Experian 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial statements • Notes to the Group financial statements

Notes to the Group financial statements

for the year ended 31 March 2014 continued

130

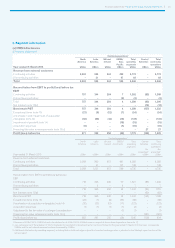

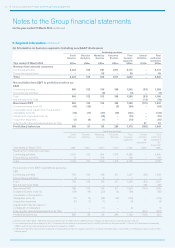

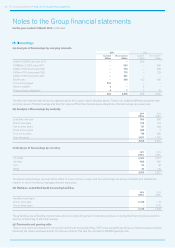

16. Tax charge in the Group income statement continued

(b) Tax reconciliations

(i) Reconciliation of the Group tax charge

2014

US$m

2013

(Re-presented)

(Note 3)

US$m

Profit before tax 1,049 434

Profit before tax multiplied by the main rate of UK corporation tax of 23% (2013: 24%) 241 104

Effects of:

Adjustments in respect of prior years (28) (26)

Exceptional items 8 5

Other income not taxable (21) (27)

Increase in fair value of Serasa put option not deductible – 134

Other expenses not deductible 87 67

Adjustment in respect of previously unrecognised tax losses (1) (3)

Adjustment in respect of tax benefits recognised on corporate transactions – (98)

Reduction in future rate of UK corporation tax 23 12

Different effective tax rates in non-UK businesses (7) (17)

Group tax charge 302 151

Effective rate of tax based on Profit before tax 28.8% 34.8%

(ii) Reconciliation of the Group tax charge to the Benchmark tax charge

2014

US$m

2013

(Re-presented)

(Note 3)

US$m

Group tax charge 302 151

Tax relief attributable to exceptional items 8 11

Tax relief on other adjustments made to derive Benchmark PBT 42 41

Deferred tax charge arising on rate reduction (23) –

One-off tax credit – 98

Benchmark tax charge 329 301

Benchmark PBT 1,232 1,189

Benchmark tax rate 26.7% 25.3%

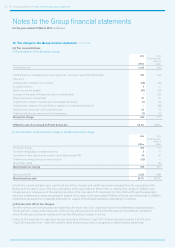

In both the current and prior year, significant one-off tax charges and credits have been excluded from the calculation of the

Benchmark tax rate in view of their size and nature. In the year ended 31 March 2014, a deferred tax charge of US$23m was

recognised as a consequence of the enacted reduction in the main rate of UK corporation tax from 23% to 20% and the associated

reduction in deferred tax assets recognised in respect of tax losses. In the year ended 31 March 2013, the one-off tax credit of US$98m

comprised a tax benefit on a corporate transaction in respect of the Group’s subsidiary undertaking in Colombia.

(c) Factors that affect tax charges

The effective tax rates for both years are higher than the main rate of UK corporation tax with the differences explained above.

The Group’s tax charge in the future will continue to be influenced by the profile of profits earned in the different countries in

which the Group’s businesses operate and could be affected by changes in tax law.

In the UK, the main rate of corporation tax was reduced to 23% from 1 April 2013. Further reductions reduce it to 21% from

1 April 2014 and 20% from 1 April 2015 and the effect of these reductions is recognised in these financial statements.