Experian 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Experian annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 Governance • Directors’ report

Directors’ report

The directors present their report and

the audited financial statements for the

year ended 31 March 2014. The Corporate

governance report forms part of this

Directors’ report. The Strategic report

contains certain information equivalent

to that required in this Directors’ report.

Research and development

Research and development plays a key

role in supporting Experian’s activities.

Details of such activities are given in

the Strategic report.

Results and dividends

The Group income statement shows

a profit for the financial year ended

31 March 2014 of US$754m (2013:

US$401m, as re-presented). The directors

have announced the payment of a second

interim dividend in lieu of a final dividend

of 26.00 US cents per ordinary share (2013:

24.00 US cents) to be paid on 25 July 2014

to shareholders on the register of members

on 27 June 2014. An interim dividend of

11.50 US cents per ordinary share was paid

on 31 January 2014, giving a total dividend

for the year of 37.50 US cents per ordinary

share (2013: 34.75 US cents).

Directors

The directors’ names, biographical

details and key skills and experience are

shown in the biographies section. Details

regarding Board changes are contained

in the Corporate governance report.

Particulars of directors’ remuneration,

service contracts and interests in the

Company’s ordinary shares are shown in

the Report on directors’ remuneration.

There have been no changes in the

directors’ interests in such ordinary

shares between the end of the financial

year and 6 May 2014.

In accordance with the UK Corporate

Governance Code, all directors (with

the exception of Sir John Peace, Sir

Alan Rudge and Chris Callero, who will

retire from the Board with effect from

the conclusion of the annual general

meeting (‘AGM’) on 16 July 2014), being

eligible, will offer themselves for election/

re-election at the AGM. An external

evaluation of Board and Board committee

performance, together with an evaluation

of the performance of individual directors,

was carried out during the year ended

31 March 2014 and the Board is satisfied

that all directors contribute effectively and

demonstrate commitment to their roles.

Further details regarding the evaluation

process are contained in the Corporate

governance report.

Insurance and third-party

indemnification

During the year and up to the date

of approval of this annual report, the

Company maintained liability insurance

and third-party indemnification provisions

for its directors and officers.

Acquisitions and disposals

Information in respect of acquisitions

and disposals made during the year is

contained in the Strategic report and in

note 40 and note 42 respectively to the

Group financial statements.

Post balance sheet events

Details of events occurring after

the end of the reporting period are

contained in note 47 to the Group

financial statements.

Share capital

Details of the Company’s authorised

and issued share capital and changes to

the Company’s share capital during the

year ended 31 March 2014 are set out in

note K to the parent company financial

statements. The rights and obligations

attaching to the ordinary and deferred

shares are also set out in note K and

the Company’s articles of association, a

copy of which can be obtained from the

Experian website, www.experianplc.com.

ADR programme

The Company has a Level 1 American

Depositary Receipt (‘ADR’) programme

in the US for which the Bank of New York

Mellon acts as depositary. The ADRs are

traded on the highest tier of the US over-

the-counter market, OTCQX, where each

ADR represents one Experian plc ordinary

share. Further details are given in the

Shareholder information section.

Restrictions on transfers of

shares and/or voting rights

The Company is not aware of any

agreements between shareholders that

may result in restrictions on the transfer

of securities and/or voting rights and,

apart from those matters described

below, there are no restrictions on the

transfer of ordinary shares in the capital

of the Company and/or voting rights:

• Certain restrictions on transfers of

shares may from time to time be

imposed by, for example, insider

dealing regulations. In accordance

with the UK Financial Conduct

Authority’s Listing Rules, directors

are required to seek the Company’s

approval to deal in its shares.

Certain employees are also

required to seek approval to

deal in the Company’s shares.

• Some of Experian’s share-based

employee incentive plans include

restrictions on transfer of shares

while the shares are subject to

the plan.

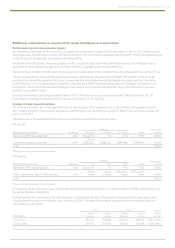

Substantial shareholdings

Substantial shareholders are required to notify their interests in accordance with the Company’s articles of association,

which obliges shareholders to comply with the notification obligations to the Company contained in the UK Disclosure and

Transparency Rules. As at 6 May 2014, the Company had been notified of the interests below in its issued ordinary share capital

or voting rights.

Date of notification Shareholder Direct/indirect interest

Number of ordinary

shares/voting rights

Percentage of issued

share capital/voting

rights

30 January 2014 Harris Associates L.P. Indirect 50,233,366 5.02%

P64

P62

P04

P64

P04

P78

P67