Experian 2014 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

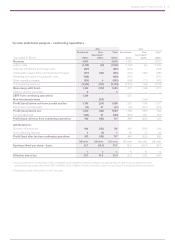

Strategic report • EMEA/Asia Pacic

Credit Services

Total and organic revenue growth at

constant exchange rates was 2%. While

market conditions in the Eurozone

remained mixed, we saw stability,

recovery and growth across some of our

major bureau markets, including Spain,

Netherlands and South Africa, offsetting

weakness elsewhere. We also delivered

good growth across our business

information bureaux in China and

Singapore, and we were pleased to realise

a small first-time revenue contribution

from our new bureau in Australia towards

the end of the year.

Decision Analytics

Total and organic revenue growth at

constant exchange rates was 11%

and 10% respectively. Our actions

to reposition our Decision Analytics

operations in EMEA have been successful

and the business returned strongly

to growth during the year, driven by

demand for PowerCurve software, fraud

prevention products, analytics and

collections software. During the year, we

undertook similar actions to reposition

our Asia Pacific operations, to focus on

our most significant opportunities, and

we were pleased to secure a number of

new PowerCurve and fraud prevention

deployments towards the end of the year.

Marketing Services

Total revenue growth at constant

exchange rates was 2%, while organic

revenue declined 3%. The decline in

Marketing Services was due to the

wind-down of a large email contract in

EMEA, as we have previously announced.

Excluding this one-off item, Marketing

Services performed well, with a good

reception for our combined approach and

particularly for our new cross-channel

marketing platform, which has led to a

number of new client wins during the year,

with a good pipeline of prospects.

EBIT and EBIT margin

In EMEA/Asia Pacific, EBIT from

continuing activities was US$7m (2013:

US$20m). The reduction in profitability

was largely due to ramp-up in investment

in the Australian bureau development and

the impact of the wind-down of the large

client contract in EMEA, referred to above.

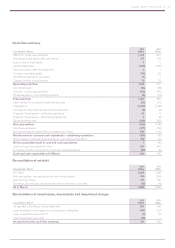

7

m 1.4% 2014

38%

Credit Services 38%

Decision Analytics 25%

Marketing Services 37%

4% 2014

2% 2014

Highest % of revenue

from Credit Services

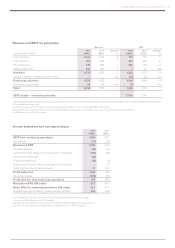

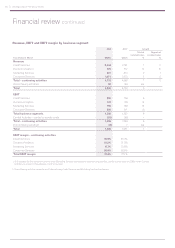

Year ended 31 March

2014

US$m

20131

US$m

Total grow th2

%

Organic growth

2

%

Revenue

Credit Services 187 186 2 2

Decision Analytics 127 116 11 10

Marketing Services 185 189 2(3)

Total continuing activities 499 491 4 2

Discontinuing activities 47 107

Total EMEA/Asia Pacific 546 598

EBIT

Continuing activities 720 (60)

Discontinuing activities (3) 4

Total EMEA/Asia Pacific 424

EBIT margin31.4% 4.1%

1. 2013 restated for the movement of some businesses to discontinuing activities.

2. At constant exchange rates.

3. EBIT margin is for continuing activities only.

2%

7%

7%

3%

1%

10

12

11

13

14

4%

6%

12%

17%

4%

10

12

11

13

14

7m 1.4%

38m 6.6%

52m 10.4%

51m 11. 2%

20m 4.1%

10

12

11

13

14

41

EBIT (US$m) and EBIT margin (%)

Revenue by business line

Total revenue growth

Organic revenue growth