ 5,528 $

Actual return on plan assets 2,344 46

Employer contributions 129 149

Plan assets acquired through acquisition 299,175 7,636

Benefits paid (3,450) (149)

Fair value of plan assets at end of year $ 303,726 $ 7,682

Funded status at end of year $ 82,985 $ (76,528)

Balance Sheet Presentation:

Other assets $ 96,191 $

Other liabilities (13,206) (76,528)

Net amount recognized at end of year $ 82,985 $ (76,528)

Accumulated benefit obligation at end of year $ 213,061 n/a

Components of net periodic benefit cost:

Service cost $ 1,087 $ 6,942

Interest cost 1,347 2,708

Expected return on plan assets (2,223) (46)

Amortization of transition obligation, prior service credit, and

net actuarial loss 175 (3,711)

Net periodic benefit cost $ 386 $ 5,893

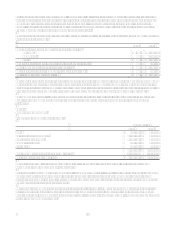

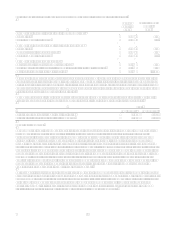

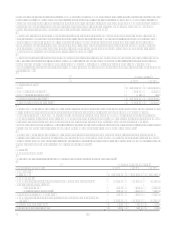

The following table sets forth the aggregate benefit obligation and aggregate fair value of plan assets for plans with benefit

obligations in excess of plan assets. Based on the status of the Companys pension plans, the information presented also

represents the aggregate pension accumulated benefit obligation and aggregate fair value of plan assets for pension plans with

accumulated benefit obligations in excess of plan assets.

Pension Benefits

Postretirement

Benefits

2006 2006

Benefit obligation 17,704 84,210

Fair value of plan assets 4,498 7,682