Experian 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

Annual report on remuneration continued

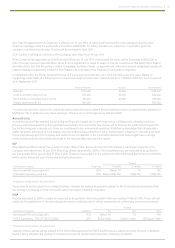

Awards under this plan will not be made to Don Robert and Chris Callero, as a result of their change in role and forthcoming

retirement as a director of the Company, respectively.

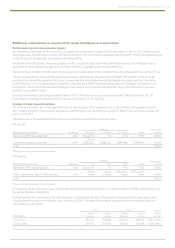

Don Robert’s outstanding share awards

Upon Don Robert’s retirement as Chief Executive Officer, the following treatment will apply to his outstanding share awards in

accordance with the relevant plan rules:

Share-based incentives Treatment

Share options These will remain exercisable until their final lapse dates (31 May 2015 and 2 June 2016).

CIP awards Awards vest on the normal vesting dates subject to the achievement of the relevant performance conditions.

PSP awards Awards vest on the normal vesting dates, subject to time pro-rating and the achievement of the relevant

performance conditions.

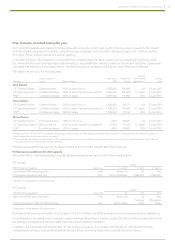

Chief Financial Officer (‘CFO’)

As announced on 29 April 2014, Lloyd Pitchford will join Experian, as CFO. The Committee has agreed an annual salary of £525,000

on appointment and this will next be subject to review in April 2015. His ongoing remuneration package will be structured in line

with the remuneration policy set out in the Directors’ remuneration policy report.

On leaving his current employer, Mr Pitchford will forfeit a number of long-term incentive awards and an element of annual bonus.

The Committee’s approach to compensating Mr Pitchford for his forfeited incentives was in line with its belief in not over-paying on

recruitment and that any replacement share incentives (‘buyout awards’) would take into account the likely vesting and resulting

value of the share incentives that was being given up.

In agreeing the structure of the arrangements for Mr Pitchford, the Committee’s starting position was to replicate as closely as

possible, in terms of structure and vesting dates, the share awards that were being forfeit. However, the Committee was mindful of

shareholders’ views that vesting periods should be a minimum of 12 months and that performance conditions should be applied to

awards. As a result, vesting of all of the awards being made to Mr Pitchford is subject to performance conditions and the vesting

periods have been extended, in some cases significantly, beyond those of Mr Pitchford’s existing awards. Further information on

how the buyout awards will be structured is set out below.

In the structure of buyout awards agreed, the Committee believes it has reached an appropriate balance between the views and

concerns of shareholders and the commercial reality of hiring senior executive talent. Full details of the actual awards made will

be disclosed in next year’s Annual report on remuneration.

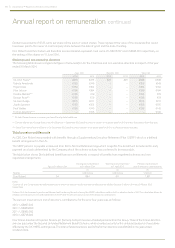

Recruitment awards to Lloyd Pitchford

Lloyd Pitchford’s historic share awards were as follows:

• awards vesting in March 2015, March 2016 and March 2017 with no performance conditions; and

• awards vesting in March 2015, March 2016 and March 2017 subject to the satisfaction of performance conditions based

on earnings per share and TSR.

The share awards, to be granted when Mr Pitchford joins Experian, will be structured as follows:

• for the awards with no performance conditions, these will be replaced with grants of Experian share awards with a similar face

value and, with the exception of the award due to vest in 2015, will vest on the normal vesting dates in March 2016 and March

2017. The replacement award, for the original award vesting in March 2015, will vest 12 months from the date Mr Pitchford joins

Experian. The vesting of these replacement awards will be subject to satisfactory financial and business performance over the

vesting period and the achievement of Mr Pitchford’s personal objectives.

• for the awards with performance conditions, these will be replaced with an award under the PSP in 2014. This will be subject to

the same performance conditions as other PSP awards made in 2014 and will vest at the end of the three-year performance period.

In establishing the magnitude of the replacement awards, an independent consultant was used to estimate the fair value of the

outstanding awards such that this value could be replicated after taking into account the fair value of the Experian awards.

For the avoidance of doubt, no further awards will be made to Mr Pitchford under the Experian share plans until 2015.

Governance • Report on directors’ remuneration

P79