Capital One 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

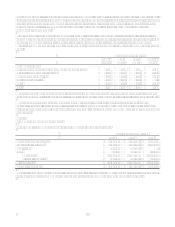

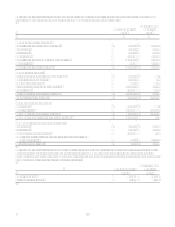

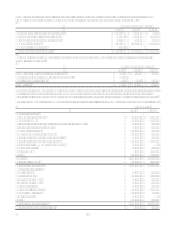

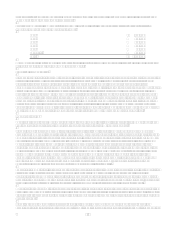

The following table presents weighted-average assumptions used in the accounting for the plans.

Pension

Benefits

2006

Postretirement

Benefits

2006

Assumptions for benefit obligations at measurement date

Discount rate 5.6% 5.7%

Rate of compensation increase 4.0% n/a

Assumptions for periodic benefit cost for the year ended

Discount rate 5.5% 5.5%

Expected rate of return on plan assets 7.5% 7.5%

Rate of compensation increase 4.0% n/a

Assumptions for year-end valuations

Health care cost trend rate assumed for next year n/a 9.3%

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) n/a 5.0%

Year the rate reaches the ultimate trend rate n/a 2016

To develop the expected long-term rate of return on plan assets assumption, consideration was given to the current level of

expected returns on risk-free investments (primarily government bonds), the historical level of the risk premium associated

with the other asset classes in which the portfolio is invested and the expectations for future returns of each asset class. The

expected return for each asset class was then weighted based on the target asset allocation to develop the expected long-term

rate of return on assets assumption for the portfolio.

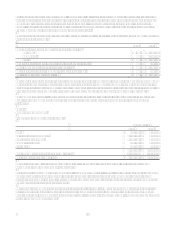

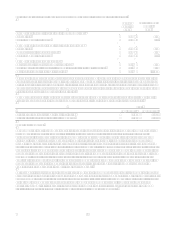

Assumed health care cost trend rates have a significant effect on the amounts reported for the other postretirement benefit

plans. A one-percentage point change in assumed health care cost trend rates would have the following effects:

2006

1% Increase 1% Decrease

Effect on year-end postretirement benefit obligation 9,393 (7,768)

Effect on total service and interest cost components 2,014 (1,595)

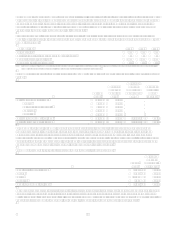

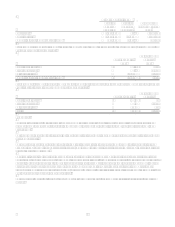

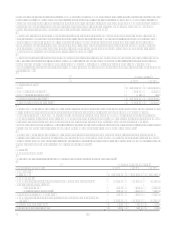

Adoption of SFAS 158

On December 31, 2006, the Company adopted the recognition and disclosure provisions of SFAS 158. SFAS 158 required

the Company to recognize the funded status (i.e., the difference between the fair value of plan assets and the benefit

obligations) of its defined benefit plans in the December 31, 2006 statement of financial position, with a corresponding

adjustment to cumulative other comprehensive income, net of tax. The adjustment to cumulative other comprehensive

income at adoption represents the net unrecognized actuarial losses, unrecognized prior service credits, and unrecognized

transition obligation remaining from the initial adoption of SFAS 106, all of which were previously netted against the plans

funded status in the Companys balance sheet pursuant to the provisions of SFAS 87 and SFAS 106. These amounts will be

subsequently recognized as net periodic benefit cost pursuant to the Companys historical accounting policy for amortizing

such amounts. Further, actuarial gains and losses that arise in subsequent periods and are not recognized as net periodic

benefit cost in the same periods will be recognized as a component of other comprehensive income. Those amounts will be

subsequently recognized as a component of net periodic benefit cost on the same basis as the amounts recognized in

cumulative other comprehensive income at adoption of SFAS 158.

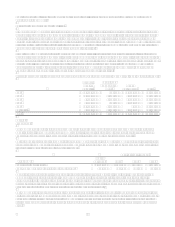

The incremental effects of adopting the provisions of SFAS 158 on the Companys balance sheet at December 31, 2006 are

presented in the following table. The adoption of SFAS 158 had no effect on the Companys statement of income for the year

ended December 31, 2006, or for any prior period presented, and it will not affect the Companys operating results in future

periods. Had the Company not been required to adopt SFAS 158 at December 31, 2006, it would have recognized an

additional minimum liability pursuant to the provisions of SFAS 87. The effect of recognizing the additional minimum

liability is included in table below in the column labeled Prior to Adopting SFAS 158.