Experian 2014 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21 Strategic report • Protecting our business

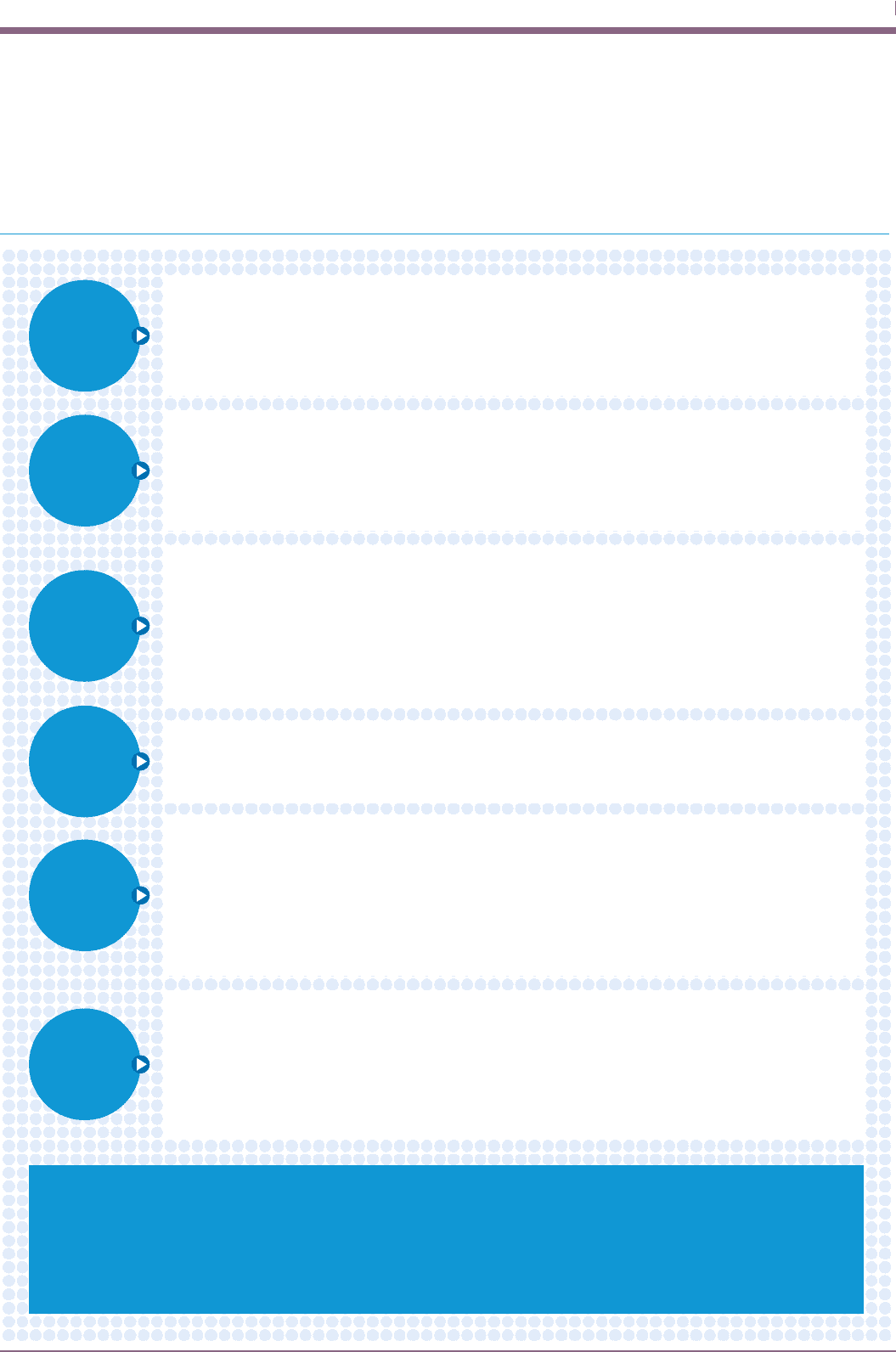

Respond to

risks

• Defined Board and Board committees’ terms of reference

• Defined global and regional authorities

• Review significant business commitments through global and regional strategic project committees

• Oversee the risk management process through global and regional risk management committees

• Report on risk to the Audit Committee and Board

Defined

governance

structure

Identify

risks

Evaluate

current

control

environment

Monitor

Communicate

Additional financial reporting internal controls

We have detailed policies and procedures to ensure the accuracy and reliability of our financial reporting and the preparation of

consolidated financial statements. This includes our comprehensive Group Accounting Manual (‘GAM’), which contains the detailed

requirements of International Financial Reporting Standards (‘IFRS’). The Group’s finance team owns the GAM and we have rolled it out

across the Group, obliging all Experian companies to follow its requirements. The GAM’s aims are to: provide guidance on accounting

issues; enable consistent and well-defined information for IFRS reporting; provide uniform quantitative and qualitative measures of

Group performance; and increase the efficiency of the Group’s reporting process.

• Assess the potential effect of each strategic, operational and financial risk on the achievement of our

business objectives

• Identify and escalate new, emerging or changing risks, significant control gaps and risk acceptance

• Consider external factors arising from the environment in which we operate and internal risks arising

from the nature of our business, its controls and processes, and our management decisions

• Evaluate compliance with policies and standards addressing risk management, compliance, accounting,

treasury management, information security, fraud and whistleblowing

• Execute formal review/approval procedures for major transactions, capital expenditure and revenue expenditure

• Monitor budgetary and performance reviews tied to KPIs and achievement of objectives

• Apply a risk scoring system, based on our assessment of the probability of a risk materialising, and the

impact and velocity if it does

• Require executive management confirmations of compliance with Experian’s system of internal control,

policies, and corporate governance and corporate responsibility processes

• Have active risk remediation strategies including internal controls, insurance and specialised

treasury instruments

• Use formal review and approval procedures for significant accepted risks

• Board- and Group-level finance reports including financial summaries, results, forecasts and revenue

trends, investor relations analysis and detailed business trading summaries

• Regional-level detailed performance reviews

• Regional and executive risk management committee and Audit Committee risk reporting on the status of

principal/emerging risks, the progress of strategic projects/acquisitions and escalation of significant

accepted risks

• Global Internal Audit reporting to the Audit Committee on assurance testing and fraud/whistleblowing

investigation results

• Management, internal audit and third parties control reviews and follow-ups

• Global Internal Audit independent assessment of the adequacy and effectiveness of the system of

internal controls

• A variety of Audit Committee risk reporting addressing material/emerging risks, material litigation,

information security and regulatory compliance

• Audit Committee annual review of the effectiveness of Experian’s systems of risk management and internal

control; receipt of an annual report on the controls over relevant risks

PRINCIPAL FEATURES OF THE RISK MANAGEMENT AND INTERNAL CONTROL FRAMEWORK